You may wonder if it is possible for the average investor to “beat the market” on a regular basis. When building wealth, there are two factors that make the biggest impact on how much you’re able to grow your investments. One of the biggest factors in growing your wealth is the rate of return that you generate on your investments. The other main factor is the amount of time that you have for your investments to grow. Even improving your annual rate of return by one or two percent per year can make a big difference in the end result over a long period of time such as 30 or 40 years.

What Is “Beating the Market”

So to start we’ll want to determine what we mean by “Beat the Market”. Typically this just means generating higher than average returns on a regular basis. In many cases the S&P 500 index is used as an overall gauge of average market returns. Even though the index is varied from year to year on its performance, it averages at right around 10% per year over the history since it started in 1957. As you may be aware, there are some years that it performs much better than the average and some years where it performs much worse. Some years even have a negative return or a decline in the index.

So to beat the market, you would want to average over a 10% annual return over a long period of time. There are a number of ways to possibly beat this return with a fairly high level of certainty. Obviously as always, with investments there is nothing that is 100% certain. But applying a number of different strategies can help to increase your chance of success.

Asset Allocation Is the Key

The key to achieving a specific rate of return for your investments is to invest in assets that are expected to average out to the rate of return that you’re striving for. As we already mentioned, if you were to put all of your investments into the S&P 500, you would expect that over time your average annual rate of return would be around 10%. If you were to invest your entire portfolio in bonds you would expect an average annual return of around 5%. If you did a mix between these two of 50% in each it would be expected to average out to be 7.5% annually over time.

Expected Rate Is Not A Guaranteed Rate

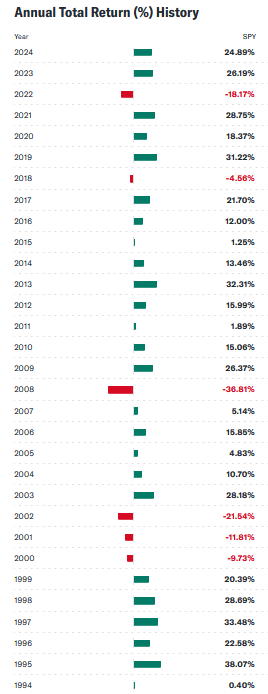

When we refer to expected rate of return, it’s important to remember that there is no guarantee for how well investments will perform in the future. Especially when it comes to something like the stock market. The chart below shows the annual returns for the ETF SPY which simulates the performance of the S&P 500. As you can see there is quite a variance from one year to the next. So depending on what time period you’re looking at, the average can be higher or lower than 10%.

In the last 10 years SPY has had an average return of 13% per year. So the most recent 10 year period is higher than normal. If we were to look at the 10 year period from 1/1/2000 to 1/1/2010 the average annual return would be -1.041%. Yes, this means that the value of SPY was lower at the end of that decade than at the beginning. This was primarily due to both the downturn in the market in 2000 through 2002 and the financial crisis of 2008-2009.

The Importance of Diversification

You will hear me talk a lot about diversification as a means to lowering your volatility. This is important because if you have assets that will go up and down in different directions and at different times, it will decrease the amount that your overall portfolio goes up and down. I’ll give a very basic example. We’ll look at an example of a portfolio that has 50% in SPY so it will go up and down with the stock market as a whole. The other 50% is invested in real estate investments. Real estate investments typically have a lower level of volatility than the stock market in general. Real estate also typically doesn’t go up and down at the same time and direction as the stock market. There are always exceptions to this, but this is what happens in the majority of situations.

In this example, if SPY went down 20% and your real estate investments stayed at a stable value during that period, the value of your overall portfolio would only go down 10% rather than 20%. The reason is that only half of your investment went down 20%. So you would take 50% of the 20% to determine your overall decline which is 10%.

This works even better when you have your investments spread out over a larger number of different asset types. You may have some of your assets that go up when others are going down which evens things out even more.

