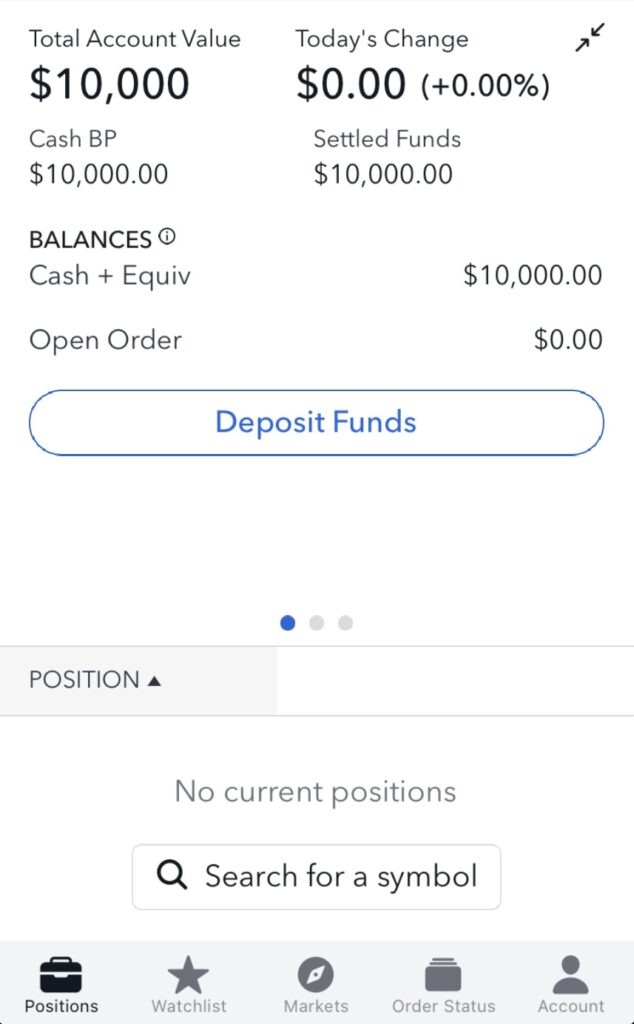

In my article which outlines the strategy that I use for options trading, my focus is on generating a decent return on a consistent basis. This article will be the first in sharing details of using the strategy to grow an account starting with $10,000. The weekly articles will show the actual trades that I made and the amount that I am able to generate in premiums as well as showing positions that I have to manage and how I manage them.

This isn’t meant to be a recommendation on specific trades as that needs to be determined by each individual trader. Also by the time I post my results, that trade very well may not be in the same position as it was when I placed the trade. Instead it is meant to help you learn what kinds of trades you could possibly look for to be used in your own trading.

Be Aware of the Risks

It’s important to be aware of the risks when entering any trading strategy. There will be times using this and most strategies that your overall account value will go down as you’ll see over time. The key is to be prepared to know best how to manage the positions that go against you. Some traders prefer to take a loss on a losing trade. My preference is to work the trade out over time to prevent the loss if possible. In many cases it can be done. Because each position is a relatively small amount of the whole account, it is easier to take time to work these out on individual positions.

My Goal For this Account

With this strategy $10,000 is probably the minimum that you would want to start with for it to work well. Ideally it is better to have more. The more capital you have to work with, the more you can spread your trades out to reduce the overall risk. My preference is to only use 2-3% of my capital for each position as collateral. With a $10,000 account that is quite limiting, so at least initially we’ll have to use a little larger percentage for each position until the account grows.

I’m going to target generating 0.7% each week in options premium. In my article explaining the strategy I suggest using 0.5%, but that is mainly to start out more conservatively. In my own trading I usually target 0.7%. So on a $10,000 account my goal starting out will be to generate $70 a week in options premium. As the account grows that amount will grow as well.

One thing to be aware of is that these trades are in a Roth IRA account. This is important as the gains are not taxable. If you’re using a non qualified account you’ll have to take into account the taxes that will be due on your earnings each year.

My Report for the Week

As I show my trades for the week, I’ll give some of the things I look for when deciding if a trade looks like a good one. There may be other criteria that you use to determine your risk level and if you think it is a good trade. Each trader gets a feel for what they think seems like a good trade to make. Obviously there will be many times where a trade will go against you, but managing them is the key. As I mentioned, I’m starting out with a new Roth IRA account with $10,000. I rolled this money over from a Roth IRA from another broker.

