In week 6 of our journey of growing a $10,000 account using options trading we were able to let some positions expire and open new positions. We’re also still working on recovering our loss from a couple of weeks ago on WOLF puts. It was helpful that the market was up even though there was a little bump in the market later in the day on Thursday due to a little tiff between President Trump and Elon Musk. Continue reading to see the trades we made this week and how we were able to reach our target as well as made a little extra to go toward recovering our loss on WOLF.

Getting Comfortable With Your Tickers

You’ll probably find that as time goes on and you get more experience with trading options that there are certain tickers that you will use more often than others. It is important to do your research on a ticker before you sell an option contract on it, but as you go through the process of selling options on certain tickers in different market environments you get a feel for how the share price moves.

It’s one thing to look at the historical chart to see how the share price has performed over time. It is important to do this also, but actually holding a put or call during the price movements will give you a better sense of how the price moves. Your confidence will grow the more experience you have. I continue to learn from my experiences in trading options and continue to refine my trades and strategy as I get more experience.

Week 6 Results

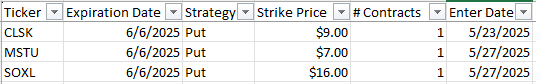

I started out the week with the following open positions:

On Monday morning both my MSTU and SOXL puts were out of the money so my hope was that they would stay that way through the end of the week. The share price for CLSK was a little below my strike price, but I decided to wait and see if the share price might go up so it would end up above my strike price by the end of the week.

Also on Monday morning I opened a new position by selling a put on SEDG. This is a ticker I’ve used quite a bit in the past and the share price seems to be on it’s way up so I sold a put with an expiration of 6/13 with a strike price of $16. The share price at the time was right around $17. For this trade I was able to collect a premium of $73.

As the week went on the market overall was moving in an uptrend except for a little blip late on Thursday due to that tiff between Trump and Musk. But when the market opened on Friday things were up a solid amount partly due to a good US jobs report. So on Friday morning, the three puts I had that were expiring that day were all fairly solid being out of the money so I let those expire.

I also opened one other new position. I chose to sell a put on TSLL which is the leveraged ETF on TSLA. The share price had gone down significantly late in the day on Thursday due to the white spat which made the implied volatility go up which made it more favorable for selling puts. But the share price was on it’s way back up so I sold a put on TSLL expiring on 6/13 with a strike price of $9.50. The share price at that moment was around $10.50. For this trade I was able to collect a premium of $46 which gave me a solid amount of premium total for the week.

List of Trades

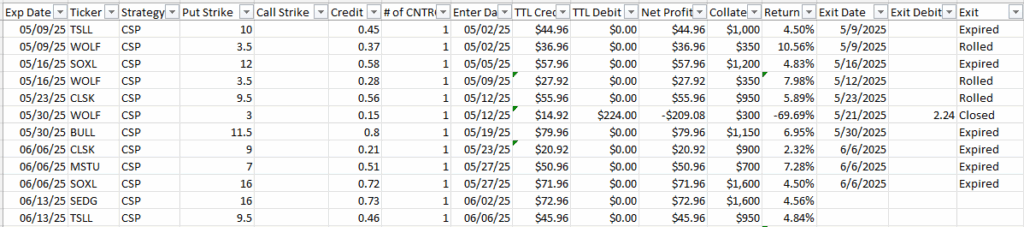

You may find it helpful to see a list of all the trades we’ve made in the 6 weeks since we started this journey. Below is a chart listing all of the trades

Feel free to leave a comment below if you have any questions about anything in the chart.

Summary

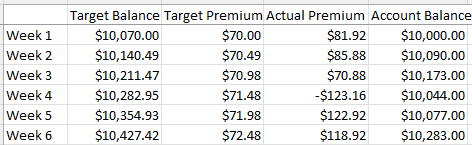

We have once again made some progress on recovering our loss from WOLF that we had a couple of weeks ago. For week 6 we brought in $119 in premiums and were able to let our open positions expire. So we ended the week with $2,550 of our capital committed to cover the open puts that we have which is a comfortable amount. Here is the chart of our progress up to this point:

So as you can see from our account balance at the end of week 6, we are getting closer to our target balance and being back on track.

Read: How to Generate Consistent Returns Through Options Trading