The best way to take control of your finances and control where your money is spent every month is by creating and following a budget. The process does take a little work, but in the end, you’ll be glad for the effort after seeing the results of the freedom you have by being able to control your finances rather than letting your circumstances control this part of your life.

Where Do I Start in Creating A Budget?

You may be thinking, “I have no idea how to create and manage a budget!” Don’t worry, it’s not as difficult as you might think. Basically, it’s about making a plan on how your money needs to be used and tracking any money that you spend so you don’t use money for one thing that should have been used for something else. Such as using the money that was supposed to be used for your rent or mortgage to buy a new phone.

There are different ways to keep track of your budget. You can keep track on paper or in a basic spreadsheet on the computer, but most people would probably find using an app to be the easiest method of keeping track of their budget. Using an app means you can easily record any transactions as they are made on a regular basis on your phone or other device.

There are many different apps out there for budgeting. If you’re working on controlling your spending and paying off your debt, the best option for you would be a free app so you’re not adding to your expenses to manage your finances. Several of the budgeting apps have free options, but the one that I find that works the best for planning your budget and managing your expenses is the EveryDollar app from Ramsey solutions. It is available for both iOS and Android devices.

Creating Your Budget

Okay, so it’s time to jump in and create your budget. We’ll use the EveryDollar app to demonstrate the process, but if you decide to use some other method, the process is basically the same.

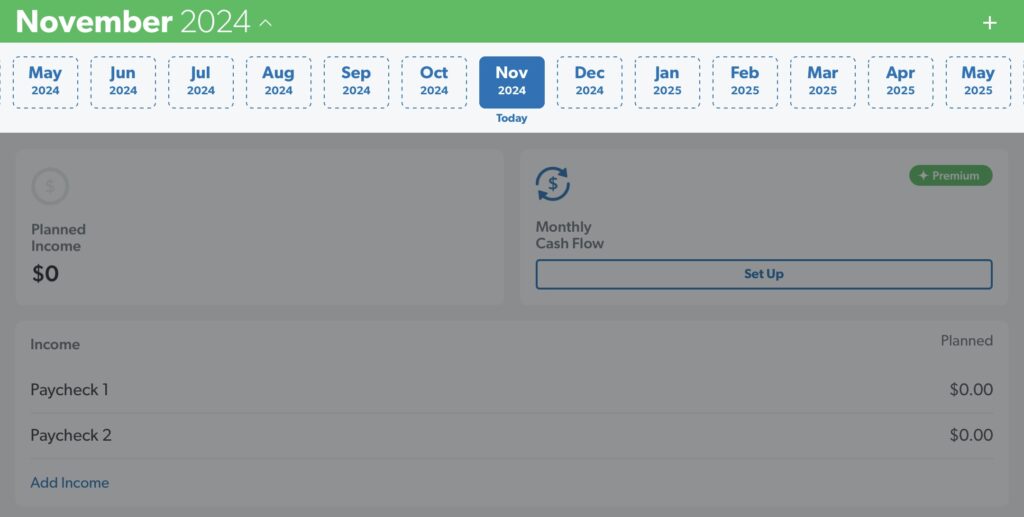

The first step once you have the app setup is to create a new budget for the month. If you’re starting this at the beginning of the month, you’ll obviously want to start with the current month. If you’re part way into the month, you could try and setup a partial month budget, but it may be best to just start planning for next month. So, for example, if it’s November 1st you’ll start by creating a budget for November.

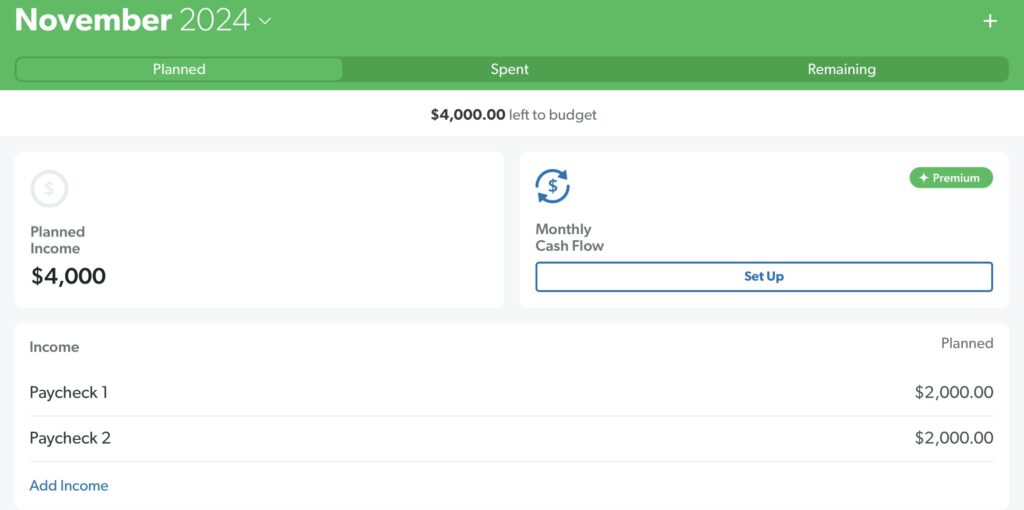

The next step is to budget your expected income. If you have a regular salary or hourly job, in many cases you know the amount of take home pay you have in each check whether it be weekly, biweekly or monthly. You can create as many Income items as you need to match the number of paychecks or other forms of income you know that you’ll receive in the month. For our sample budget, we’ll use an example of two semi monthly paychecks of $2,000 each assuming you get paid twice a month on the 1st and the 15th of each month. This should be based on your take home pay as that is the amount we’ll have to work with when planning how much we have to spend.

Once we’ve established our income for the month, the next step is to divide it into different categories for our expenses. At this point you may not know how much you spend on certain things such as gas and groceries if you’ve never analyzed how much money you spend on certain things each month. You probably know the amount that you pay for certain necessities such as your rent or mortgage and your phone bill, but other items we’ll have to make our best guess and make adjustments to the next month once we see how much we spend for those categories from keeping track throughout the month. We want to make sure we’re starting with absolute necessities first which include your housing, transportation and food. These are things we all need to survive.