Choosing Assets That Perform Better Than the Market on Average

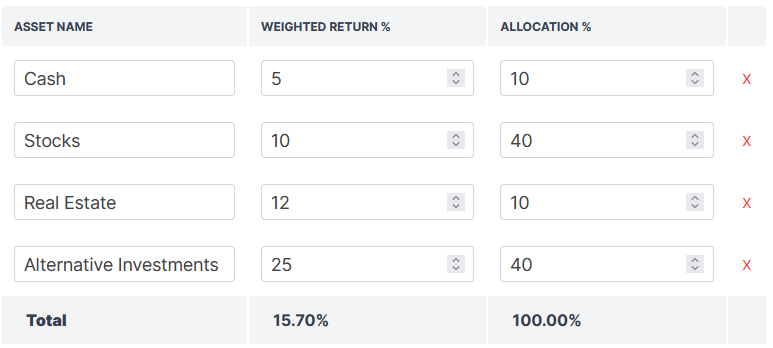

In deciding how to allocate your investments, the key is to have the average expected rate of return of your investments to be higher than 10%. You can still have some of your assets in investments that you expect to get an average rate of return. But putting some of it in higher performing investments will raise your overall return. Look at this sample asset allocation to see how it works:

In this example we still have 40% of our portfolio in stocks getting an expected return of 10%. We also have 10% of our portfolio in cash getting a much lower return. But we have 10% in real estate that we expect to get an above average return of 12%. We also have 40% of our portfolio in alternative investments which we’re expecting an average return of 25%. This increases our average weighted return to 15.7%. Over an extended period of time this extra 5.7% will make a huge difference in the value of our portfolio.

There are an endless number of different combinations that you could use for your asset allocation. This is just shown as an example for illustrating how you can get above average returns. You can increase your returns by educating yourself on different investment products and strategies that will generate above average returns to help you “beat the market”. We offer an Asset Allocation Calculator tool so that you can try some different allocations to see how adjusting things affects the overall return: Asset Allocation Calculator

What Kind of Investments Beat the Market?

You may be wondering what kind of investments will generate higher than average returns. There are plenty of investments available that have the potential to generate high returns. The key is to find the ones that will create these returns without having to take on extreme levels of risk. It is true that there may be an increased level of risk when investing in assets that have higher returns. What you want to do is to be able to understand the investment to a level that you can evaluate the risks and determine if you are comfortable with that risk. All investments have some level of risk. Some have much higher risks than others.

Read: Types of Investments Risks

My goal with the Everyday Money Manager website is to help provide education so that you can learn about investing products and strategies that will help you to be able to generate higher returns to build your wealth over time. Keep in mind, that none of the investments that I talk about are meant to be suggestions for you as an individual. You have to be able to determine what investments are right for you based on your goals and risk tolerances. While this definitely isn’t an exhaustive list, it gives you some examples of investments that can possibly generate higher than average returns.

ETF’s That Outperform the Market

For those that don’t want to have to spend much time in the managing of their investments, ETF’s are a good investment product to use. In many cases they are diversified within the fund to provide some level of volatility control. Many of them also pay dividends which will add to your overall return. Of course the largest and oldest ETF is SPY which simulates the returns of the S&P 500. So to get average returns, you can invest in SPY. But of course our goal here is to find investments that will generate above average returns.

Now there are hundreds of different ETF’s to choose from. So how do you choose ETF’s that can outperform the market? There are several different ways you can go about analyzing ETF performance. Even though some would try and convince you that you have to have a finance degree to thoroughly analyze stocks and investments, it doesn’t have to be that difficult. You do want to learn how to analyze an investment at least to a certain level to be able to determine if it is a good one to put some of your money into.

The nice thing about diversification is that if you have your money spread out enough that you only have a small portion in each individual investment, if one or two of your investments don’t do well, it’s only a small loss to your whole portfolio. The higher your level of confidence in the investment, the higher allocation you can be comfortable investing in it.

