In the 3rd week of our journey growing a $10,000 account through options trading, things are still going smoothly. Of course the market went up a fairly significant amount this week which makes things good overall for selling put options. I actually ended up placing both of my trades for the week on Monday which I’ll go into detail about later in the article.

Choosing Tickers

I’ve gotten quite a few questions on the best way to choose a ticker or how to determine which tickers are best to trade on. Each trader may be different, but for me I try and choose tickers that have high implied volatility which results in higher option premiums. I certainly realize that the risk is higher overall, but using this strategy makes it so I don’t have to use as much of my capital to generate the target level for premiums each week. Keeping more of my capital in cash actually lowers the risk level. So at least in my mind it evens out the risk level.

There are a number of different ways to find the best tickers to use. There are screeners available that will screen for high volatility. I have actually gotten some suggestions through some of the subreddits on Reddit from others who use a similar strategy or like to use high volatility tickers.

Probably the resource that I’ve found to be the most helpful is a research tool through the broker that I use for one of my trading accounts. Firstrade is the broker that I use for the account that I’m using for this $10,000 journey. One of the advantages that I like about Firstrade compared to some of the other online brokers is that they only charge a $0.04 fee per contract for options. Many of the other brokers charge a higher fee. I know with Tradestation it’s $0.60 per contract and Schwab is $0.65 per contract. I know it’s not a lot, but over time it adds up.

Option Research Tool

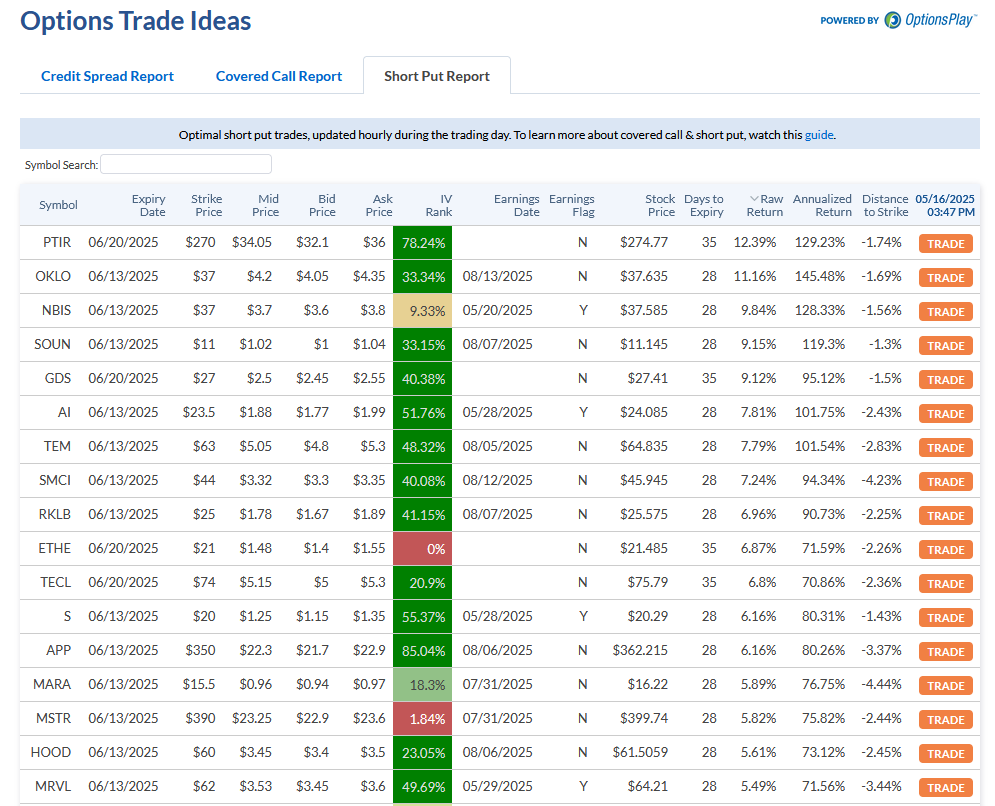

Here is a screenshot of the list of possible high volatility tickers from the the tool that I use through Firstrade.

I still do some research on these before I determine if they fit my criteria. For example if we were to look at the first ticker on this list which is PTIR. This is the 2x leveraged ETF based off of PLTR. I have sold options on this ticker a number of times and it has worked out well. I haven’t opened new positions on this ticker recently because the price has run up quite a bit in the last few weeks. My preference is to sell options on tickers that are near where I think is a low for the share price. I also like to have the current share price near the bottom or below the price target range for the stock. Of course this wouldn’t apply to ETF’s. But like in the case of PTIR, I would look at the price target range for PLTR.