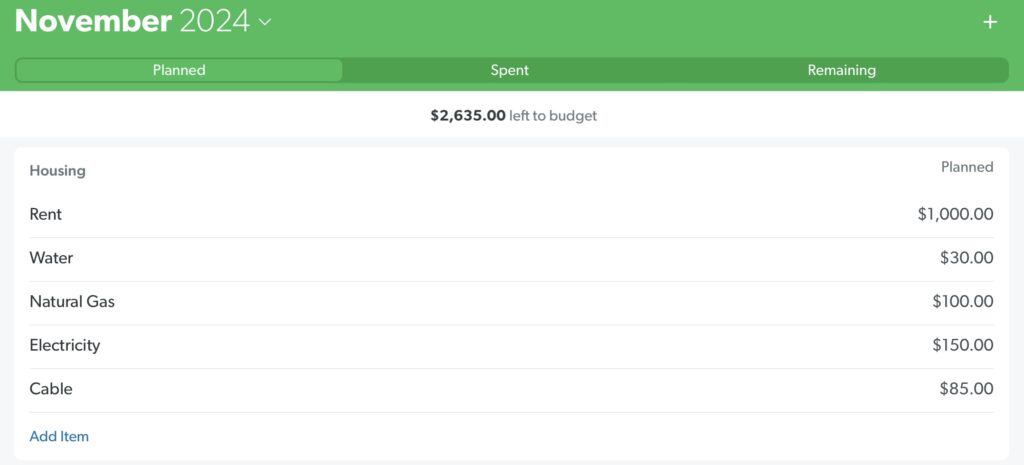

Housing

Housing costs vary greatly from one area to another. Costs for housing in large cities are typically much higher than smaller towns or rural areas so the percentage of your budget that goes toward housing will vary depending on your situation, but it still comes down to the fact that your budget spending has to still work with the amount that you bring home. In our example I am using assumptions of $1,000 for rent and average amounts for electricity, gas and water. I realize that in some areas, you can’t rent an apartment for $1,000 so you’ll need to adjust your budget based on what your actual costs are. As you can see in the example below, the app will show how much you have left to budget as you input expenses. I put cable into the sample budget even though it isn’t a necessary expense, because at this point you’ll want to put expenses into these categories that you’re currently spending on. If you have other housing items that you have you can add them. Once we get to the end of setting up our budget we will go through and make adjustments as needed.

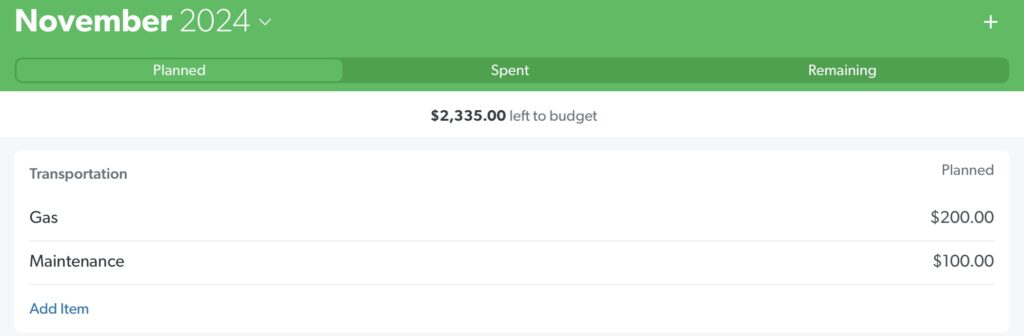

Transportation

Transportation costs would include such things as gas and maintenance for your vehicle. These costs will vary. Gas costs will vary depending on how many miles you drive and the gas mileage of your vehicle and maintenance costs will vary based on how old your car is and how much you drive. Even though maintenance costs won’t be consistent from month to month, it’s important to plan for this expense because the time will come when repairs are needed. Other vehicle costs that you may have are things such as tolls or public transportation costs. Car insurance will be included in the Insurance category so there’s no need to include that here.

If you have a car loan, typically that would fall under the category for Debts. Though probably if you are saving money to have a down payment or to pay cash for your next vehicle, you would create a fund in the transportation category. If you’re wondering what advantages there are to saving up and paying cash for your vehicles, see our article about the tremendous advantage to paying cash for your vehicles rather than taking out a loan: Should I Take Out A Loan For A Car?

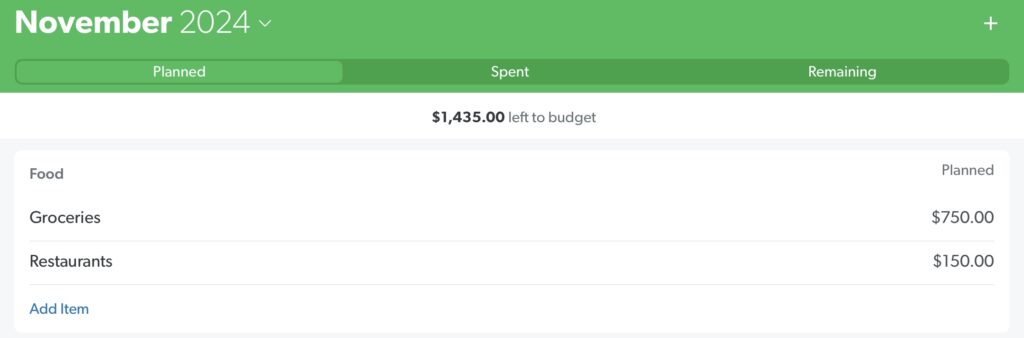

Food

Food is another category that will greatly vary based primarily on how many people are in your household, but also what kind of food your family eats. You also may not know how much you spend on groceries or on eating out if you haven’t tracked this in the past, but again, you can make an educated guess on what you think you spend. Eating out is not a necessity, so when we finish setting up our budget, we may very well adjust this item to accomplish other goals.

