So if you’ve been following our journey, you know that last week ended up with a loss due to a position in WOLF. This week continues the process of generating 0.7% per week in options premiums. We’ll also be increasing that a little for several weeks to try and recover the loss from last week to get us back on track.

You may notice that I use different tickers most every week. Part of my reason for this is to demonstrate that the strategy is not dependent on a small number of tickers. There is a wide variety of stocks and ETF’s to use with our options strategy.

Lower Volatility in Up Markets

You’ll probably notice that as you get more experience with selling options that Implied Volatility is lower when the stock market is rising. In most cases volatility rises when the share price is dropping. This also means that premiums will be lower than when the volatility is elevated. We’ll still work at reaching our weekly goal, but we may have to use a little more collateral to reach the target level of premiums.

Week 5 Results

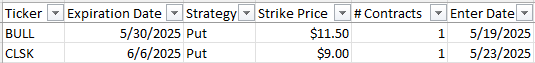

We started the week out with two positions:

On Tuesday both of these positions looked good with both of them being out of the money. My hope was that BULL would end the week being out of the money. If so, I would just let it expire at the end of the week. I opened two new positions on Tuesday since Monday was the Memorial Day holiday. I sold a put on MSTU with an expiration of Friday of the next week with a strike price of $7. For this trade I was able to collect $51. I also opened an SOXL put with a strike price of $16 expiring next week Friday for a premium of $72. This obviously brought my premiums well above my weekly target, but remember that I’m trying to collect some extra each week until my loss from WOLF has been recovered.

The week ended in a relatively decent place even though there were some ups and downs with the ongoing uncertainty over tariffs with the US government. My BULL put was able to expire worthless at the end of the week due to the share price going up during the week. My CLSK put was slightly in the money, but we still have another week to see if the share price may go up some to end next week out of the money.

Summary

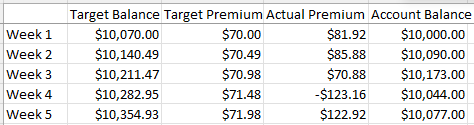

Even though we’re still behind our target, we made some good progress this week with bringing in $123 in premiums. Here is the chart showing the summary for the 5 weeks so far in our journey:

Read: How to Grow $10,000 Using Options – Week 6 Update

Read: How to Grow $10,000 Using Options – Week 4 Update

Read: How to Generate Consistent Income Through Options Trading