Screening for ETF’s

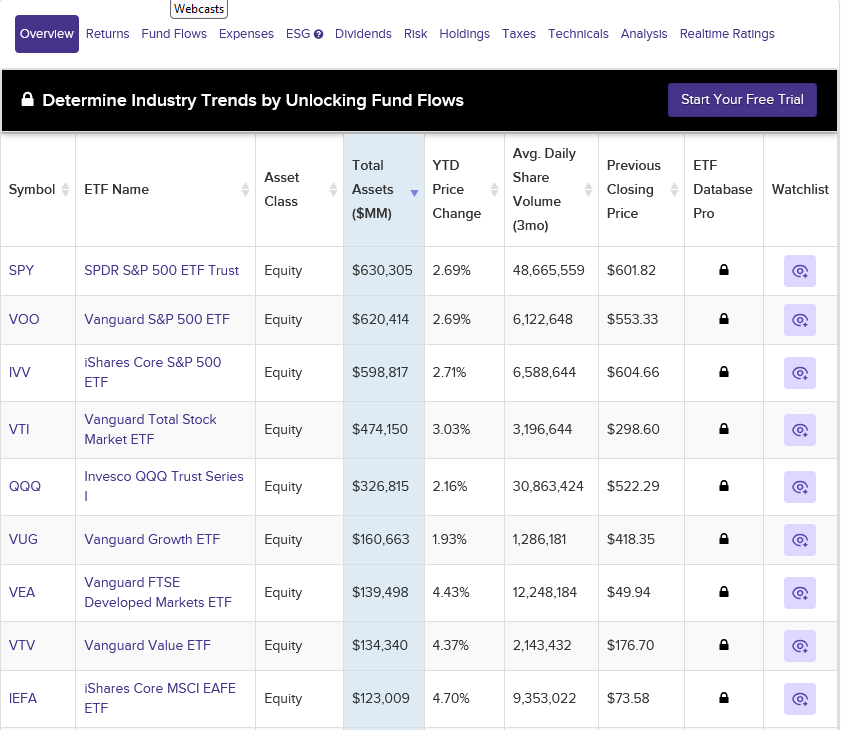

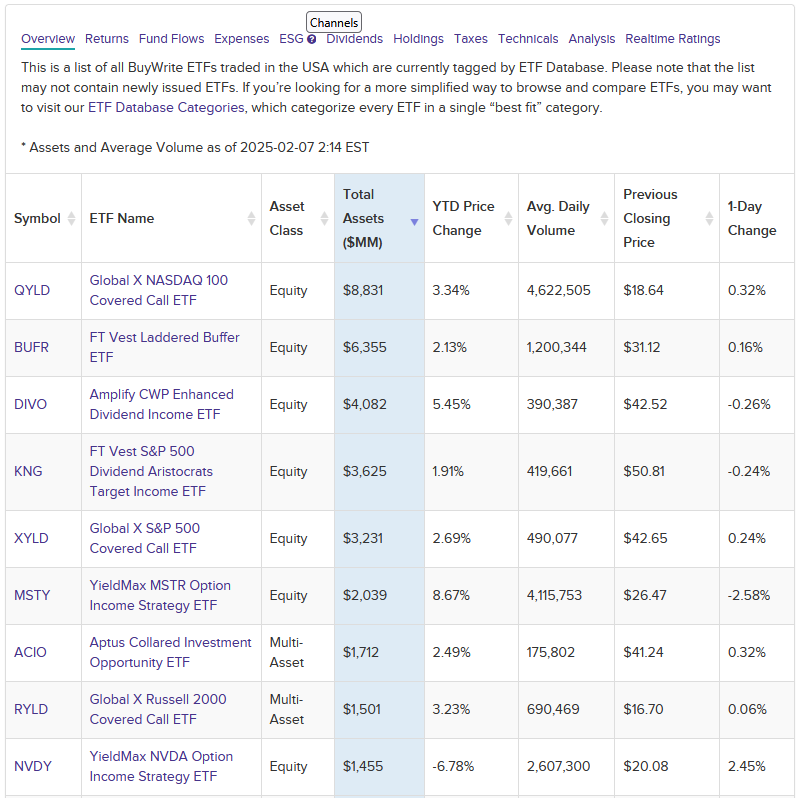

One website that I use to screen or search for ETF’s is the ETF Database Screener. This is a really helpful tool to sort through all of the ETF’s available by many different factors. You can sort by size (total assets), trading volume and returns among other factors. Here is a screenshot showing the largest ETF’s by total assets:

From this you can see that SPY is the largest with over $630 billion in total assets. QQQ is another popular one that is on this list which simulates the returns of the Nasdaq 100 index.

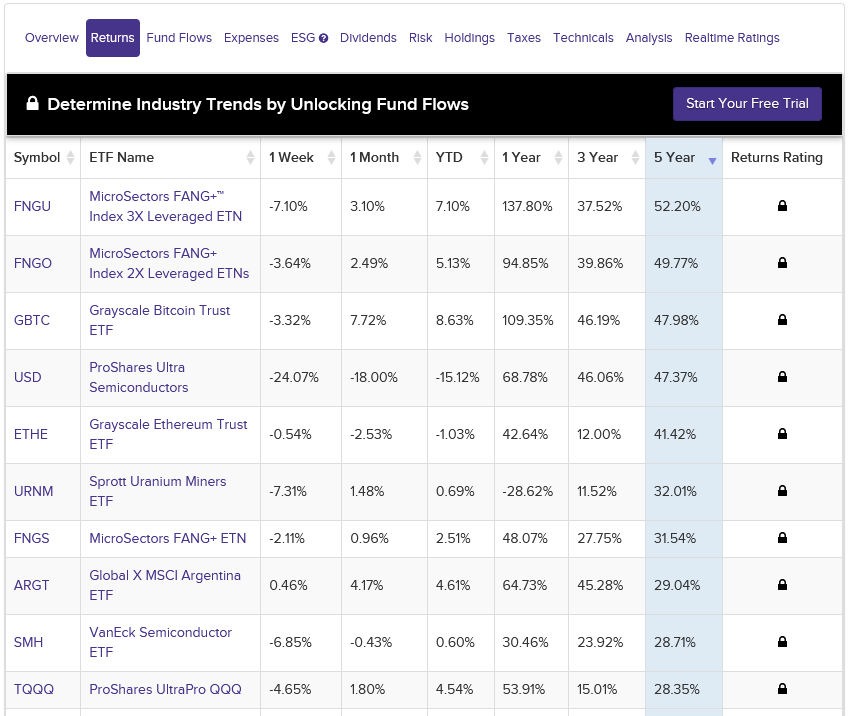

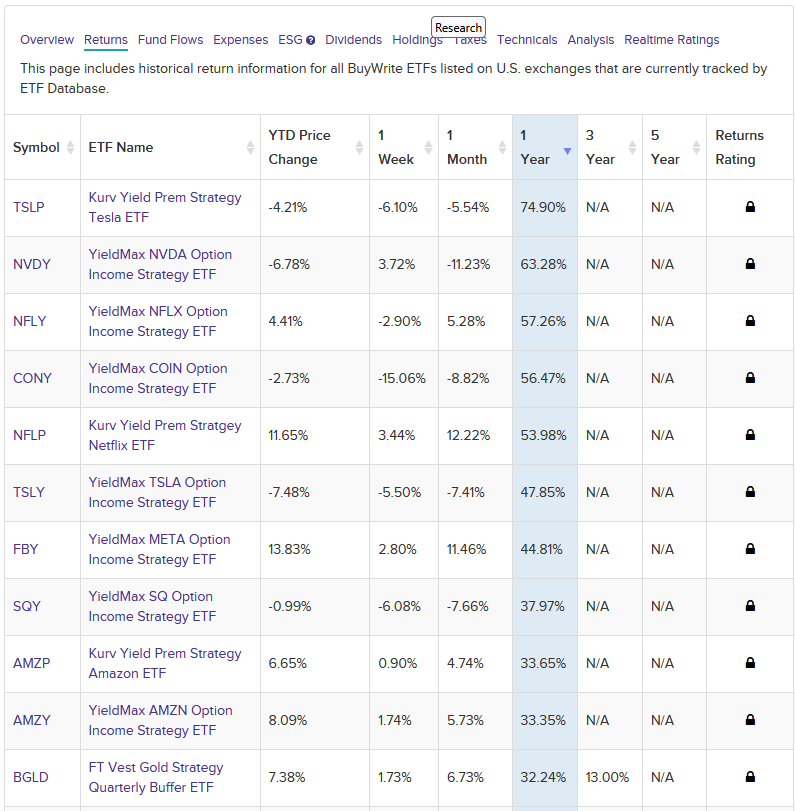

To see the average returns for each of these you would select the Returns tab. From there you can sort by highest or lowest returns for a specific time period.

From this chart you can see which ETF’s had the highest annual 5 year average return. Now it’s important to not just look at this number as there is always more behind the returns than this. But from this chart you can see that the ETF that had the highest average annual return over the last five years was FNGU. It had an average annual return of 52.2% over the last 5 years. Another one on this chart that is a fairly popular one is at the bottom of this list which is TQQQ. This is a triple leveraged ETF. It simulates 3X the daily performance of QQQ.

Read: TQQQ – A Detailed Performance Review

So in looking at these ETF’s, you can see that there definitely is the potential for beating the market with some of these ETF’s. Many of them will have higher volatility and higher risk than SPY, but that’s where you have to learn to be able to assess the risks and determine your comfort level for the risk. It is also important to learn techniques that can help you manage the risks with these types of ETF’s.

When looking at this list, the 5 year average annual return for SPY was 14.65%. On this list there are actually 165 ETF’s that had a higher 5 year average annual performance than SPY. So there are plenty to weed through and choose from.

Another factor that I look at is the volatility level over time. I also try and determine if the ETF is expected to perform as well in the future as it has in the past. The concentration level is also important to think about. For example, when looking at TQQQ, even though it is a triple leveraged ETF, it is based off of the performance of an index that covers 100 of the largest tech companies in the USA. This spreads the risk out much more than an ETF like FNGU which is also a triple leveraged ETF, but it is only based on the stocks of 10 companies rather than 100.