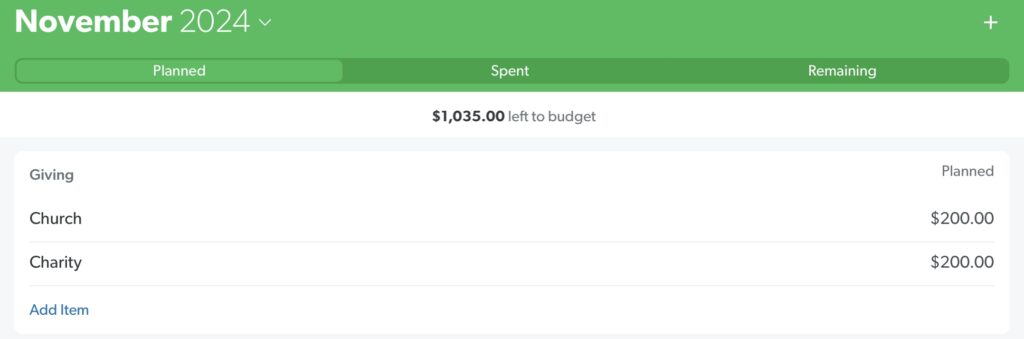

Giving

In the Every Dollar app, Giving is actually the first category listed. You may or may not agree with me, but I believe giving is an important part of being a good money manager. Having an attitude of gratefulness really changes our mindset on finances. When we look at all that we have with gratefulness instead of what we don’t have that we wish we had, it can go a long way in helping us in our financial journey. Oftentimes, financial difficulties are caused by our desire for things we don’t need and often can’t afford which is in most cases, a cause of building up debt. Being content with what we have and being grateful can help change our thinking on that and giving to others is just an extension of having a grateful attitude.

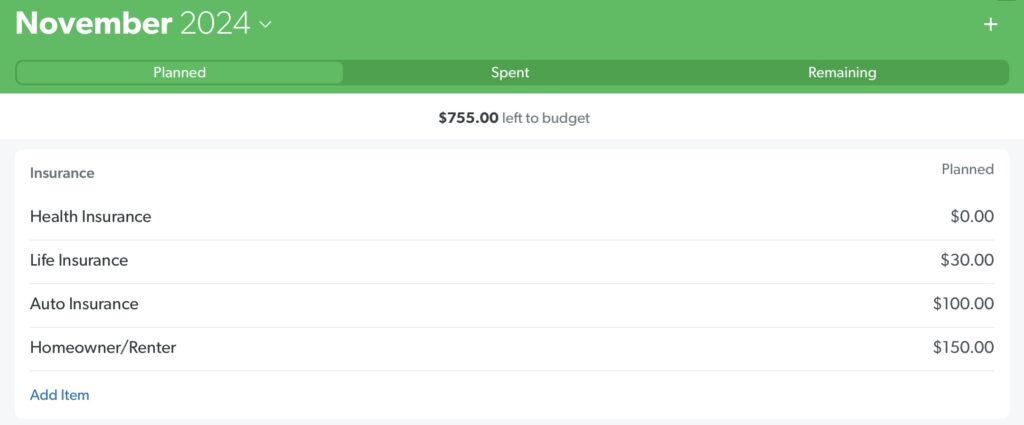

Insurance

Insurance costs will also vary depending on various factors. Auto insurance will depend on the age and value of your vehicle(s). In our example, I didn’t include anything for health insurance as in some cases this covered by your employer and even if you have to cover some of the cost through your employer health insurance, it is often taken directly out of your paycheck so it wouldn’t have to come out of your take home pay.

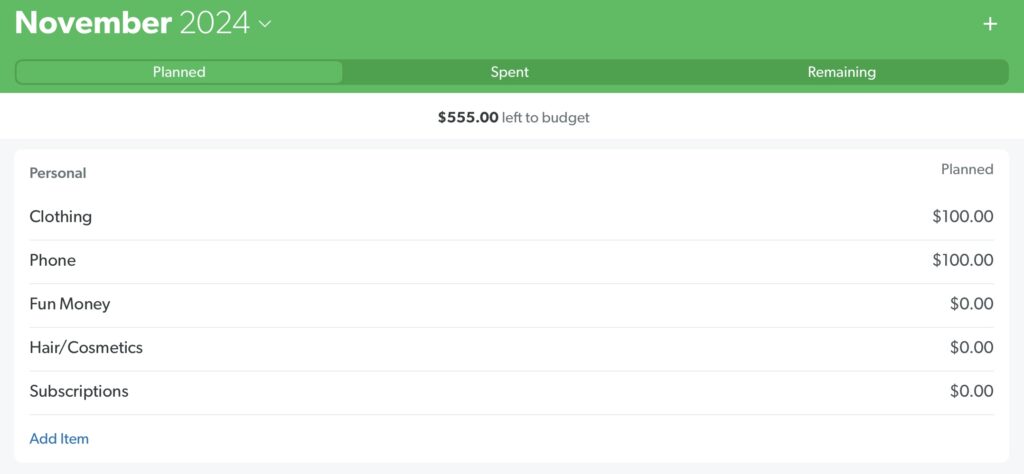

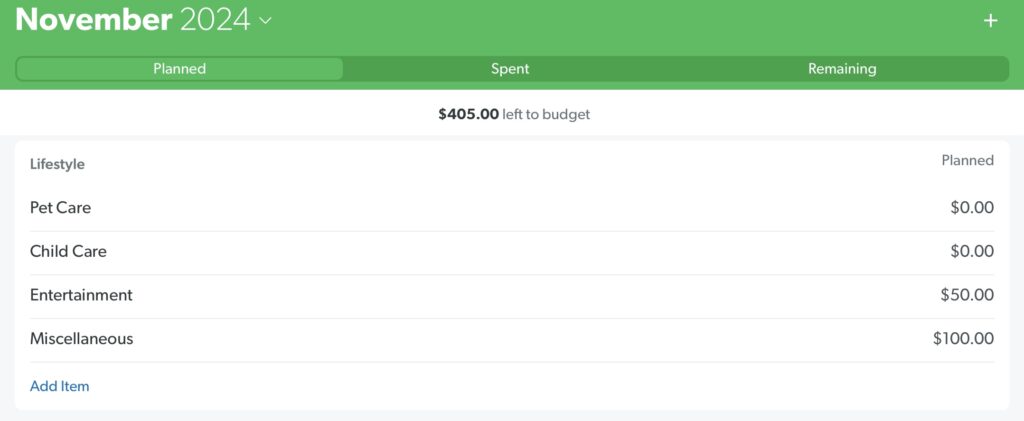

Personal & Lifestyle

There are a few other miscellaneous items that we need to include or we won’t end up having money allocated for them.

