When investing in the ETF TQQQ, one of the ways to maximize your returns while lowering the volatility is to use a rebalancing TQQQ strategy. In our article detailing how TQQQ would have performed in the past, we were able to see how volatile this ETF is. One of the ways to reduce the volatility level is by using a rebalancing strategy. This can also increase the returns in certain market environments. In this article, we’ll look at how this will affect the overall results in various situations.

The Basic Strategy

A rebalancing strategy for TQQQ can be a good one given the big ups and downs of the share price. This way you’re selling some shares when the price is up and buying them when the price is down. Now we know we can’t predict when it’s going to go up or down. We also can’t predict how much it will go up or down when it does. So having a system to determine when to buy and sell is a more controlled way to handle this.

The system that I use for rebalancing involves setting a target. You can set a percentage that the target increases with over time. Then for the rebalancing if the price goes above the target by a set percentage you would sell shares equal to the number of shares that you own by that percentage. If the price goes down by that percentage you would buy shares. As you can see the strategy is somewhat a hybrid of rebalancing and swing trading.

An Example

An example might clarify the whole process. Say you currently own 1,000 shares at the share price of $100 a share. So the current value of your shares would be $100,000. You could start with that $100,000 as your target. If your percentage target is 10%, then if the share price goes up to $110 you would sell 10% of your shares or 100 shares. You would then have 900 shares worth $99,000. You would also have $11,000 in cash that you got from selling the 100 shares. If the share price goes down to $90 per share you would buy 100 shares.

Of course at the beginning you’ll want to have cash set aside for buying shares when the price goes down. The hope is that it will go up more than it goes down, which in the long run it typically does. If this happens you should have cash from selling shares when the price goes up to buy shares when the price goes down.

Repeat the Process

Moving forward, you would continue the process. Every time the shares moved up or down enough that it increased or decreased the value of your shares by 10% more or less of your target you would buy or sell another 10% of the shares you own.

Real Life Example

Let’s look at this in more detail using the real share prices of TQQQ since it launched. TQQQ was launched on 2/11/2010. Say we started with $100,000. The price of the shares on that date closed at $82.56 per share. So we buy 1200 shares for $99,072. I’m rounding the number of shares to the nearest 100 shares. You’ll see the reason for this later on in the process. After buying the shares we are left with $928. We’ll keep track of this cash as we go also. It will be held in reserve for buying shares when the price goes down.

I also set an initial target value of $100,000 and planned for this to increase by 0.1% per day that the market is open. There are approximately 250 trading days in a year. This means our target will increase by a little over 25% per year since the increase compounds.

Setting Buy and Sell Targets

From here we set a buy and sell target. The way this is calculated is as follows:

- Buy Target is calculated by taking our Value Target ($100,000) and multiplying it by 90% or 0.9. We would then divide that by the number of shares we own which is 1200. Here is the formula: 100,000 x 0.9 / 1200. So our Buy Target would be $75.00. That means if the share price drops to $75 we would purchase 10% more shares. Since we’re rounding the number of shares to the nearest 100 we would purchase 100 shares if the price drops to $75 for $7,500.

- Sell Target is calculated by taking our Value Target ($100,000) and multiplying it by 110% or 1.1. Then we would divide that by the number of shares we own. So the formula for our sell target is: 100,000 x 1.1 / 1200. So our Sell Target is $91.67. So if the share price went up to $91.67 we would sell 100 shares. So if that happened we would sell 100 shares for $9,167.

Because our Value Target would be increasing by 0.1% every day our buy and sell targets will be increasing by a small amount each day also. Our buy and sell targets will also adjust when we buy and sell shares based on the formula.

Variations of Rebalancing TQQQ

There are numerous different variations you could do based on this strategy. You can change the amount that the target increases. Another option is to change the percentage that you set the buy and sell targets at. You could set these at 5% instead of 10%. Or you could increase these to 20% instead of 10%. We’ll look at some examples of how changing this affects the outcome. We’ll also look at examples of how it worked during certain periods.