Read: What Is A Leveraged ETF?

Stock Options Trading

When exploring avenues on how to beat the market, options trading is one that you may want to explore. You may or may not be familiar with options. You also may have heard that they are super high risk. It is definitely true that there are strategies in options trading that are extremely high risk, but there is a wide range of strategies that can be used in options trading. Some of these strategies have very low risk. Like any other investment, it’s important to learn about how options work before you decide to risk your money in them.

What Are Stock Options?

To do justice in giving a complete detailed explanation of what options are would take much more than can be explained in this article, but I’ll give the basics as a place to start. An option is a derivative contract that can be bought or sold. The buyer of the contract has the right, but not the obligation to buy or sell a stock at an agreed upon price until a certain date. The seller of the contract has the obligation to buy or sell the stock if the buyer chooses to exercise his right to buy or sell the stock. For that right the buyer pays a premium to the seller for the contract.

There are two basic types of contracts, calls and puts. We’ll give an example of a call first. Say you own 100 shares of SPY. You decide to sell a call contract on those 100 shares. The price of one share of SPY is approximately $600 currently. You decide to sell a contract with a strike price of $610 that expires in 30 days. The strike price is the price that you agree to sell the 100 shares at if the buyer of the contract decides they want to purchase the shares at that price. In this example the buyer of the contract pays a premium of $6 per share or $602 total for the contract since it is for 100 shares. The premium is paid to the buyer of the contract. The buyer can decide to buy those shares from you for a price of $612 anytime before the expiration date of the contract. Of course if the price stays below $612, the buyer wouldn’t typically buy the shares at a price higher than the current price, so the contract would just expire. The seller gets to keep the premium regardless of what happens with the contract.