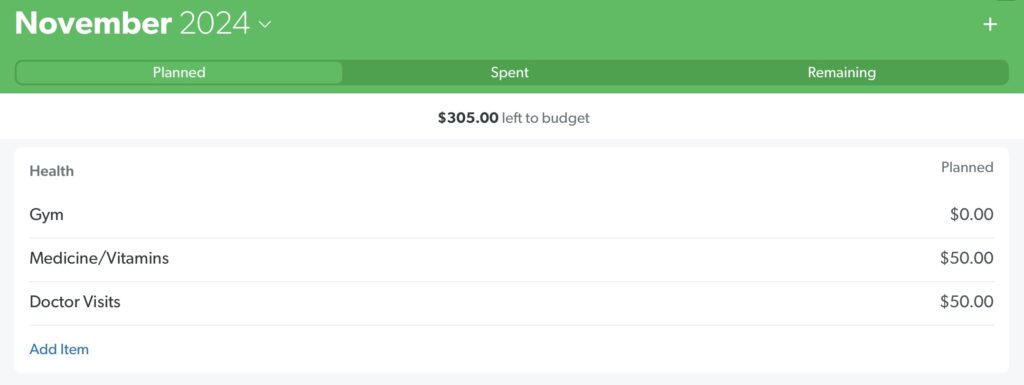

Health

Health costs would include items such as copays for the doctor and prescriptions as well as gym memberships if you have one.

Debts

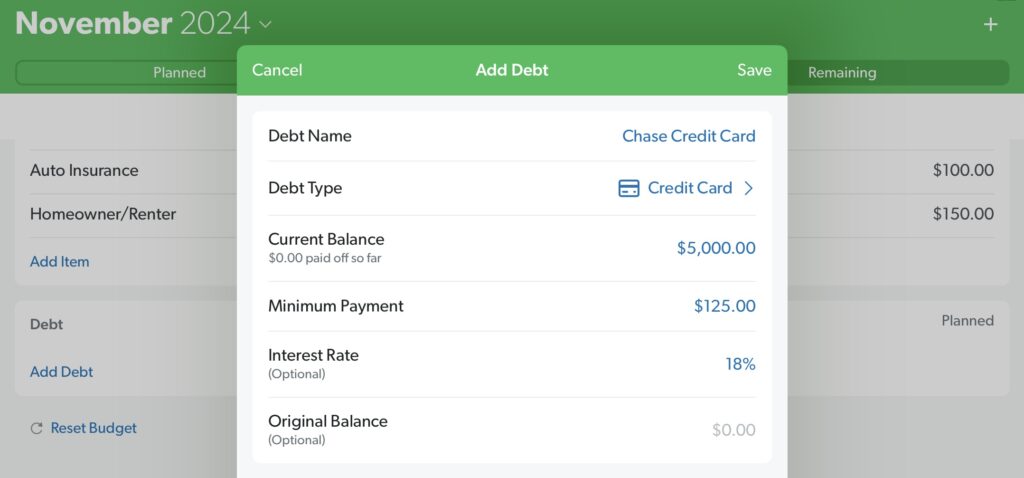

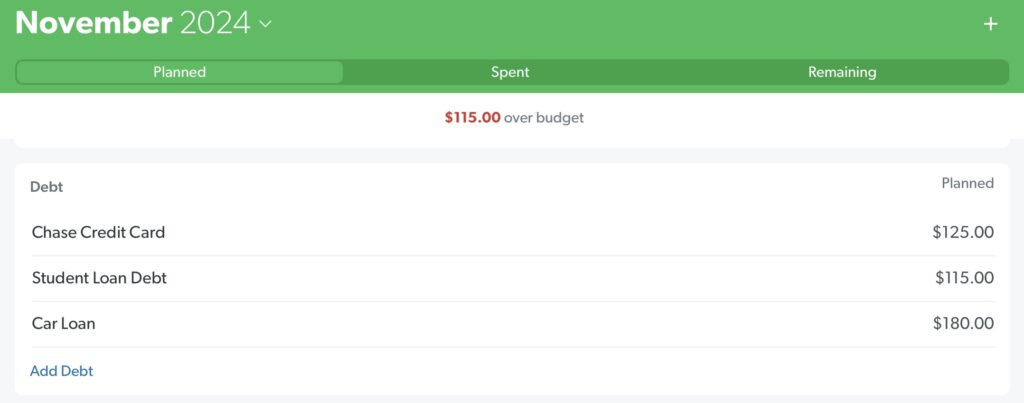

Including the payments on any debts we have would be the next step. At this point, I would recommend starting out with putting in minimum payments on each debt to see where we are with the overall picture. Hopefully your goal would be to pay the debts off as quickly as possible which means applying more money than just the minimum payments. We’ll get into more of how best to go about that later. So for now, you’ll input each of your debts. In the Every Dollar app, you would input the current balance and the minimum payment of each debt. You also have the option of putting the interest rate. In the example below, we’ll add a credit card balance of $5,000 with an interest rate of 18% which is a typical, but below average credit card interest rate. In many cases the minimum payment is calculated as the amount of interest for the month plus 1% of your balance. So on this $5,000 balance, the minimum payment would end up being $125. We’ll also put in a car loan and a student loan for our sample budget. For the car loan in my example, I used an original 5 year $10,000 loan with a current balance of $8,000 at a 3% interest rate which would make your monthly payment $180. For the student loan debt in my example I used an original 10 year $10,000 loan with $6,000 remaining on the balance at a 6.8% interest rate which would make your minimum monthly payment $115.

At this point we have put in all of our expected expenses and as you can see from the last image, our expenses are $115 over our expected income. This is the point where we start planning on what things we need to change to make things work. Being able to see everything laid out should help you to clearly see where you may be overspending in certain categories and what changes need to be made to balance your budget and get onto a better path.

Emergency Fund

One very important thing we haven’t addressed yet is an Emergency Fund. The reason it’s important to have an emergency fund is that life happens. There are times when unexpected things come up that we didn’t plan for. It’s important to have money set aside for these instances. So if you’re living paycheck to paycheck or don’t end up having enough money left at the end of each month, you probably don’t have any savings set aside. Even while you’re paying off your debt, it is important to have something set aside for life’s emergencies so you don’t end up having to use a credit card to cover when the emergencies happen. Initially it is a good idea to have at least $1,000 set aside for this.

