You may wonder if it is possible to generate consistent returns through options trading. There are many strategies available when exploring options trading. Some strategies are more consistent in their success than others. If your goal is to generate somewhat consistent returns through options trading, the key is to implement a strategy that will accomplish this. With all of the different strategies available, there are more than one that would accomplish this goal.

I would like to share the one that I find works well for me. This article won’t teach you all the details about how to trade options. So if you’re unfamiliar with options trading you’ll want to learn the basics of how options work before diving in. One of the websites that I found to be helpful when I was first learning options was Option Alpha. They have a good beginners course on learning options: Beginner Options Training Course

The Basic Strategy

There are a lot of details that I’ll be presenting in this article about the strategy that I use for options trading. I’ll start off though with giving you the basic elements of the strategy to give you an overview of how it works. Make sure to read through to the end as we’ll be sharing many details including examples. I’m sure I’m not the only one to use this type of strategy, but I’ve pieced different things together to come up with the thing that works best for me. You may find variations to this strategy that work best for you as an options trader. That’s one of the nice things about options trading. There are so many different variations that each person finds what works best.

Element #1 – Always Be An Options Seller

The first and probably most important element is that being an option seller is a much easier way to be consistently profitable than being an option buyer. This is based on my own experience. So there may be some traders who disagree with this premise. Now when I say to always be an options seller, the exception to this would be to when you’re rolling a contract to a new position. In this case you would need to buy to close your open contract to sell to open a new contract. This is always done for a net credit though, so I’m not paying out capital to roll the position. I’m always taking in additional credit.

Element #2 – Always Start With A Put Option

There definitely are instances to sell call options. But with the strategy I use, I primarily start a new position with selling a put option. The ultimate goal is to generate returns from collecting the premium from selling the put options. In an ideal world the share price will always stay above your put strike price and you can just continue collecting premium week after week. I can guarantee that this doesn’t always happen. There will be some weeks that the share price will drop and you’re forced to either roll the position or to end up purchasing the shares.

Element #3 – Only Trade With a Portion of Your Available Funds

I only use a portion of the funds that I have allocated for options trading. The reason for this is that my goal is to be relatively consistent with the amount that I’m bringing in as premium on a weekly basis. If I used all of my capital for current positions and there were a time period when there is a downturn in the market overall, I wouldn’t have anymore available cash to place new trades. I keep cash available to use to open new positions when I have positions that I need to manage and aren’t able to make as much premium on my existing positions.

Element #4 – Use a Target Range For Your Weekly Premiums

Having a target range goal is the way to keep consistency in your profitability with options trading. The target range that I use is to shoot for somewhere right around 0.5% per week of the funds that I have allocated for options trading. I find this to be a relatively easy target goal to reach. It also generates a higher than average return with lower volatility than the stock market as a whole. If you generated a 0.5% return per week, your annual compounded return would be 29.6%. Depending on how you manage your trades, you may achieve a higher or lower return than this.

Element #5 – Target Options With High Implied Volatility

When considering pricing of options premium, there are a number of different factors that determine the premium price. One of the factors is Implied Volatility. Basically, Implied Volatility is the expected price movement in the shares over a period of time. So implied volatility represents expected future volatility in the share price. Higher implied volatility will result in higher options premiums. There also is higher risk involved, but our goal is to manage this risk by diversifying our positions and managing trades that go against us.

Choosing options with higher implied volatility means you’re collecting more premium in relation to the collateral you’re using for the position. Because we’re still trying to reach a target goal, if we collect higher premium on our options, it means we are using a lower percentage of our available capital to reach that target goal. Using a smaller amount of our capital is essentially lowering our risk overall because we’ll have more to work with when trades don’t go in our favor.

Element #6 – Manage Your Positions

It’s important to manage positions that are turning against you. My preference is to do what I can to avoid getting assigned if possible. This means rolling a position early enough to hopefully avoid assignment. Even if I have to roll the position out further in time, I try and roll the strike price down if possible to make it more manageable. If the position does get assigned and you end up having to buy the shares, you can then sell calls on those shares at a price that is no lower than your breakeven price. It’s preferable though to not sell the shares lower than the price you purchased them for.

Learning the skill of managing your positions is probably the most difficult part of this process as there isn’t as much of a set of rules to go by. There are some guidelines, but because you don’t know what the share price will do in the near future, one way may be better than another. As we get into more details about this it will make more sense.