The other type of option is a put. A put is the opposite of a call. In a put contract the buyer of the contract has the right to sell shares at the strike price anytime before the expiration date. The seller has the obligation to buy the shares at that price if the seller decides they want to exercise their right to sell the shares. The seller must be prepared to buy the shares in the case that the contract gets exercised. This typically means you should have the cash available to buy the shares if required to. It can be done without having the cash, but this greatly increases your risk of loss.

Buy or Sell Option Contracts?

You may be wondering if you should be the buyer or the seller of the option contract. In most cases, the buyer of the contract is taking a much higher level of risk than the seller. For taking that higher level of risk, the buyer has the potential to see a much higher profit on the trade. From my experience, selling option contracts are much easier to manage and the risk of loss on the investment is much lower.

How Much Can You Make Trading Options?

There is a wide variation in what kind of return you can get trading options. The reason is that it depends on the stock or ETF that you trade the options on. Stocks or ETF’s with a higher level of volatility will naturally pay a higher premium than more stable stocks. Let’s again look at SPY as an example. SPY is less volatile than something like TQQQ. The price per share of SPY is currently at $602 per share. If you sold a call contract on 100 shares of SPY that you own at a strike price of $614 or about 2% higher than the current price with an expiration date that is 30 days from now you could collect about $5 in premium per share or $500 total for the contract. That is about return of 0.8% for a 30 day contract. On an annualized basis that is 9.6% per year. That may not sound like much, but if the price of your shares went up 10% for the year and you didn’t end up having to sell them, then your total return would be closer to 20% for the year.

Keep in mind that there is always the risk that you would be required to sell your shares in any given month because the share price went up more than usual. There are ways to manage this, but this helps you to see the possible risks. Looking at an example with an ETF that has a much higher volatility level, you can see the difference in the premium amount.

If we take TQQQ as an example, with a current price that is at $82.80, and sold a call with a strike price that is about 2% above the current price with an expiration date 30 days from now, the premium would be closer to 5% of the current price of the shares. That would be an annualized return of 60% rather than 9.6%. Of course the likelihood that the share price of TQQQ going up more than 2% in 30 days is much higher than it is for SPY.

So to answer the question about how much you can make trading options, it isn’t unreasonable to have the potential to generate a return of 30% or more a year on your capital selling options. The question in connection with buying options is much harder to answer as many people end up losing money when engaging in option buying. Though others who are quite good at it can get a much higher return than 30%. I will be sharing many more articles on strategies that can be used in options trading to maximize returns while minimizing risks. Here is an article where I share my experience with selling puts on the stock DJT:

Read: My Journey with DJT Cash Secured Puts

High Yield Covered Call ETF’s

One category of ETF’s that is relatively new are what are referred to as covered call ETF’s. These are ETF’s that generate income from selling covered call options. The income generated is paid out every week month or quarter depending on the distribution schedule of the particular ETF. These vary in risk levels as well as returns. Also because many of them are quite new it’s difficult to predict how they will perform in the long term. One could try and analyze the performance based on the strategies used with each of the ETF’s. You can also look at the performance of each of the funds so far since inception.

These things can possibly give you an idea about future performance. As always, it’s important to remember that past performance doesn’t guarantee future results. Because of this you’ll want to carefully determine how much of your portfolio you want to invest in these based on the somewhat uncertain nature of these ETF’s. I do have a relatively small portion of my portfolio in the covered call ETF’s, but I spread it out over several different ETF’s to lower the risk level overall.

Where Can I See the List of Available ETF’s?

There are a number of different resources, but the ETF database provides a good list with some details on each of the ETF’s. Here is a link: ETF Database Cover Call ETF’s. You can sort the list by a number of different factors. In the overview tab you can sort by the largest which would be the Total Assets column. Here you can see the largest ETF’s in this category.