Now remember that the emergency fund isn’t for things you can do without. Such as if you get partway through the month and you’ve depleted your restaurant budget for the month and feel like going out for dinner. If you use your emergency fund for non essential things, it won’t be there when you need it.

Once you get all of your debt paid off and are in stage 3, you’ll want to focus on saving up a larger emergency fund. We’ll cover more details about that when we get to that point.

Everyone’s Budget Looks Different

Now obviously I realize that this exact budget isn’t going to be exactly what anyone else’s budget looks like because everyone is going to have different circumstances. You may have a higher or lower income level than this. You may have a higher or lower mortgage or rent payment. Your debt levels will be different than what we show in the example. But once you have your budget put in, this will be the start of knowing where to start making changes.

Cutting Expenses

There are two things you can do to balance your budget.

- Lower Expenses

- Increase Your Income

Sometimes it takes a combination of both to accomplish your goals. We can start with taking a look at where expenses may be able to be cut to bring us closer to balancing the budget.

Which expenses you cut are totally up to you as this is a personal decision. Only you can decide what you are willing to give up. Here are some suggestions though. Another thing you’ll want to think about is the fact that some of the cuts to your expenses will be temporary. As you can see from the sample budget, if there was no credit card balance or student loan balance, you would have a budget surplus rather than being short each month. So once the debts are paid off, things definitely become easier to manage.

Obviously most of the expenses in the Housing category are not really able to be adjusted much. Though you may have items in your housing category that you can adjust, like for example, the cable bill. If you have cable, you could make the decision to cancel this service and save $85 in your budget. This may mean making some changes in what you watch. As long as you have internet, there are always other options. Streaming devices or Smart TV’s now come with apps that provide an almost endless supply of things to watch without having to pay for cable. You could try and lower your utility bills by adjusting your thermostat to reduce your gas and electric costs.

While you’re working on paying off your debt, you could commit to spending less on clothes. If you cut your $100 a month allowance in half, that would save $50 a month. Or maybe you have a lot of clothes and decide that you can go without buying more clothes for a year while you’re focusing on eliminating your debt which would save $100 a month. For your phone, you may be able to find a less expensive phone plan that could save some money. There are cell phone plans that you can get for around $25 a month. If you are able to cut $75 a month out of your budget that ends up being $900 a year which can go a long way in paying off your debts faster.

Maybe you’re willing to forego spending anything on entertainment during this stage. It doesn’t mean you can’t do things for fun, you would just need to decide to find things that don’t cost money. That would be another $50 in savings every month.

Just based on these items, we freed up $310 a month. So we went from being $115 a month short to having an extra $195 a month to go toward paying off the debt faster. There probably are other things you can do to save even more.

Increase Your Income

Besides cutting your expenses to balance your budget, you can also do some things to increase your income. You may not be able to convince your boss to give you a raise at your job, but there are other things to earn additional income. Some jobs offer overtime work which can quickly add additional income and is probably one of the easier ways to increase your income as working some extra hours at a job you’re already working takes little effort besides the additional hours.

Working a side job is probably the next most popular option. There are a lot of part time jobs you can get to make additional money to accelerate your debt elimination goal. There are even a lot of what they call “gig” jobs which are mostly self employed work that is generally flexible. The most common one is being a rideshare or delivery driver. This would include things such as driving for Uber, DoorDash or Instacart.

If you have specific skills, oftentimes you can make more for your time than the average part time job. For example, if you are skilled in doing handyman tasks, you can generally make up to $50 or more an hour offering your services. You may have computer skills, writing skills or even bookkeeping skills that you can do side work to make extra money to help with your budget. Especially in this day and age, the internet makes finding side work much easier than in the past.

Another way to bring in some extra money would be to see if you have things that are of value that you no longer need or use and sell those items. This can help bring in some extra money to jumpstart the process.

With putting in some extra hours, it may not be too difficult to bring in an extra $500 – $1,000 a month in extra income from working extra outside your regular job. This can be a huge catalyst for knocking out your debt relatively quickly depending on how much debt you have.

Managing Your Budget

Now that you have your budget created, the goal now is to implement it by tracking every dollar you bring in, whether it be from your paycheck or from other sources, and also tracking every dollar you spend, whether it’s for your regular bills or for any other spending you may do.

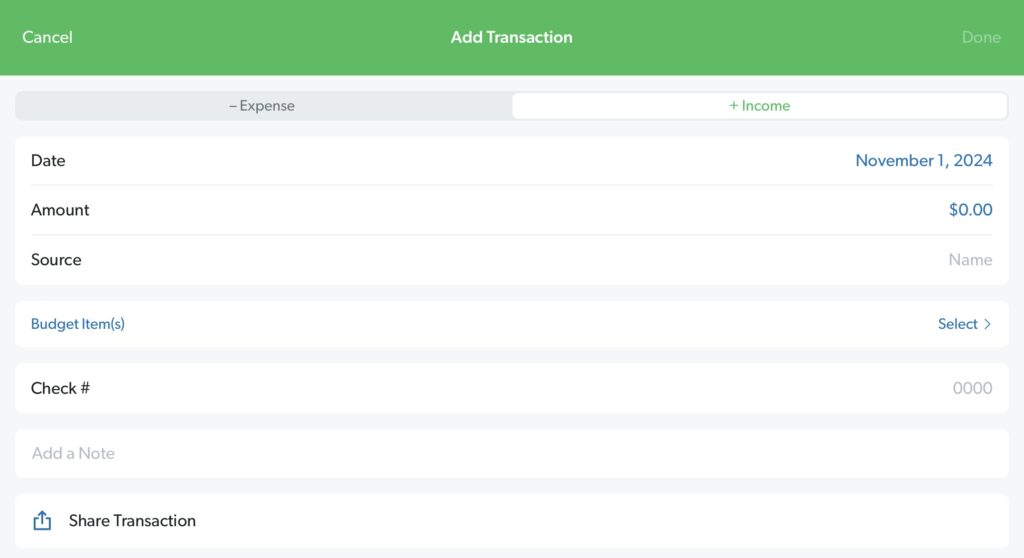

Input your Income

To record your first income transaction in the Every Dollar app you’ll click the + sign in the top right corner of the Budget page to add a transaction. This will take you to the screen where you can add either income or an expense. Once you have this screen up, be sure to select the +Income tab at the top of the page.