How to Get Started

When starting out with this strategy, there are a few things to establish so you have a good system when starting to make your trades. If you have a system with guidelines, it will help you to be disciplined in the strategy which will help you to be more consistent with your profits. This is especially helpful when the stock market goes through a period of high volatility where it is moving much more than normal.

Preparation Step 1: Determine How Much of Your Portfolio You Want to Allocate to Options Trading

As we always emphasize, it’s important to diversify your investments. This means that you’ll have a variety of different types of investments which in many cases will reduce the overall volatility of your investment portfolio. So for example, say you have $200,000 in your investment portfolio and you want to allocate 25% to options trading. This would mean you have $50,000 that you are allocating to using for options. You may want to consider having a separate account specifically for your options trading. This can simplify things for you so you can better track what money is designated for options in your portfolio. It isn’t necessary, so you can decide if you want to structure your accounts this way.

Preparation Step 2: Determine Your Weekly Profit Target

Setting a weekly profit target will help you to stay disciplined with controlling how much of your funds you’re committing at once. As I mentioned earlier, the goal is to not use all of your available funds so that you have something to work with when you’re having to manage some of your positions during times when the market goes down. Having a profit target makes it so when you reach your target, or at least close to it, you can wait until the next week to open any new trades.

When starting out, it’s better to stay on the more conservative side until you start to get a feel for how the system works. It’s one thing to understand how the system works, but you get a much better understanding of it once you start trading. 0.5% weekly profit from your options premium is a good target. Like I mentioned earlier this would equate to a 29.6% annual compounded rate of return. You could start with a little lower target to be more on the conservative side. Even if you lowered your target to 0.4% per week, this is still a 23% annualized rate of return.

So based on a 0.5% weekly premium profit, if you had $50,000 allocated for options trading, this would be a profit of $250 per week. As this grows, your profit would grow to still be 0.5% per week. If you were able to grow your options funds to $80,000 in a year, then your weekly profit would have grown to be $400 per week.

Preparation Step 3: Determine What Percent of Your Funds You Want to Use for Each Position

Another guideline to use in this process is how much of your funds you want to use for each trade or position. Just as it is important to diversify your whole portfolio, it’s also important to diversify your options positions. The reason for this is that there will be many weeks where at least some of your trades will need to be managed. If you have multiple positions with different ticker symbols, hopefully some of the positions will turn out well and those funds can be used for opening new positions.

The percent that you allocate for each trade will somewhat be determined by how much capital you have to work with. I find that 2-3% is an amount that works well. If you have a smaller amount of money to work with, you may need to have a higher percentage for each trade without having to only trade in very low priced tickers. The reason is that to sell one contract, you would need to allocate enough money to be able to buy 100 shares of a stock or ETF.

An Example

So for example, if you had $30,000 to work with for options trading, 2% would be $600 and 3% would be $900. So only using 2-3% of your $30,000 would mean you would be limited to selling puts on stocks or ETF’s that were somewhere between $6 and $9 per share. There are definitely opportunities for trades on tickers in this price range, but you may want to trade on some tickers that are a little higher than this to give you more flexibility. This would mean using a little higher percentage for those trades.

Even if you raised your percentage to 5%, with $30,000 of capital to work with, this would put you at option strikes up to $15. This broadens your possibilities quite a bit. As you can see, as you have a higher amount of money to work with, you can diversify your positions out to more stocks and ETF’s which in some cases makes things more manageable.

Preparation Step 4: Setup A System to Track Your Trades

When trading options it’s important to track your trades in order to gauge your profitability. It also helps you to learn from your trades as you can look back and see what trades were the most successful over time. There are a number of websites out there that you can pay a monthly fee to use for tracking your options trades. Personally, I just use an Excel spreadsheet to track my options trades. It is probably a little more work than using a service that connects to your brokerage and downloads and analyzes your trades for you. But I prefer to keep things simple and just do it with my own spreadsheet.