From this you can see the largest by the amount of total assets in the fund is QYLD. Part of the reason for this is that QYLD is one of the older Covered Call ETF’s. But it isn’t one that gets the highest returns. If you click on the Returns tab you can sort by the highest returns by several different time frames.

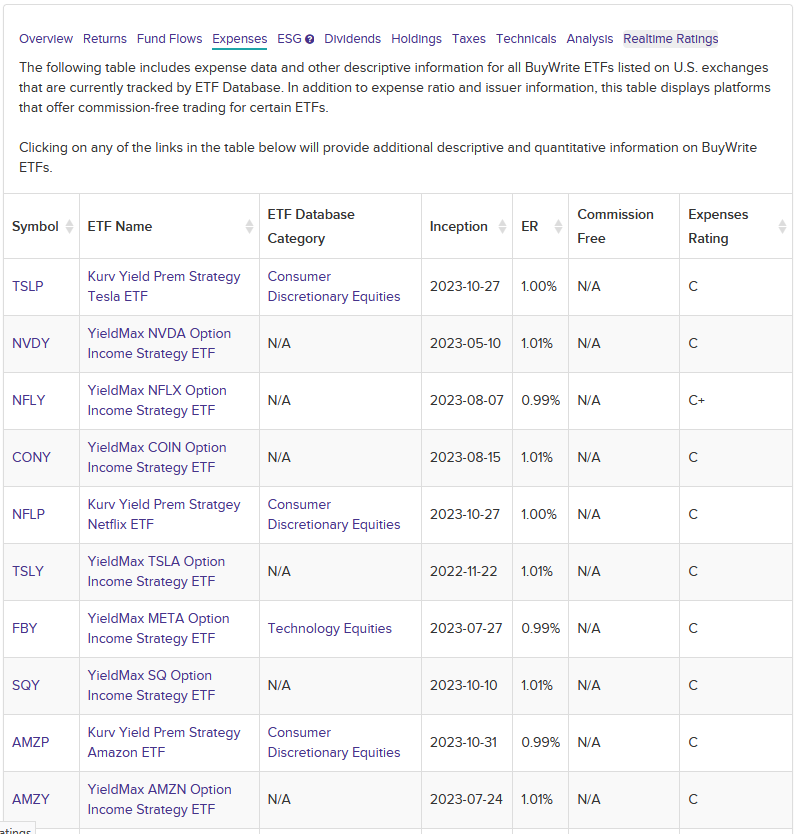

From this view you can see that TSLP has had the best overall 1 year returns at 74.9%. You also may have noticed that most of these don’t have data from 3 or 5 year average returns. The reason is that these haven’t been around for 3 years yet. If we look at the list of these same ETF’s under the expenses tab you can see their inception date. You can see that most of the highest yielding ETF’s on the list were started in 2023.

Because these are becoming so popular, new ETF’s are being introduced regularly. In fact, many of the newer ETF’s didn’t come up in this list because they are less than a year old. One of these is MSTY. Here is a link to an article that I wrote on giving an analysis of MSTY: MSTY Review.

So as you can see, there is the potential for making well above average returns with this type of ETF. But as like any investment, it’s important to weigh the risks to determine if it is the right investment for you.

Investing In Real Estate

Real Estate investing has become much more common due to the fact that there is the potential for making higher than average returns with a potentially lower level of volatility. There definitely are risks involved with investing in real estate, but in some cases these risks can be managed.

There are various ways to invest in real estate. Some of the more common are to fix and flip properties or invest in rental properties that can generate income from the monthly rent. Both of these typically take a relatively sizeable amount of money to get started in. There is also generally at least a little more work involved than more passive investment options. Returns on real estate investments can vary greatly. This is dependent on the property and if you borrow part of the money to buy the property.

There are opportunities to invest in real estate with a smaller amount of money and that are more passive. There are platforms that allow you to invest in a small portion of a property or real estate loan. Here are a couple of options that I currently invest in. (These are not recommendations, so it’s important to do your research to see if it is a good investment for you.)