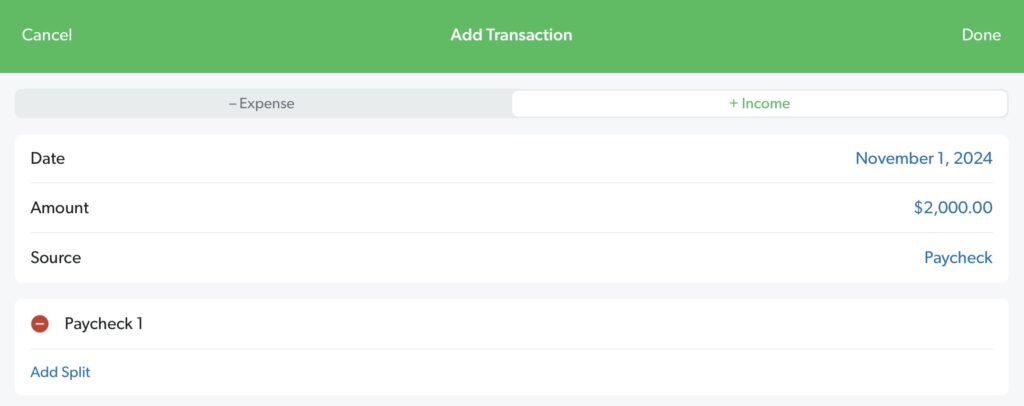

Select the date that you received the money. Since in our sample budget, we have two paychecks a month on the 1st and the 15th, this check will be for the 1st of the month. You would put in the amount that you received and the source. The last item would be the Budget Item line that this income matches in our budget which would be Paycheck 1.

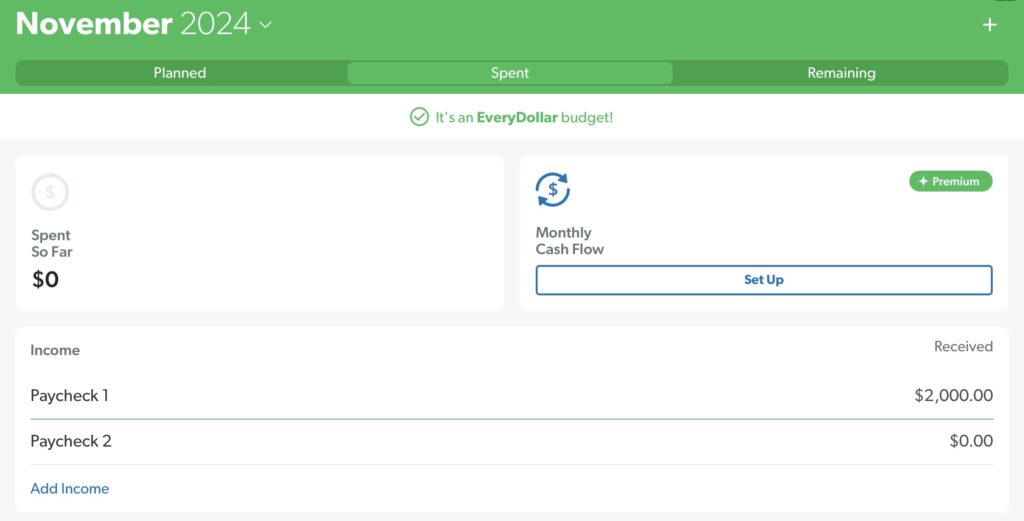

Once you put in the details of the check, you would click Done in the top right corner. If you click on the Spent tab at the top of the Budget page you’ll now see that Paycheck 1 has been received.

You would go through the same process when you receive your paycheck on the 15th of the month.

Input Your Expenses

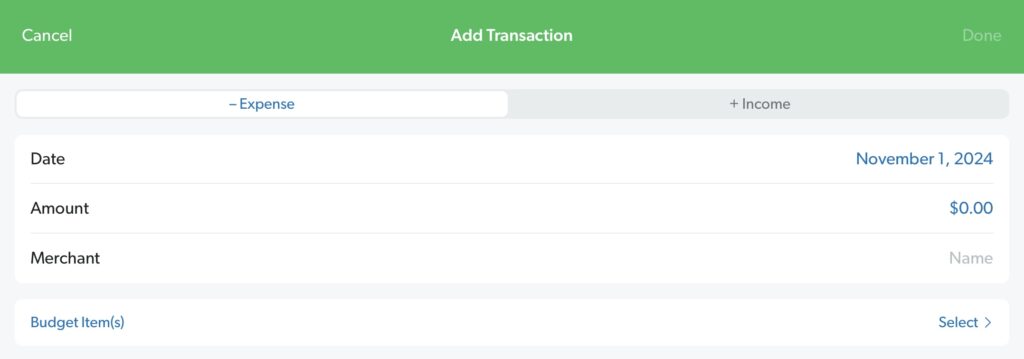

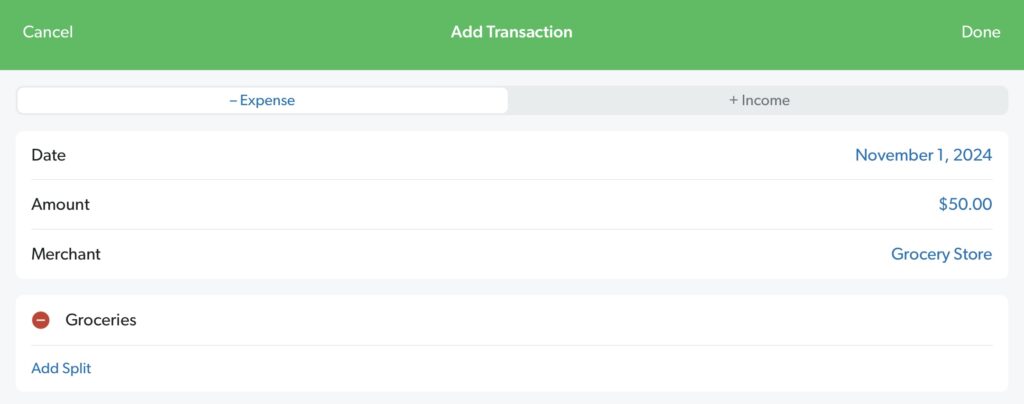

Recording your expenses would be a similar process to recording your income. On the main budget page you would click on the plus sign in the top right corner to bring up the screen to add a transaction. With expenses, you of course would select the -Expenses tab at the top of the page.