I’ll be writing an article at some point that goes into more detail about creating your own option tracking spreadsheet. For starting out though, it doesn’t need to be anything fancy. Here are the basic elements that should be included:

- Expiration Date

- Ticker

- Strike Price

- Strategy (e.g. Covered Call, Cash Secured Put)

- Premium amount per share

- Number of Contracts

- Entry Date

- Exit Date

- Total Credit

- Collateral Amount

- Return on Collateral

It’s not necessary, but I also have fields for number of days the contract was held as well as the annualized rate of return based on the number of days the contract was held. There are plenty of other items you can include in your tracker and over time this can be developed. To get started though, it doesn’t have to be anything fancy.

Placing Your First Trades

So you have your preparation work done and you’re ready to start placing your first trades. Once you’ve determined a few stocks or ETF’s you want to place your first trades on, you’re ready to start trading. I’ll give some examples of trades you could place to achieve your goals based on the criteria you established in the preparation steps. None of the tickers I’m using in my example are recommendations as market conditions may be different when you’re reading this compared to what they are when I’m writing this.

Open New APLD Put Option Contracts

The first step would be to open new put contracts on tickers that you’ve decided would be good ones to start with. We’ll use an example of someone that has $50,000 that they have allocated for options trading. Based on our 2-3% guideline for each trade, we’ll target using around $1,000 – $1,500 collateral for each position.

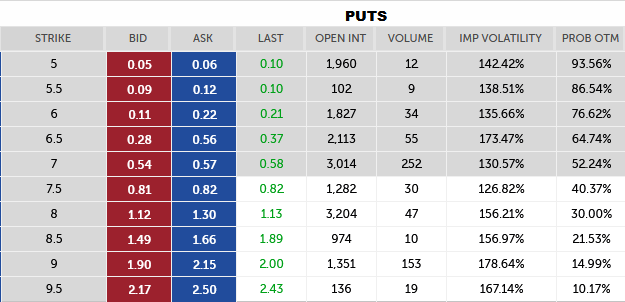

For our first trade example, we’ll look at the Ticker APLD which is for the company Applied Digital Corporation. The share price is currently $7.27. The option chain shown below is for contracts that are 11 days ’til expiration. If you were to sell 2 contracts with a strike price of $7 you could collect $54 per contract for a total premium collected of $108. And placing this trade would commit $1,400 of the money you have set aside for options as collateral in case you ended up having to buy the shares at $7 a share.

Open New HUT Put Option Contract

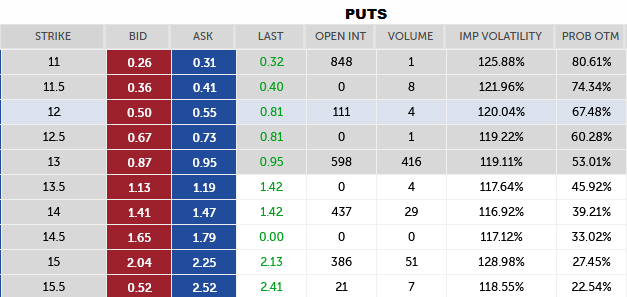

So if you set your goal of collecting 0.5% per week of your options allocation we would be shooting for a goal of $250 for the week. In our first trade we collected $108 so we are still looking to collect an additional $142 or so for the week. In our next example trade we can look at the options for the ticker HUT. These are for options that are also 11 days ’til expiration. The current share price is at $13.49. If you were to sell 1 put contract with a strike price of $13 you would collect $87 for the contract. and would have used an additional $1,300 of collateral.

Open New WOLF Put Option Contracts

In our last example trade we’ll look at WOLF. At this time WOLF is trading at $5.87 a share. This option chain is also for strikes that are 11 days ’til expiration. If we were to sell 3 contracts with a strike price of $5 we would collect $23 per contract or a total of $69 for the 3 contracts. For opening these contracts, we would be committing $1,500 of collateral for the trade in case we were required to buy the shares at $5 a share.

Read: How to Grow $10,000 Using Options Trading

Wait Until Next Week

At this point we’ve reached our goal of collecting around $250 in premium for the week. Here is a summary of our trades:

- Sold 2 APLD puts with a strike price of $7 collecting $54 per contract or a total of $108

- Sold 1 HUT put with a strike price of $13 collecting $87 for the contract

- Sold 3 WOLF puts with a strike price of $5 collecting $23 per contract or a total of $69

- Total Premium collected: $264

- Total Collateral committed: $4,200

So at this point, I would be finished for the week. As you’ll soon see, this is the easiest part. Opening new contracts makes selling options look really easy. The part that can be a little more difficult is managing trades that have gone against you. This system is manageable, but it takes a little work.