Results

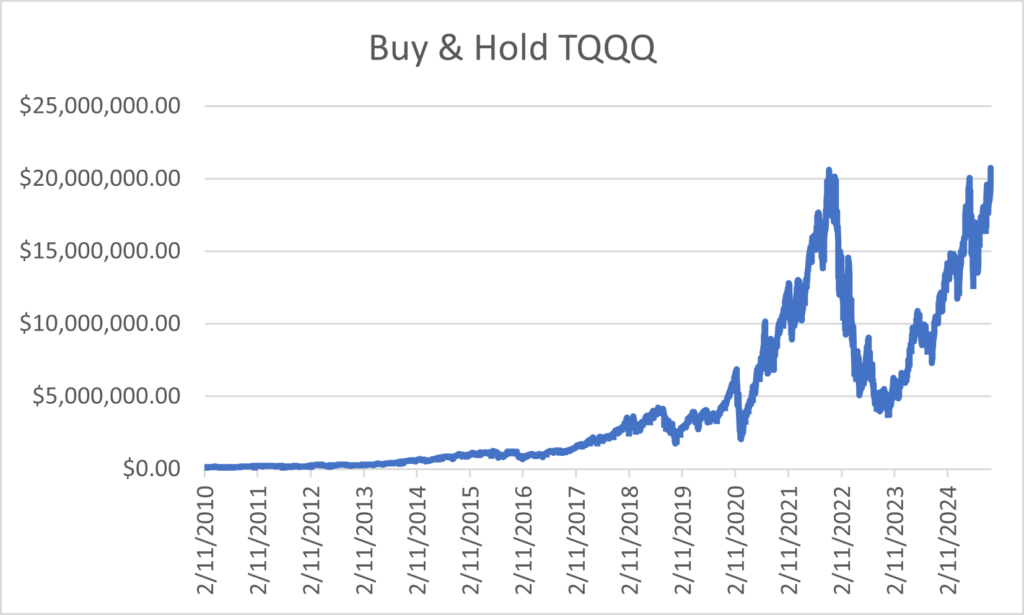

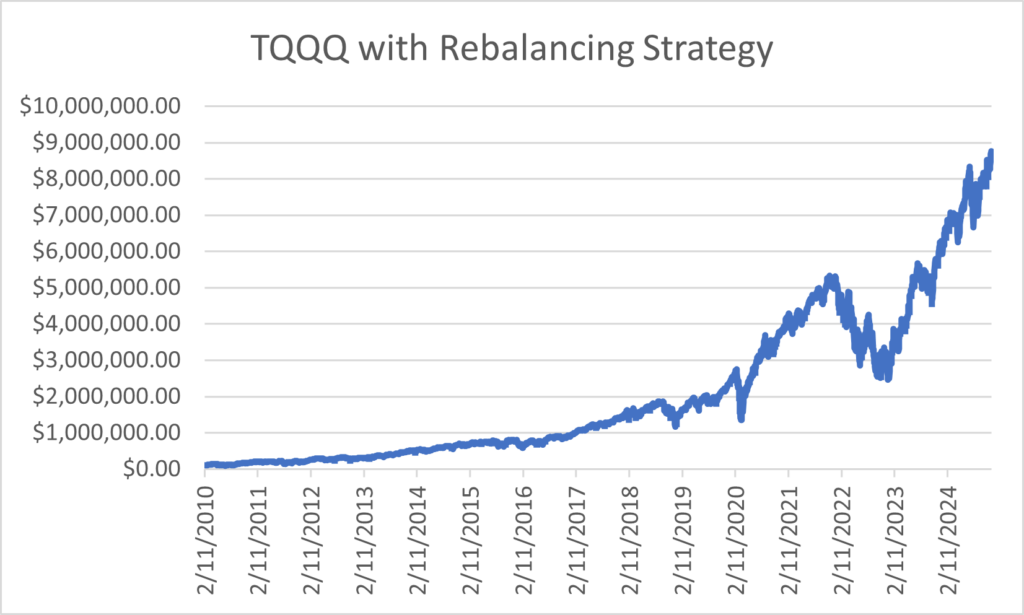

We’ll first look at the period of when TQQQ was first launched on 2/11/10 through 12/10/24. This is a period of 14 years and 10 months. We’ll compare the performance between a buy and hold strategy compared to this rebalancing strategy.

Just looking at the ending value during this specific time period, the buy and hold strategy comes out ahead. Starting with $100,000 we end up with $20,051,188 with the Buy and Hold strategy. This is an average annual return of 36.274%. This is taking into account the splits and the dividends that were received. I didn’t figure in reinvesting the dividends into more shares. But this is something that could be done. The amount that would have been received from dividends is $343,556.

With the Rebalancing Strategy the ending value is $8,617,332. This is an average annual rate of return of 30.422%. Out of this, $4,305,808 was the value of the shares we were holding and $4,311,524 was held as cash. I also included dividends and added that to the cash as dividends were paid out. Here are the charts showing the difference.

Volatility Difference

One thing to take note of is the difference in volatility between the strategies. There really was only one major downturn in the market during this time period. There were smaller shorter downturns. The one that had the biggest impact was the downturn starting at the end of 2021 and going to January of 2023 before it started going back up.

During that downturn the value of the Buy and Hold strategy declined 81.4%. The value of the account with the rebalancing strategy only declined by 53.6%. This is still a fairly sizable drop, but not as extreme. The one thing to notice about the drop is how long it took to recover. The Buy and Hold strategy account would almost have recovered by the end point of our example which has been almost two years since the downturn hit a bottom. The Rebalancing Strategy account would take only about 6 months to recover after the bottom was reached.

Drawdown

The main risk in the rebalancing method is having enough cash during a downturn to be able to buy the shares. If you increase the percentage that the Target Value goes up, you can potentially end up with a higher ending value. The downside is you also increase the risk that you’ll need more cash when there is a downturn. The reason for this is that you won’t be selling shares as frequently.

In our example using the Rebalancing Strategy there were only 29 days that our cash balance went into the negative. This means that we needed more money than was available from selling shares to buy shares as the price went down. The highest amount it went into the negative was -$13,879. So these funds would have had to come from other sources than money we had from selling shares. This is a fairly small amount in the grand scheme of things considering the size of the account.