Let’s say you needed to buy some groceries. You would fill in the date, the amount you spent and the name of the store. Then select Groceries under the Budget Item line to show that it was from your grocery budget.

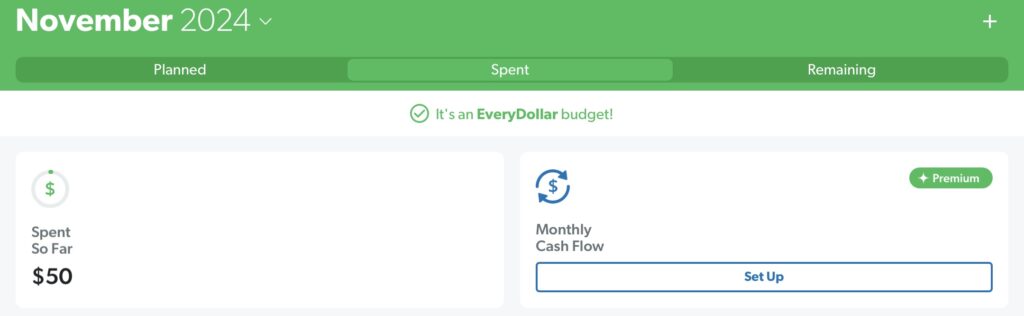

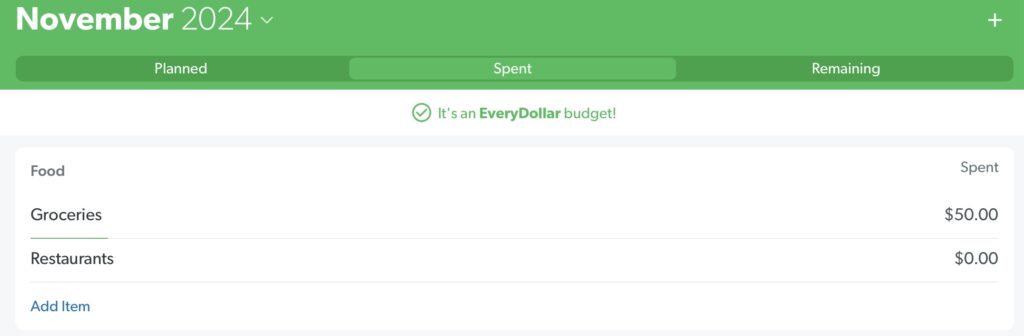

Now you can see on the Spent tab on the Budget page, that it shows that you’ve spent $50 so far for the month. And scrolling down to the Food category, it shows that you’ve spent $50 for groceries so far this month.

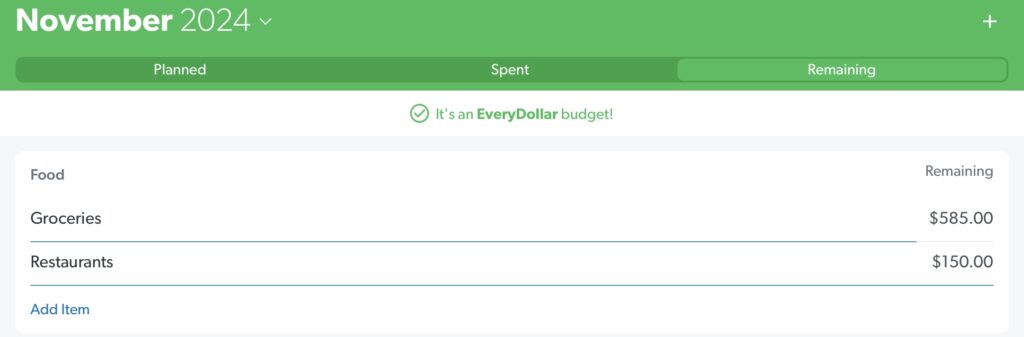

You can also select the Remaining tab at the top of the page and you’ll be able to see how much you still have available for the month in each category. So you’ll notice of the $635 we have budgeted for groceries, you have $585 remaining for the month. This helps you to manage your spending throughout the month so you don’t overspend in certain categories. If you weren’t tracking your spending in the past, it was probably easy to overspend on certain things by not knowing how much you were spending for the month.

As you can see, using a budget gives you the knowledge to be able to have the freedom to make the decisions on how you spend your money so that you don’t run out of money by the end of the month. It gives you immediate feedback on knowing if you’re on track or not so you can make adjustments before things get out of control. This way you don’t get to the end of the month and wonder, “Where did all the money go?”

End of the Month

When you get to the end of the first month with your new budget, you’ll be able to see what, if any, adjustments that need to be made. Maybe you underestimated in one category, but overestimated in another. Now the goal isn’t to spend all of the money in each category as some categories have fluctuations where some months you’ll spend more than other months. Such as for car repairs and clothes. In these cases, you’ll want to roll over the unspent funds in each category to the next month. If after several months you see that you are able to adjust to be more accurate with your actual spending, then you can do that and add that money to either paying your debt off faster, building up your savings or adding some extra to your entertainment budget depending on your goals.