Choosing Strike Prices

When you look at the trades in our example above, you may wonder why I don’t choose strike prices that are further out of the money. It certainly does reduce the risk that the share price will go below your strike price by being further out of the money. The thing you want to consider though is that as you go further out of the money for your strike price you also collect a lower premium amount. This results in having to use more of your cash as collateral to generate the same amount in premium with either more contracts or additional positions.

Assess the Outcomes

When you sell a put contract, the ideal outcome is for the share price to stay the same or go up. The way that I like to look at it is there are five basic things that can happen with the share price by the expiration date:

- Share price stays about the same

- Share price goes up a little

- Share price goes up a lot

- Share price goes down a little

- Share price goes down a lot

I realize this is very generalized, but it is a simplistic way to look at the possible outcomes. When you sell a put option just below the current share price, the first three of these outcomes would result in the position expiring worthless which is our goal. If the share price goes down a little, even if it goes below the strike price, it is fairly easy to manage the position by rolling out and even down and out if needed. When the share price drops a lot the position can still be managed, it sometimes just means you have to roll it out further in time and possibly manage it until you can close it out without going below your cost basis for the position.

If you sold a put contract with a strike price that is a little lower to reduce the risk that the share price goes below your strike price, there will be some instances where the contract can expire worthless where a closer strike put would have to be managed. But if the share price drops a lot you’ll still end up needing to roll it to manage it to be profitable. This is where you just have to determine if taking in a lower premium is better for this reduced risk.

Choosing a Ticker to Trade

There are many factors to look at when you’re deciding which stocks or ETF’s you want to trade your options on. I’ll be sharing more details of finding optimal tickers to trade options on in future articles. One thing that is often considered is if the prospect for the shares of the stock or ETF is to be stable or go up over time. The tickers in my example above are options that have a higher than average level of volatility. This results in higher than average premiums, but also potentially higher risk.

When choosing tickers, the situation is similar to choosing strike prices. If you choose lower volatility stocks or ETF’s, the risk is potentially lower, but the premiums are also lower. So this results in having to use more collateral to generate the same amount of premium. Using more collateral in a sense raises your risk level. So the two balance each other out. Which method would be best just depends on what happens with the market over a set period of time.

Why Not Use All of Your Capital for Options?

You may wonder why I only use a small portion of my allocated capital for opening options positions. The reason is that there will be times when the share prices on some or all of my positions goes down. When this happens, I end up having to manage those positions and sometimes managing them over a period of time. My goal is to generate profits on a relatively consistent basis. In most cases you aren’t able to bring in as much premium when you’re managing your positions as you do when you’re opening new positions. I’ll show examples of this further in the article. So to generate the same level of profit, we’ll need to have capital available to open additional positions.

If we knew that our positions would always expire worthless every week, it would be easy to use a much higher percentage of our capital for selling puts, but this just isn’t the case. You can use a much higher percentage of your capital, but this raises the risk that there won’t be capital available when you’re managing your need it and you may have times when you aren’t able to generate profits as consistently.

What Percent of Capital Is Typically Being Used?

I have found that much of the time with this system, I am using somewhere in the 20-40% range of my allocated capital. There are times when the market goes through a period of a downturn that I end up using a higher percentage than this, but it still results in consistent profit. It is possible during an extended period of a much larger than normal downturn that you would run out of capital to open new contracts, but you would still be generating premium from managing your positions, it may just be lower than your target. This should be a situation that is rare, but just be prepared for this possibility.

Managing Your Positions

One of my primary goals is to do what I can within reason to avoid getting assigned on my puts. There are times when the share price drops on some of my positions that I end up getting assigned. So if the share price in any of my positions is dropping a significant amount, I will usually roll it early enough to avoid assignment in most cases. What this means is that on Monday I’ll check my positions that are expiring on Friday of that week. If any of them are far in the money, I’ll usually roll them.

Depending on how far in the money they are will determine how far out I have to roll them. If possible I will try and roll the strike price down as well as rolling out to work on bringing the strike closer to the share price. This obviously brings in more premium, but it lowers the risk of the position to some degree.