Groundfloor

One platform for investing in real estate loans is Groundfloor. There are a few different options that Groundfloor offers, but they primarily offer the ability to invest in a portion of a loan to a real estate investor. You can invest as little as $10 in each property. The returns are higher than some other platforms. Groundfloor states that the average return on all of their completed loans is around 10%. In my own personal experience with Groundfloor, I have been able to average 11.7% on all of my paid off loans. I have been investing in Groundfloor for about 2-1/2 years and have about 100 loans.

You can open a new account with Groundfloor with as little as $100. They currently are offering a $50 bonus for new accounts that are opened and invest at least $100. This makes trying them out an easy way to start in real estate loan investing. Use this link to take advantage of the $50 bonus offer: Groundfloor

Lofty

Another platform that offers fractional ownership in real estate is Lofty.ai. The difference with Lofty compared to Groundfloor is that you purchase an equity share in the properties you invest in. This does typically mean higher risk, but also has the potential for higher returns. From my experience with investing in properties through Lofty, it’s important to choose your properties carefully. There are some properties on the Lofty platform that haven’t performed as well as others. I’ll be doing a more detailed analysis of Lofty and some things that I have learned in a future article. From my experience with Lofty up to this point, it is possible to get returns of 15% or more.

Shares in a property can be purchased for as little as $50 or even less in some cases. Lofty is also currently offering a bonus to new investors. If you are a new investor and open an account with Lofty and invest at least $250 you will receive a $50 bonus. Here is a link to use if you’re interested in this offer: Lofty.ai

Business Ownership

Owning a business isn’t probably something that many people think of when considering investment opportunities. But business owners had to invest something to start the business. It is true that in most cases owning a business isn’t a passive way to make money on your investment. But it can be a way to build wealth in a way that many other investments can’t.

How Much Money Do You Need to Start or Buy a Business?

The amount of money needed to start or buy a business can vary widely. Some types of businesses can be started with very little money. The cost to buy an already established business will mostly depend on how large the business is. As you can imagine, starting a business at the very least takes a lot more work to establish. Also it can in some cases be much more difficult to get a new business off the ground. When buying an already established business that already has a presence including sales channels and customers, the probability of success in many cases can be higher.

Costs to Start A New Business

The costs to start a new business will depend on what kind of business you’ll be starting. Creating a content website would be considered a type of business which can have minimal startup costs. If you’re considering a retail type business, the startup costs would include such things as inventory and having a place to keep your inventory and the business operations. If you start small, this type of thing can be started in your own home if you have the space for it. It’s difficult to give an amount to start a new business because there are so many variables.

Cost to Buy An Established Business

Buying an already established business will mostly depend on the size of the business and how much money it makes. Typically well established businesses can start in the price range of $100,000 at the low end. Though there can be available businesses that will sell for less if they are very small. When I say $100,000 as a starting price range, this means that most businesses will sell for more than this and in some cases much more.

Can Anyone Be Successful in Owning a Business?

The short answer in my opinion is no. It does take certain skills and abilities to be able to successfully own a business. You have to understand the ins and outs of how to manage the business in a way that will be profitable. There is a considerable amount of risk involved in owning a business. But with that risk does come some fairly decent potential for a high return on your investment.

I started a business from scratch and over 13 years was able to build it to a level where I was able to sell it for a seven figure amount. I can say it took a lot of work to build the business. In the beginning it didn’t make a lot of money which will be the case with many new businesses. As time passed and I continued to grow the business it became much bigger than I ever imagined when I first started it.

What Kind of Return Can A Business Generate?

Since this article is about getting an above average return on your investment, we’ll want to look at what kind of return you can get from owning a business. Here again, the amount can vary. There are different ways to measure this. If you paid cash for an already established business it wouldn’t be unusual to see a return of 20% to 50% annual profit from your investment if you were able to be successful in managing it. Of course unlike most investments, there is a lot more work to owning a business than just buying shares of stock or an ETF. Though some businesses definitely take more work than others. Some established businesses are setup in a way that most of the work is done by existing employees.