Funds

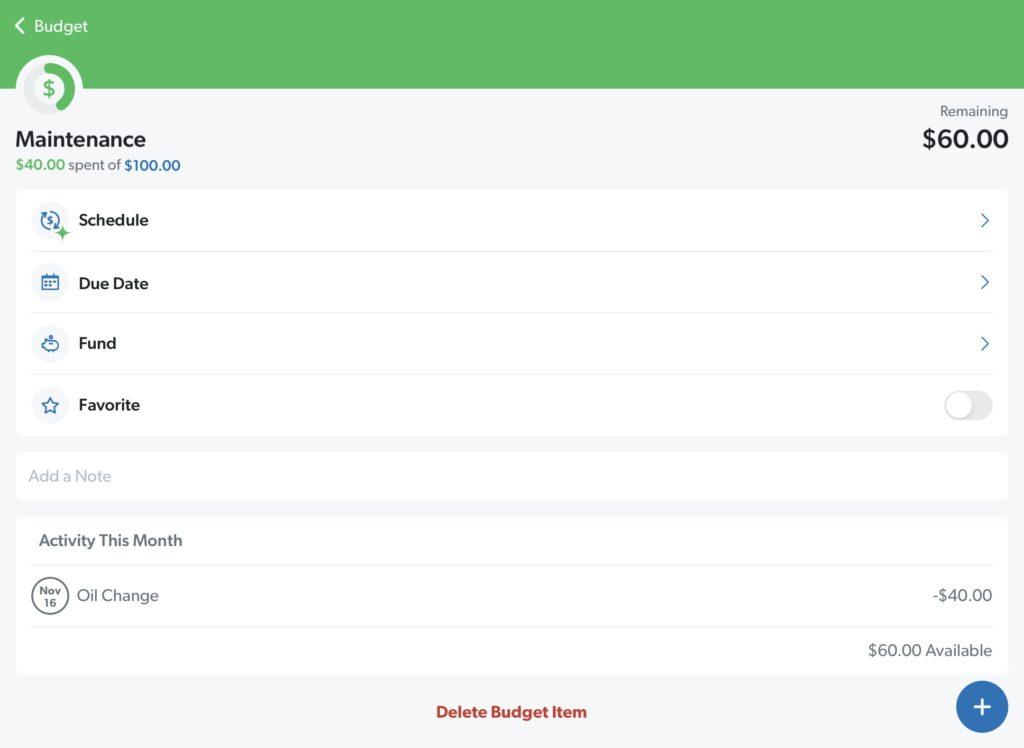

In the Every Dollar app, I find the easiest way to manage the budget items that have fluctuating amounts each month is to make each of those budget items a fund. This way any unused money from that budget item each month is rolled over to the next month. The way to do this is to click on the budget item on the budget screen to pull up the details of the item.

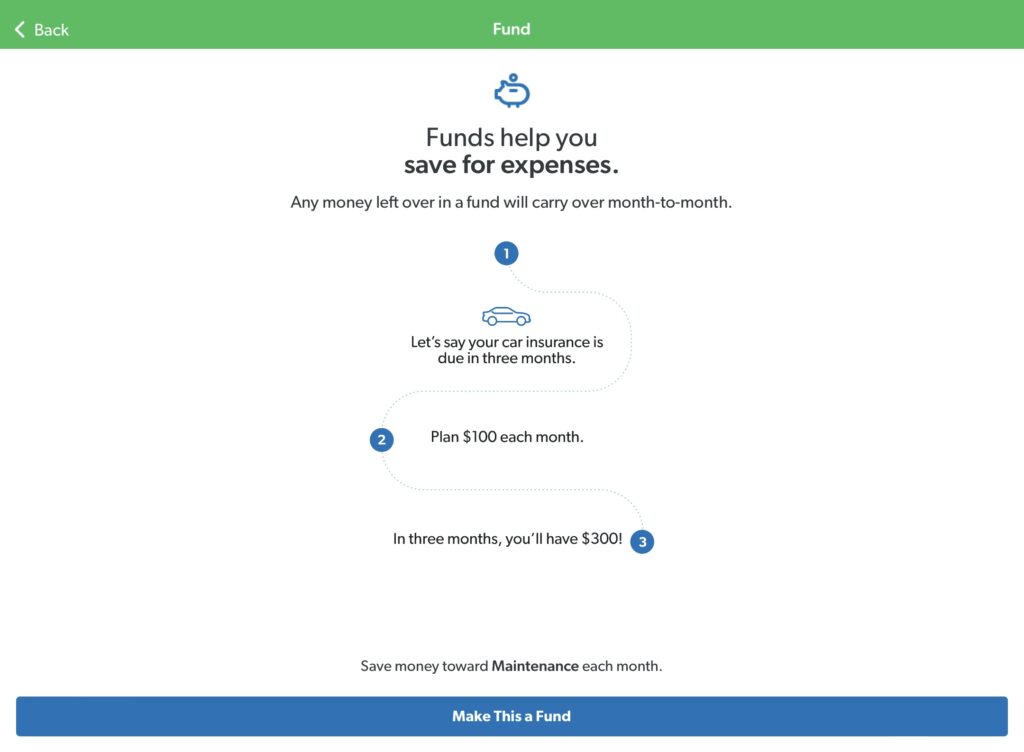

As you can see we have $60 left at the end of the month in the car maintenance budget that we can rollover to next month. From here, you would select the line that says Fund. This will take you to the screen where you can choose to make this budget item a fund so it will rollover leftover balances from month to month.

You would just select the option at the bottom of the page to Make This a Fund.

This can be done with any of the budget items that you want to carry balances over from one month to the next.

Rinse and Repeat

Once you’ve made any adjustments that you feel need to be made after seeing how things went your first month, your second month should be even easier. You’ll still need to make adjustments from time to time, but that’s part of the beauty of having control is that you are the one that decides what you want to accomplish based on your personal goals.

Is It Worth It?

You may be thinking, “I don’t know if I want to go through all of that”. Or you may be thinking that you don’t want to have to give up certain things to reduce your expenses or to give up your time to have to work extra hours.

Let’s look at the reality of what this can mean for you. In our sample budget, We have payments of $420 per month going to our three debts. If we only pay this amount each month, it would take 56 months or 4 years and 8 months to pay off the debts. If between cutting your expenses and bringing in some extra income, you were able to put an extra $1,000 a month toward those debts, you could have all three debts paid off within 14 months! Something else to consider is that if you only paid $420 per month, the total amount of interest you would have paid is $4,184.93. If you put the extra $1,000 a month and paid it off in 14 months you would have only paid $673.46 in interest which would be a savings of over $3,500 in interest!

If we go even one step further and say when you got to the end of the 14 months with all of the debts paid and took the $420 that you would have been paying on the debts for the remainder of the 56 months and invested it at a rate of return of 10% per year, at the end of the 56 months you would have accumulated over $21,000! So just by doing some sacrificing for 14 months to pay off the debt early you could potentially have built up an additional $21,000 in savings.

If you’re not convinced yet, let’s take that one more step further. If once you got to the end of the 56 months and continued adding $420 per month to your investments, after an additional 20 years, the total value of your investments would have accumulated to be $476,889 or nearly half a million dollars! Does that make you pause to think if it is worth it? And that is only the start. You will find that once you have your debt paid off, the path to stability and even growing your wealth becomes much easier.