Example of Rolling A WOLF Put

I’ll share an example of a put that I rolled today which is a typical roll that I would do. Today is Tuesday and I had put contracts on the ticker WOLF that were expiring this Friday with a strike price of $6. This morning when I was checking my open positions I noticed that WOLF was currently trading at $5.25. Since my goal is to try and avoid assignment I decided to roll that position out to next week. I was able to roll it out to Friday of next week for the same strike price for a credit of $0.10. This would equate to $10 per contract.

You won’t typically get as much premium for rolling contracts as you do when opening new contracts. It is still a way to bring in additional premium. Even though it’s a lower premium, this is a 1.47% profit after fees for rolling it out one week. Annualized this would equate to a 76.44% rate which is still a decent return on the capital.

The other thing you could do is not roll the contract and if it gets assigned you could sell a covered call on the shares. In some cases you can get more this way. One of the reasons I prefer to roll the put is in some cases I prefer to roll the put down rather than have to buy the shares at a price that is higher than the current share price. I have an article which shows the details of a months long process of rolling puts that I went through in 2024 with DJT. You can read the details of my journey here: My Journey with DJT Puts.

Example of Rolling A CONL Put

Another example I’ll show is of some contracts that I had on the ticker CONL. On a Tuesday with an expiration of Friday of the following week which would be 10 days ’til expiration I had CONL puts at a strike price of $20. When I checked the current share price it was trading at $17.84 a share. I decided on this position to roll it down which also I had to roll it out in time further than one week. I was able to roll it out 4 weeks and down to a strike of $19 for a credit of $0.77 which was an additional premium of $77 per contract. After fees this was a 3.99% profit for 4 weeks.

I could have rolled it out at the same strike price and received a higher premium, but I decided on this position to roll the strike price down to make it easier to manage in case the share price stayed down for a longer period of time. Knowing when to roll down or stay at the same strike price is something that you learn as you get more experience.

When I first opened the position of the $20 strike put I took in a premium of $2.05. So with the additional $0.77 premium, this brought my breakeven point on the position to a share price of $16.18. That is one of the other benefits of rolling the strike price down rather than keeping it at the same strike price.

Managing Assigned Contracts

In some cases you will get assigned on your put contracts occasionally. Even though I try and avoid this, it doesn’t mean that I will end up with a loss on the position. Once you own the shares from being assigned on the put, you can then continue to make money on premiums from selling Covered Call options on the shares that you now own. Ideally you want to set your strike price at a point that is not lower than the price you were forced to buy the shares at. Though in some cases the share price has dropped enough that it makes it difficult to collect much premium on call options. Sometimes I will sell the call at a strike lower than what I bought the shares at, but I won’t go lower than my break even point for the position.

Managing An Assigned Position By Selling A Covered Call

One example I’ll share is of a position that got assigned this week. I had a put contract on DELL with a strike price of $114. Up to this point I had collected $5.14 per share in premium on the contract and was assigned. So I ended up buying 100 shares for $114 a share. The shares were trading at around $91. I decided to sell a covered call on the 100 shares with an expiration date that was 31 days ‘til expiration. There wasn’t much premium available for selling at a strike of $114 since the share price had dropped so much, but since I had brought in $5.14 per share of premium up to this point I decided to choose a lower price strike. I could collect an additional $0.90 per share of premium for a call with a strike price of $108.

With the additional premium this brought my break even point to $107.96 so even if I end up having to sell the shares at $108, I still didn’t lose money on my positions with DELL. I would lose the premium that I had previously brought in, but not a loss overall. Now from here, ideally the share price will go up, but not enough that I would have to sell the shares at $108. The ideal scenario with this is that it would go up to near the $108 strike price right before expiration and I can roll the contract to a higher strike and still not end up selling the shares for less than $114. It doesn’t always work out this way, but that is the hope at this point.

Waiting for the Share Price to Recover

In some cases when I get assigned on a put position, I will wait on selling the call if I feel that the share price will recover at least somewhat in the near term. For example this week I got assigned on some SOXL puts that were expiring this week. The strike price was $25 and the current share price is $19.60. I think it’s possible for the share price of SOXL to possibly move up next week. I could sell a $25 strike call with an expiration 4 weeks from today for a premium of $51, but if I wait until next week and the share price goes up I’ll be able to collect a higher premium. There isn’t always a best answer, sometimes it’s just deciding at the moment what seems like the best thing to do given the situation. This comes with experience.