We can look at an example of what increasing the Target Value Increase percentage would do. If we raised the daily increase percentage from 0.1% to 0.11% the results may be surprising. The ending value of the account ends up to be $11,499,889. The total number of days that our cash balance goes into the negative is 65. The largest negative value in our cash balance is -$617,233. So while it does result in a better return in the end, it means that we have a fairly significant negative in our cash balance. There are some things that we can do to offset this which we’ll look at later in the article.

Variation of Buy & Sell Target Percentage

One variable that we can look at is changing the percentage of our buy and sell targets. The results don’t change significantly at least during the time period we’re looking at. We’ll first look at changing the percentage to 20% instead of 10%. The ending total value with this change is very minimal. With this change our ending value is $8,328,079 instead of $8,617,332. So it actually is a little less than using 10% for rebalancing.

If we change the percentage to 5% the difference is bigger. The ending value with this variation is $7,761,308. But either way there isn’t a huge difference when we change the buy and sell percentage. This may have a bigger affect during different time periods.

Adding Interest on Uninvested Cash

Now one thing you already may have thought of is being able to make a return on the cash portion of the account. This does add to the overall return. I calculated the difference when getting interest on the uninvested cash. There are a number of things you could invest the cash into to get a return and still keep it liquid for when you need it for buying shares during a downturn.

If I add this to our formula, the ending value with a 6% return on uninvested cash brings our ending value to $9,678,000. So this adds over a million dollars to our total at the end. Another thing to consider is as you have a larger amount of cash, you can invest some of the cash into higher yielding investments. This will raise your overall return even more.

Performance During Other Time Periods

We’ll next look at some examples during a longer timeframe. This example will include the crisis after the dot com bubble. It will also include the 2008-2009 financial crisis. Depending on the ups and the downs in the market the results would be significantly different. You may have already figured out that this system wouldn’t work very well if you started the strategy right before a major downturn in the market.

Rebalancing TQQQ 10/1/1985 – 9/30/2024

In our article giving an analysis on TQQQ performance we were able to simulate what TQQQ would have done going back as far as October of 1985. We are able to do this because we know how TQQQ performs in relation to the Nasdaq 100. We’ll see what kind of results we get applying the rebalancing strategy to the period of 10/1/85 to 9/30/24.

In this example we’ll start with $10,000 as our initial investment. Since we’re using a simulated method, we won’t include dividends as we don’t know what dividends would have been. With just using a buy and hold strategy during that time period the value of our TQQQ investment over the 39 years would have grown to $18,743,482. This is an average annual rate of return of 19.48%.

We’ll first look at what the rebalancing strategy would look like with increasing our Target Value by .1% per market day. This is to get a comparison with the more current time period. Because this time period included the major downturn after the dot com bubble and the financial crisis of 2008-2009, the results are pretty catastrophic during those time periods.

The total value at the end of the time period does end up being $456,250,400. This is an average annual rate of return of 27.83%. The problem is that our cash level during 2002 went as low as nearly negative 1.7 million dollars. Worse than that, in March of 2009 our cash level went into the negative by about 7.4 million dollars.

Now we don’t know if or when we’ll have another decade like we had in the 2000’s with technology stocks. But it’s helpful to see what our strategy would have done during that time period.

Adjustments to Rebalancing TQQQ

If we make some adjustments, it’s interesting to see how things change. If we lowered the increase of the target value to .06% instead of .1% it makes the cash level more manageable. It still puts us at a negative cash balance in March of 2009 of about $389,000. Though if we apply adding 6% interest to our cash balance, that lowers our maximum negative cash balance to about $71,000. Using these adjustments, this brings the ending value of our account to $17,772,444. This is just a little lower than using the buy and hold method. It also lowers our volatility level.

If we were to get a 7% interest rate on our cash, it would put our maximum negative balance at only about $1,800. Also the ending value of our account would be $18,981,678, so a little higher than the buy and hold method.

Let’s look at how things would turn out if you were to get a 10% return on your cash. This would bring your ending value up to $24,435,100 and we had a very minimal risk on going negative in our cash balance. In fact getting a higher rate on our cash would allow us to increase the percentage that we use to increase our Target Value. If we used these variables and increased our Target Value percentage increase to .07% instead of .06%, our ending value would be at $48,800,905. This is an average annual rate of return of 21.98%. The maximum negative in our cash value would be just under $100,000 and this was only for 5 days during the time period which still should be well within the available margin in the account at this point.

Conclusion

As you can see, using a rebalancing strategy with TQQQ can lower the volatility level to a degree. Determining the right variables is the difficult part. But obviously there are many different ways you could go with this strategy in using different options such as varying the increase in your target rate. Also varying your buy and sell percentage will make at least a small difference in the outcome.

Disclaimer

The content provided on Everyday Money Manager is information to help users become financially literate. It is neither tax nor legal advice. Nor is it intended to be relied upon as a forecast, research or investment advice. It is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.