We’ve completed week 2 of our journey of how to grow $10,000 using options trading. Our goal is to generate an average of about 0.7% per week in options premium on the account. Here in our 2nd week things went fairly smoothly with managing the positions that we had along with opening a new position. You can see the introduction and results from week 1 here: How to Grow $10,000 Using Options Trading

Goal for 1st Year

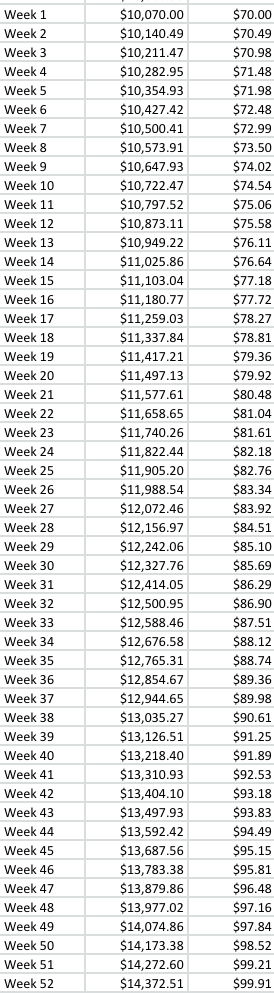

You may wonder how quickly the account will grow if we accomplish our goal of generating 0.7% premium every week. As we mentioned in the previous article, the return based on the amount of premium received would be about 43.7% annualized when taking into account the compounding factor. So here is a chart showing what the growth of the account from the options should be with the target return for the 1st year including how much our target premium should be for each week:

The Snowball Effect

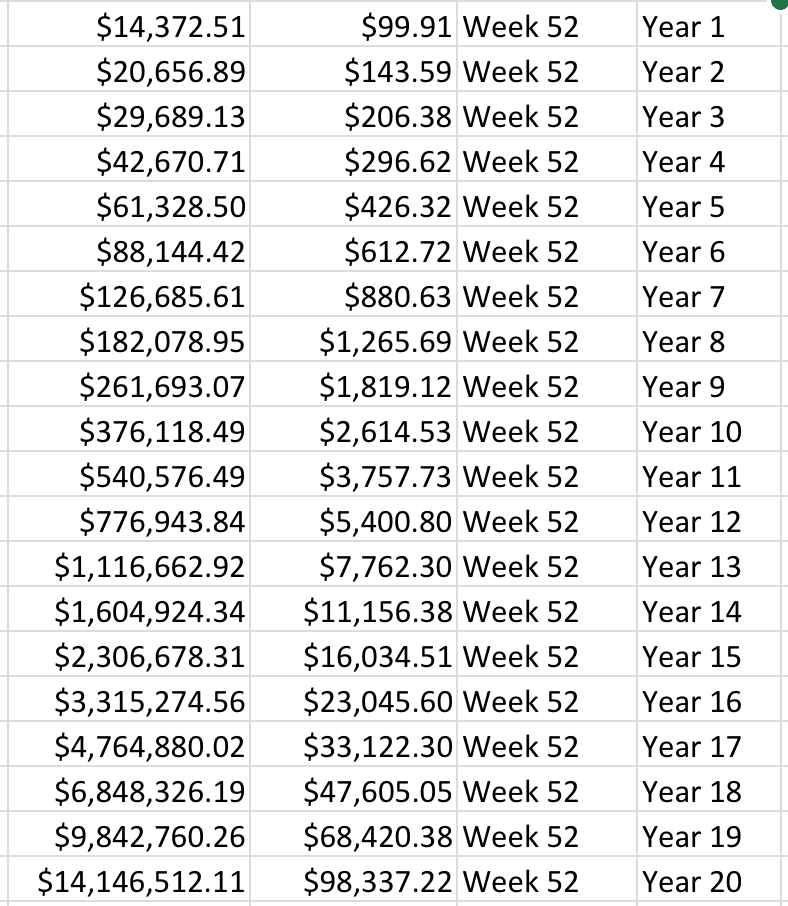

Even though the return is quite decent, it may seem like slow growth during the first year. But as the account grows it’s like a snowball and will grow faster the larger the account gets. As you can see from the chart above, your account growth from the option premiums after 1 year if all goes well, the account value would be up to $14,372.51. In the next chart you can see what the ending value would be at the end of each year and how much you would be collecting in weekly premiums at the end of each year.

By the end of the 5th year your account would have grown to $61,328.50. Sometime during the 13th year your account would have reached the million dollar mark and by the end of the 13th year your account would be collecting over $7,000 a week in premiums. And as you can see by the end of the 20th year the account will have grown to over 14 million dollars bringing in nearly $100,000 a week in options premium. Of course there are no guarantees that things will go as planned, but it is interesting to see how much the account can grow with collecting 0.7% per week in option premiums.

