There are many different avenues an individual can go down when looking for the best path to building wealth. You may think that there is some secret formula for accumulating money and wealth. The truth is that it can be done by the average everyday person. While it does help to have a higher than average income, individuals with an average or even below average income can build wealth. Much of it comes down to educating yourself. It also involves making a plan to manage your finances in a way that you can build wealth over time.

What Is Wealth?

A person’s wealth is measured by the total value of their assets. So being wealthy would mean you have an abundance of assets, or in other words, have a high net worth. Your net worth is determined by adding up everything you own and subtracting everything you owe from that. It may seem rather simplistic, but the key is to increase what you own and decrease what you owe.

What Is the Best Way to Build Wealth?

The best way to build your wealth is to grow your assets. You then invest those assets into things that will grow over time. There are three primary factors that determine how quickly your wealth will grow:

- The amount of money you put into your assets

- The length of time you have for your money to grow

- The rate of return that you get on your money

Finding the right combination of these three factors is the key to growing your net worth. If you are able to put a decent amount of money each month into your investments, but get a low rate of return, your assets won’t grow very quickly. If you get a high rate of return and expect that it will become a million dollars in a short period of time, you may be disappointed in the results.

So the best path to building wealth is to save on a regular basis, invest in things that will generate a decent rate of return and don’t expect that your wealth will grow overnight. Here at Everyday Money Manager, we want to help provide the education you need to accomplish your goals of building wealth.

How Long Does It Take to Build Wealth?

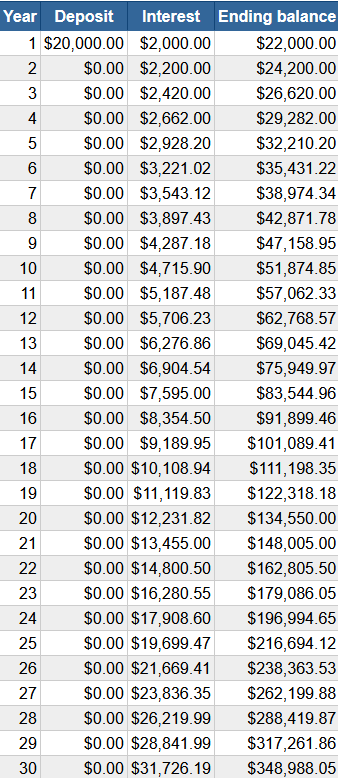

Because one of the factors in building wealth is the amount of time that you have to invest, the important thing to do is to start as early as possible. The reason for this is because of the concept of Compound Returns. The concept of compound returns refers to the cumulative gains on investments over time. Basically this means that as your investment grows from interest or returns, the money grows faster because you’re getting a return on the growth as well as the money you put into the investment. The chart below is a good way to illustrate this.

This chart illustrates making a $20,000 deposit into an investment that generates a return of 10% per year over a period of 30 years. You can see under the interest column the amount of interest that the investment generates each year. The first year the interest would be $2,000 which is 10% of the invested amount of $20,000. In year two, the interest amount goes up to $2,200 because you’re not only getting 10% interest on the $20,000 that you originally deposited, but you’re also making 10% interest on the $2,000 of interest you made in the first year. As you can see, by the time you get to year 30, you’re generating interest of $31,726.19 in that year. And your total accumulated investment would have grown to be $348,988.05.

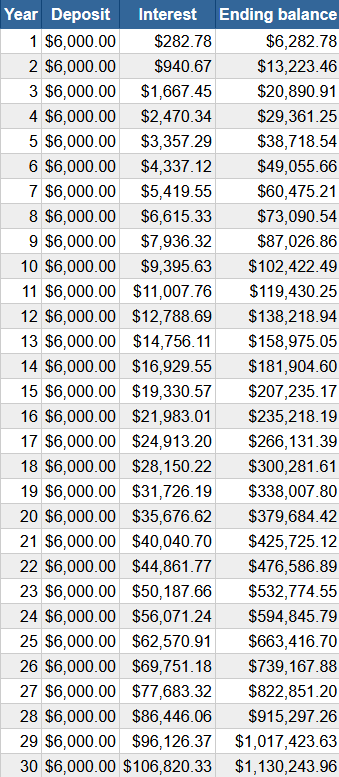

Example With Monthly Contribution

You don’t need a lump sum like in the previous example to start building wealth. Next we’ll look at an example with making a monthly contribution to our investment. In this example we’ll use a $500 a month contribution to our investments at a return rate of 10% per year over a period of 30 years.

As you can see with this example that the value of your investments would have reached over a million dollars after 30 years. In real life, most people would be able to increase the amount that they’re contributing each from increases in income. If we were to use the same example and increased the contribution amount by 5% each year we can see the results from this change.