Weekly Schedule

You may wonder what my schedule for trading options is like in a typical week. Generating consistent returns in options trading requires discipline which typically requires following a schedule. I follow a relatively consistent pattern from one week to the next. I certainly don’t have to sit watching the market all day every day. There are points during the week that I make adjustments, but I certainly don’t spend hours each week on my options trading. The amount of time that you spend will be somewhat determined by how much money you’re managing and how many positions you’re working with, but on average most options traders using this system should be able to manage it all on less than one hour a week total. So here is the basic schedule I follow from one week to the next.

Monday Morning

What I usually do on Monday morning about 30 minutes or more after the market opens is to take a look at open positions expiring the end of that week. If any of my puts are very far in the money I’ll usually work on rolling them out and possibly down depending on how far out of the money they are. I also will usually look at any new positions that I may be interested in opening. If there is something that looks like it’s at a good point of opening a new position, I’ll open a new contract for Friday of the following week in most cases. If it’s a ticker that only has monthly option contracts I’ll sell a put for the closest expiration unless it’s for that same week. In that case I would go out to the next month.

This process doesn’t have to be done on Monday morning. If you have a schedule that doesn’t allow you to do this during that time frame you can work on this at a different time. The only thing is that it would need to be done when the stock market is open. In many cases if you know ahead of time what you want to do, it should only take 10 or 15 minutes at the most to make the trades so it could be done on a break during the day.

Wednesday Morning

Usually on Wednesday morning I’ll check my positions again just to see if the market has moved in a way that would require any additional adjustments. In many cases on Wednesdays I don’t need to adjust anything additional, but if the market has made a significant move since Monday, I do need to manage some positions on Wednesday. But again, it doesn’t take very much time.

Friday Morning

The majority of the time that I spend on my options trading is done on Friday mornings. It’s best to wait at least 30 minutes after the market opens since things tend to be pretty volatile right after the market opens. On Friday morning I’ll look to see where my positions are. Often times there are positions that are far out of the money and I can just let expire. Some traders prefer to close these out if they only have one or two cents of value left. I prefer to just let them expire rather than paying the fees and the one or two cents per share to close them. Either way is fine, it’s just up to each person’s preference.

If I have any positions that are at the money whether they are just above or below the strike price of my puts, I’ll usually just roll them out for another week. Positions that are close I can usually make a fairly decent premium on these trades. If any positions at this point are far out of the money, I’ll also roll these. In some cases I’ll need to roll them out further than one week to get any decent premium on them. In the rare case that I’ve had any puts that were assigned I will usually sell calls then on the shares that I was assigned on.

Once I’ve managed my existing positions I will record my trades so I can calculate how much premium I’ve made for the week up to that point. In many cases I won’t have reached my percentage goal for the week, so I’ll look at what opportunities there are for new positions and open new puts to reach my premium goal for the week.

Rinse & Repeat

Each week you can follow the same pattern. Some weeks you’ll have more positions that you have to manage because the market has dropped and you’ll have some weeks when the market goes up that most or all of your positions will end up expiring because they’re out of the money.

Following this process can potentially provide a consistent way to create profits from options trading. Like I mentioned earlier, there may be rare periods where the market goes through a long extended time of going down overall which will result in limiting how much you can make weekly on options, but the majority of time, this system works well.

Feel free to share any questions you have in the comments below about this method as I may not have covered everything. I’ll be sharing more about this method in future articles. Make sure you subscribe to our email to be notified of updates.

3 responses to “How to Generate Consistent Returns Through Options Trading”

A highly useful and well-explained article! This website consistently delivers great content.

I think an important point that gets overlooked on rolling puts or calls is the fact that you have to buy back the initial contract at a much higher price than you sold it for. For example if you sold a put and collected $25, then had to roll, you would have to buy the initial put contract for say $50 and try to find a date and strike where you would be able to collect some more money, or a credit, say like $60. So net profit would be $35.

Yes, I agree that you do end up selling the in the money put for a higher price when you’re rolling. The goal is to eventually roll it until the position is able to expire out of the money either by the share price going up or over time rolling the strike down to eventually be under the share price. It doesn’t always work out this way, but from my experience I can eventually work the position out this way. In the meantime I’m able to collect some premium along the way.