Week 2 Results

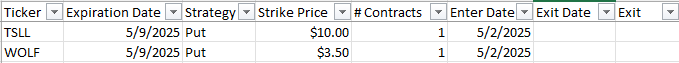

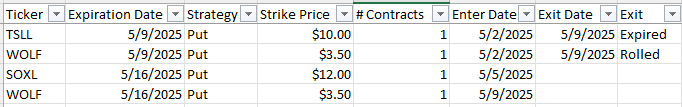

So as I mentioned things went fairly smoothly with our positions for the 2nd week. It doesn’t always go smoothly, but it’s nice when it does. As a reminder of the positions we ended with at the end of last week, we had a $10 strike TSLL put and a $3.50 strike WOLF put. The chart below shows the positions we ended last week with:

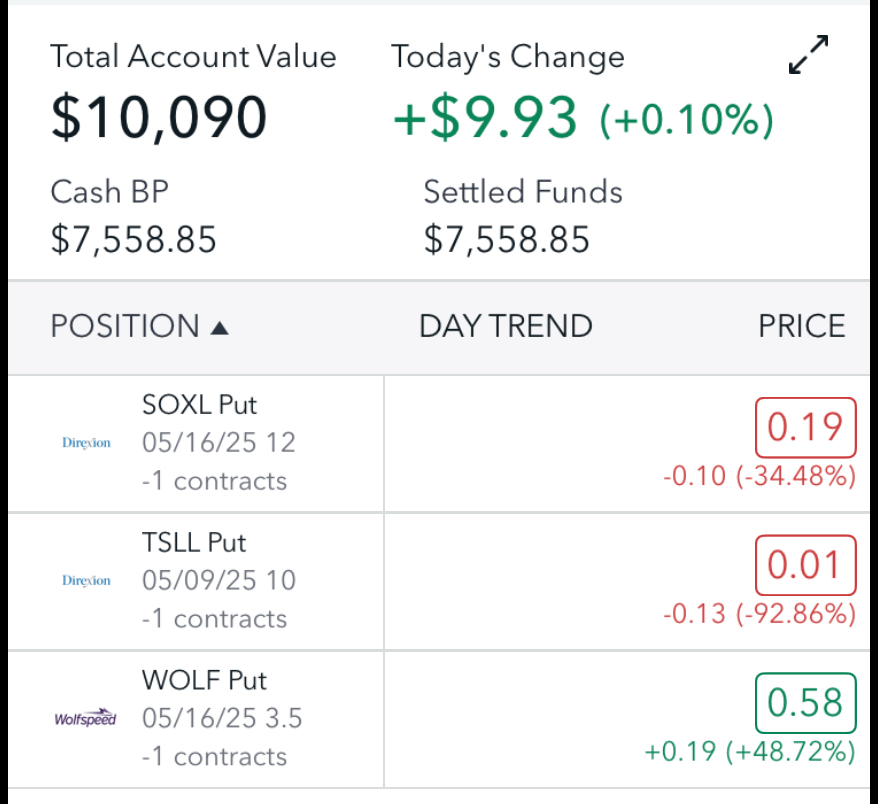

What I often do is to start the week off on Monday with new positions to get a start on the week. So on Monday of this 2nd week I chose to sell a put on SOXL that is 11 DTE at a strike price of $12 and collected $58 in premium. From there I decided to wait until the end of the week to see how my 2 open positions were doing.

When Friday came which was the expiration date of my two open contracts, my TSLL position was comfortably out of the money so I decided to let that one expire. The share price of WOLF had dropped quite a bit and was around $3.25 a share so my WOLF put was in the money so I decided to roll it to next week. I was able to do this for a $28 credit. This took me over my goal for the week. Between the SOXL put and rolling the WOLF put I had brought in $86 in premium for the week. At this point with my TSLL position expiring, I will be entering the 3rd week using $1,550 of my account as collateral for my 2 open puts. This is certainly a comfortable amount.

Summary

As you can see in the screenshot of my account below, this shows my positions. It is still showing the TSLL position because it hasn’t dropped off yet, but it has expired and will drop off by Monday. You may wonder why the value of my account doesn’t include all of the money that I’ve collected from options premiums so far. The reason is that there is still value remaining in the open positions that I have. Obviously the hope is that the positions will expire worthless and that value will go to zero which will then be reflected in the total account value.

So here is a chart of our positions at the end of the week including the positions that we rolled and let expire. Hopefully next week goes as smoothly as this week did! Feel free to share your thoughts in the comments below.

2 responses to “How to Grow $10,000 Using Options Trading – Week 2 Update”

I am following your account, but you are explaining what you are doing a good bit after you do it. How about a daily update?

Thanks for following Ryan! My main reason for sharing the updates at the end of the week is because it’s not my intention for someone to copy my trades, but instead over time learn from the strategy that I use so each trader can learn how to identify the best trades to make. Some traders may take less risk with their trades and some may take more risk. Each person decides what risk level they are comfortable with. Feel free to let me know if you have any other questions.