The difference in the results with this change are quite substantial. We end up with more than $650,000 extra by increasing our contribution by 5% per year.

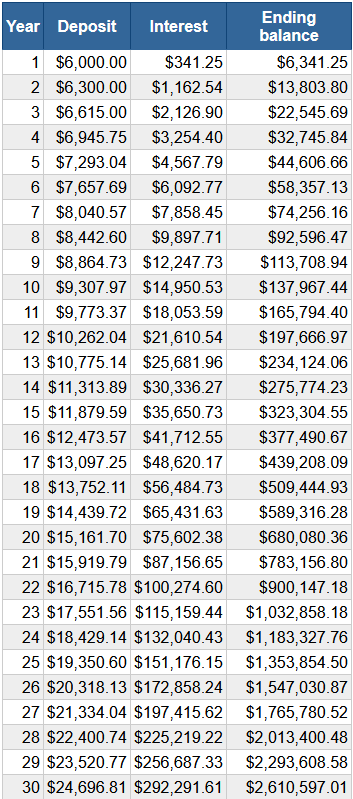

Example with Increased Rate of Return

Next we’ll look at how increasing the rate of return affects the outcome. If we look at an example where we were able to get an average rate of return of 12% per year instead of 10% per year, here is how our results would look:

This change increases our total value by over $800,000. You may be thinking that it isn’t practical to think that someone could average a 12% return over a period of 30 years in investments. That’s what some people would like to convince you to believe. It is a fact that in most cases with investments, you can’t predict with 100% certainty how financial conditions in the future will affect different types of investment. But there are ways to get above average returns without increasing your risk by diversifying to reduce your overall risk.

So to answer the question “How long does it take to build wealth?”, it all depends on different factors such as the rate of return and the amount you contribute. In our last example you would have reached the one million dollar mark sometime in the 23rd year of your path to building wealth.

Alternative Avenues to Building Wealth

Even though investing in a traditional brokerage account is the most common way to build wealth, there are other ways a person can grow their assets. The basic premise is to grow the assets that you have that will generate a return. Investing in the stock market and related types of investments is probably the most passive. If you have time and/or talents and resources to leverage, there are other opportunities available.

Growing Wealth Through Owning A Business

Starting or growing a business is one alternative way to build wealth. If you have the ability to manage and grow a business, there is a lot of potential for building wealth. There certainly is a level of risk in owning a business. But as with most investments, higher risk generally means a higher level of reward.

One advantage to owning a business includes having control over how successful your business is. The disadvantage to this is that you are also in control of how successful or unsuccessful the business becomes. Owning a business certainly takes a lot of work and isn’t a passive investment by any means. And not everyone has the skills or abilities to be a successful business owner. But with hard work and determination, growing a business can be a rewarding journey.

My Personal Journey as a Business Owner

I have been blessed to be able to have had the opportunity to start and grow a business from the ground up. It was a 13 year journey that I am extremely grateful for. At the time that I was ready to be done running the business, I was able to sell it to someone who would continue running it and service the customers that I had been serving. I’ll give you a very high overview of the financial benefits from the business I had. I started the business selling a few items on eBay related to the work I was doing. From there I used the profits from each sale to expand the number of products I was offering. Shortly after that I opened an online store. At the end of the 13 years my gross revenue was nearly a million dollars a year. I was also able to sell the business for a seven figure amount. Of course a lot of hard work went into building the business. I’ll be sharing more about my journey with starting, growing and selling my business in a future article.

Growing Wealth Through Real Estate

Outside of the stock market, investing in real estate is probably the next most popular way to invest. Growing a portfolio of real estate properties follows our premise of growing assets that will continue to grow and multiply over time. The hurdle to get over when investing in real estate is typically the amount of money you need to get started in owning individual properties. Whether you invest in fix and flips, or long term or short term rentals, you typically need at least a down payment in order to purchase the property.

There are ways to invest in real estate with smaller amounts of money. In recent years there have been a number of platforms that have been started that have what is called fractional real estate investing. This is where you can purchase a small portion of a property. There are also options where you can invest money into a small portion of a loan to an investor which would generate interest on your investment. These alternatives are actually much less work as you don’t have to be in charge of managing the property.

One thing to be aware of with most real estate investments is that the money that invest carries liquidity risk. This means that the money isn’t easily accessible if you were to need the funds for something else. If you own a property, accessing the money in the investment isn’t as easy as making a withdrawal from your brokerage account.

Education Is the Key to The Path to Building Wealth

The key to building wealth is gaining the knowledge to be able to make a game plan on how best to invest your money to grow it over time. We will be providing education about many different types of investments, both traditional and creative ways to grow your wealth.

Make sure to subscribe to our email newsletter below to be updated on new articles about building wealth!