Here is a link if you’d like to open an account with Firstrade:

Week 3 Results

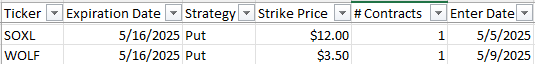

As I mentioned earlier, both of the trades for the week I placed on Monday. We started the week with the following positions:

On Monday, the market was moving up, but at least when I checked things on Monday morning WOLF was still below my strike of $3.50. I knew that I could just wait until later in the week to see if the share price would rise above my strike price. Instead I decided to roll it out two weeks to a 5/30 expiration date and roll it down to a $3 strike price which gave me room in case the share price stayed where it was or even went down more. I was still able to collect a $15 credit for this roll which is still fairly decent considering I was rolling it to a lower strike price. Of course as the week went on, the share price of WOLF did rise and ended the week above $3.50. So I could have left it until the end of the week, but this is one of those situations that you make a decision and things could have gone better if you waited, but if the share price dropped, it was better to roll it down to a lower strike.

I also opened a new position on Monday. I sold a put option on CLSK with an expiration of Friday of the following week 5/23 with a strike price of $9.50. For this trade I was able to collect $56 for this trade. So between rolling my WOLF put and opening the CLSK put I collected $71. This is near my goal for the week so at this point I didn’t need to place any new trades. SOXL ended up rising in price a significant amount over the week so my SOXL put I was able to let expire at the end of the week.

Summary For 3 Weeks

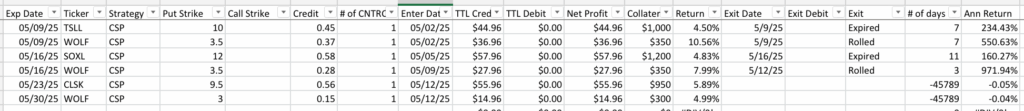

So to sum up our journey so far, we have collected a total of $239 total for the 3 weeks or if you deduct the $0.04 per contract our total premium collected is $238.76. So at least at this point we’re ahead of our goal of $70 per week. Here is a chart showing all of the trades we’ve made so far.

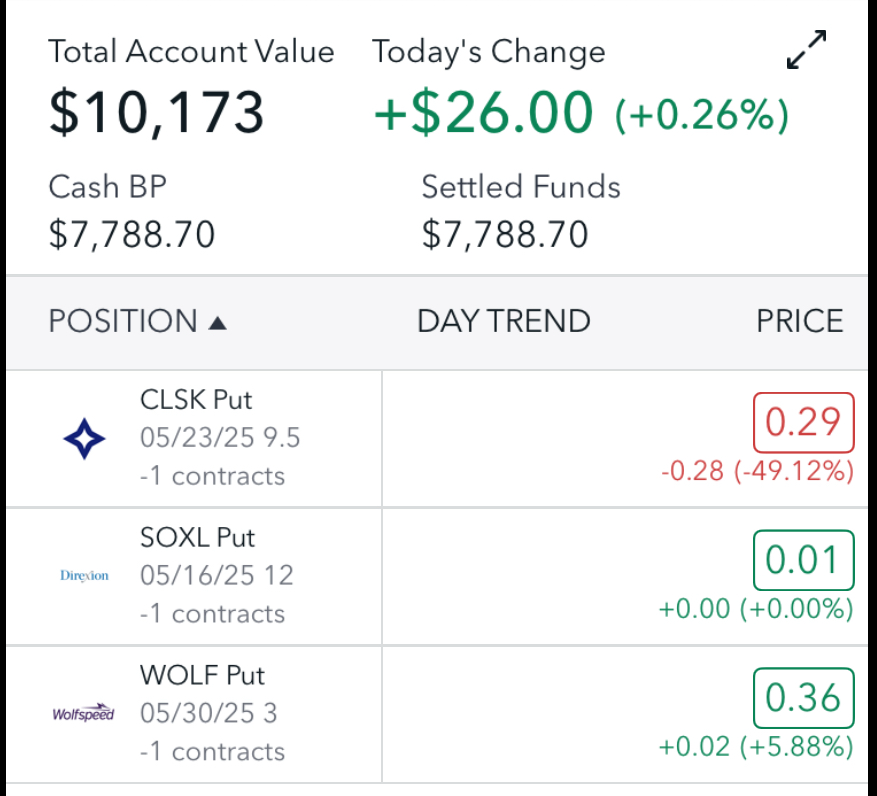

In the far right column of the chart you can see the annualized return based on the number of days the contract was held for each position. Here is a screenshot showing our account balance.

Read: Growing $10,000 Using Options Trading – Week 4 Update