It didn’t take too many weeks into our process of growing a $10,000 account using options trading to run into a major situation. This experience will show some important points about our strategy and how we have safeguards for situations like this. We’ll share the details later in the article where we share our results for the week.

Biggest Pitfall to Avoid

The biggest pitfall to be aware of in my mind with the strategy we use is to avoid the temptation to use a larger amount of capital when things are going well. Up to this point we’ve been using a relatively small percentage of our capital for our weekly positions. The temptation is there to open additional contracts to bring in more premium. You can certainly do that, but what that does is increases the risk that you would run out of capital sooner for new positions during a market downturn.

We can look at the recent example of the downturn in the market starting in the last half of February. For my main trading account that I use for options I typically use between 20-30% of my capital for collateral on open positions during normal market conditions or even in up markets. When the stock market started falling in February over several weeks I was having to use a larger percentage of my capital for new positions to reach my weekly premium goal as I had positions that were out of the money and I was having to roll them out to either avoid assignment, or the puts would get assigned and I would have to sell further out calls. By the middle of April I was using around 90% of my available capital for open positions and new positions to continue to generate my target weekly premium.

Week 4 Results

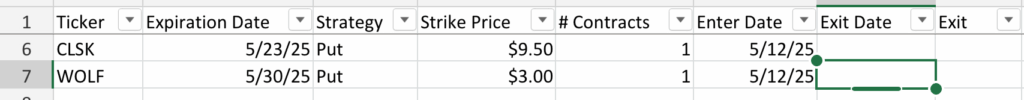

On Monday of this week, things started out as normal. Here are the positions that I started the week out with:

So as you may have noticed I usually open a new position on Monday to start the week. I sold a put on BULL with a strike of $11.50 and expiration of Friday of next week 5/30. For this trade I was able to collect $80. From there I was just planning on waiting until Friday to see how my CLSK put was turning out.

WOLF News

On Tuesday late in the day after the market closed a report came out about WOLF which I had an open put on. The report said that WOLF was preparing to file for bankruptcy in the coming weeks. So the share price of WOLF was down below $1 on Wednesday morning. At this point I had to decide to either buy to close my open put or leave it and hope that the share price recovered. In many cases I will use a wait and see approach. But in this case I decided to close the position because if the bankruptcy was going through then the possibility of the share price recovering was low.

I ended up paying $224 to close my WOLF put. Fortunately the total collateral used on this position was only about 3% of my account. So even though this was basically a worst case scenario, it wasn’t one that decimated my account. This shows the importance of keeping position sizes small. I’m confident that recovering from this loss won’t be difficult.

Recovery Plan

So my plan is to recover the $224 loss. Now because I’m using a fairly small percent of my account as collateral for my open positions, I could potentially recover the loss in one week. Instead my plan is to spread the recovery out over several weeks. What I’ll plan on doing is to increase my target premium to 1% for several weeks until I’ve recovered the loss. If I can bring in around $30 extra a week above my normal target I can recover the loss in 7-8 weeks. I also look at the fact that because I brought in more than my target on the first three weeks that I can use that as part of recovering the loss.

When Friday came the share price of CLSK was right around $9.25 a share. So my plan was to roll this out further in time since it was just a little in the money. I could have rolled it out just one week at the same strike price, but instead I chose to roll it out two weeks and down to a $9 strike to start out with the position being out of the money. For this roll I was able to collect $21 in premium for the roll. So at this point I had collected $101 for the week in premiums. Of course I took a loss of $224 from WOLF.

Summary

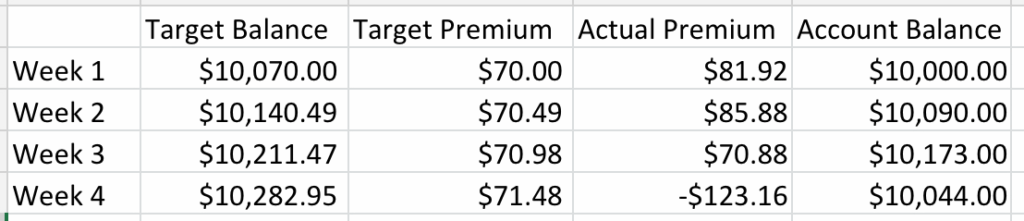

So here is a chart comparing my target for each compared to what my actual results are. This will be helpful as we go from week to week to gauge how we’re doing.

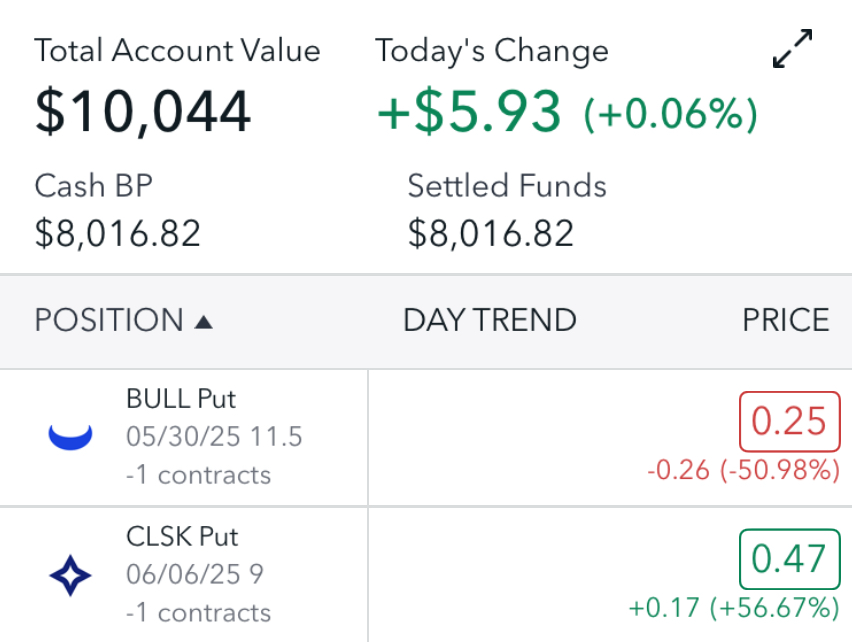

The Account balance in the last column reflects the open positions since they still have value remaining. So at least for awhile this will typically be lower than the target balance. The actual premium amount is taking into account the $0.04 fee per contract. And here is a screenshot of the account value at the end of the week:

And here is a list of all of our trades to date since the beginning:

Read: Growing $10,000 Using Options Trading – Week 5 Update