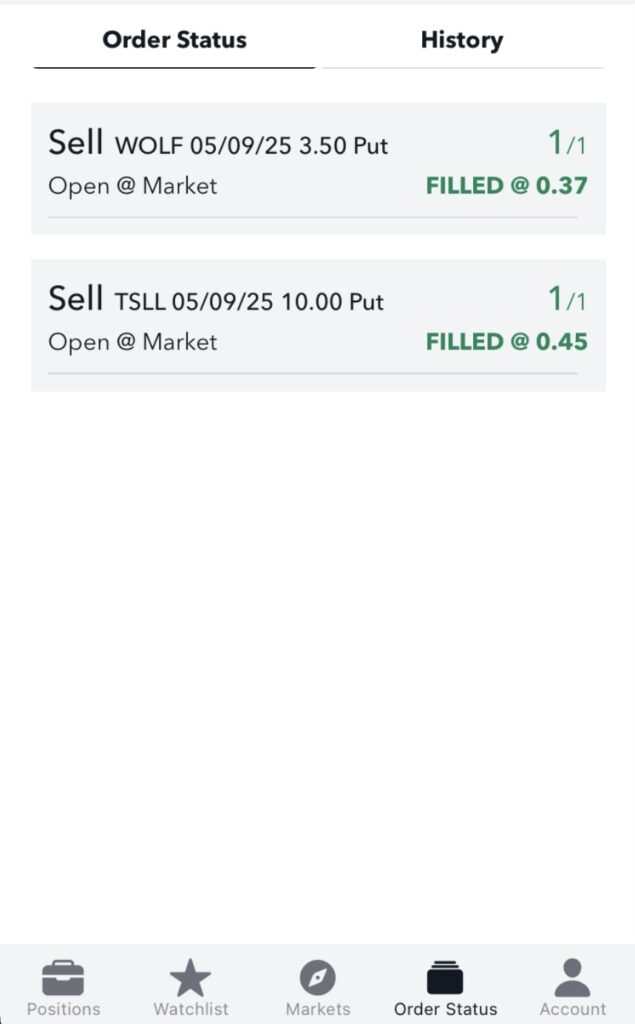

TSLL Put $10 7 DTE $45

The first ticker I chose to sell a put on was TSLL which is the 2x leveraged ETF on TSLA which is the ticker symbol for Tesla. My feeling is that Tesla has had a rough start to the year, but that in time it will recover. Selling puts on the 2x leveraged ETF for TSLA provides higher premiums. It also increases the risk.

The other thing is that to sell puts on TSLA I would need to use a lot more capital because the share price of TSLA is much higher than TSLL. I chose to sell a put that is 7 DTE (days ‘til expiration) which would be Friday of next week at a $10 strike price. For this trade I was committing $1,000 of capital to be able to buy the shares if needed and I was able to collect $45 in premium which is a 4.5% return on my collateral.

WOLF Put $3.50 7 DTE $37

The 2nd trade I made was selling a put on WOLF. WOLF is one of those that I have been selling a lot of puts on lately because it has really nice premiums. When I was making this trade WOLF was trading at around $4.50 a share. I noticed that WOLF will be reporting earnings on Thursday of next week which raises the implied volatility which in turn increases the premiums on the options. Because of the higher risk because of earnings I decided to go a little further down with my strike price to reduce the risk. I sold a put with a strike price of $3.50 that is 7 DTE and collected a premium of $37. This is about a 10.5% return on my collateral for the week. I committed $350 of my capital for this trade to be able to buy the shares if required.

Goal Reached

With these two trades I reached my goal by collecting $82 in premiums between the two. As I mentioned earlier my goal with $10,000 would be $70 per week which I surpassed. So based on this I would be done for the week and wait until next week to do anything new. At this point I’ve committed $1,350 of my $10,000 available capital which is 13.5%. I know that as time goes along and I end up managing trades that I’ll end up using more capital, but it’s important to keep the available capital for when you’re having to manage multiple trades.

Obviously the goal will be to have the positions expire worthless, but that certainly doesn’t always happen. With having a goal of 0.7% per week, taking into account the compounding, this would result in a 43.7% return in a year. Realistically it will most likely be a little higher as I usually end up getting a little more than 0.7% per week as you saw from this first week’s example.

Feel free to post any questions you might have or share your thoughts on the strategy. I always love to hear others perspectives. Here are links to the weekly updates:

Read: How to Grow $10,000 Using Options – Week 2 Update

Read: How to Grow $10,000 Using Options – Week 3 Update

Read: How to Grow $10,000 Using Options – Week 4 Update

Read: How to Grow $10,000 Using Options – Week 5 Update

Read: How to Grow $10,000 Using Options – Week 6 Update

Read: How to Grow $10,000 Using Options – Week 7 Update

Read: How to Grow $10,000 Using Options – Week 8 Update

Read: How to Grow $10,000 Using Options – Week 9 Update