You may have heard of the relatively new type of ETF they refer to as Covered Call ETF’s. Like the name suggests, these ETF’s generate income from selling covered call options. The dividend yield that these ETF’s generate is well above what you see from most ETF’s or even most stocks. They definitely can be a good source of income, but as with anything it’s important to be aware of the risks. While these ETF’s do provide a relatively high dividend, the main risk is that the value of the shares may decrease in value over time. In some cases the share value does erode significantly. And depending on what stocks the covered calls are being sold on, the volatility may be higher than usual. Here is a link to a list of Covered Call ETF’s: Stock Analysis List of Covered Call ETF’s

MSTY – 99% Annual Distribution Yield

One of the more popular Covered Call ETF’s is MSTY. This is one that has one of the highest yield percentages of the covered call ETF’s. I’m writing this MSTY review to show the potential profit and the potential risks of this ETF. Currently according to NASDAQ.com the annualized distribution yield is 99.06%. Like with many types of investments, the higher returns typically mean that there is a higher level of risk. MSTY is based on a covered call strategy selling calls on the stock for MSTR which is closely tied with Bitcoin. Because of this, the volatility level for this stock is higher than average. The higher volatility results in higher premiums for the options on this stock. This is where the high yield comes from.

As with most of the Covered Call ETF’s, MSTY is fairly new. It was launched on February 22, 2024. So the track record is relatively short compared to many ETF’s. Also something to consider is that MSTR has had quite an increase in their share price since February of 2024. On 2/22/24 the share price of MSTR was around $70. Today it is around $340. If the price of MSTR were to fall significantly, the share price of MSTY would also fall. So it’s important to be aware of this risk when investing in MSTY.

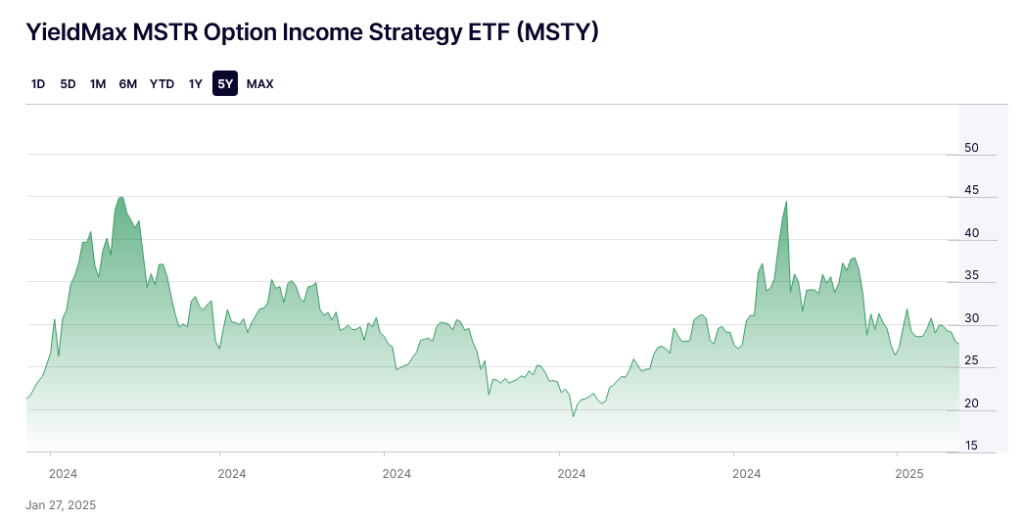

Price History of MSTY

Up to this point the share price of MSTY has been volatile. It is currently higher though than when it was launched. MSTY opened at a price of about $20 per share. It went as high as $45.90 in March of 2024 and then dropped down as low as $18.94 in September. It currently sits at around $27 as of today which is January 28th, 2025. So as you can see from the chart below it definitely has it’s ups and downs.

Distributions Paid Out Every 4 Weeks

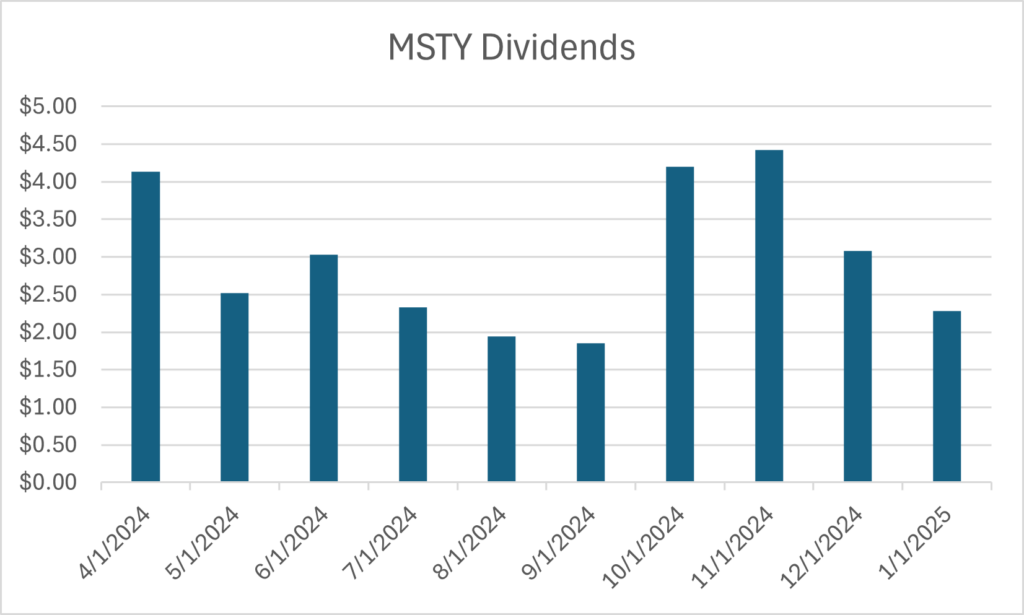

One of the nice things about many of these covered call ETF’s is that they pay distributions more frequently than once a quarter. MSTY currently pays distributions every 4 weeks so you get 13 distribution payments a year rather than just 4. Of course with the volatility the amount of each distribution varies. Since its inception it has paid out 10 distribution payments. Here are the stats for the these payments:

- Total sum of all 10 distribution payments: $29.78 per share

- Average amount per distribution: $2.98 per share

- Range of distribution amounts: $1.85 – $4.42 per share

So as you can see, based on what the current share price is, the average distribution is about 11% every 4 weeks. Now this will vary depending on the share price. And when the share price is lower, the distribution amount tends to be lower as well.

You can probably also see that if you had purchased shares in MSTY at its inception, you would have received more in distributions than you had initially invested, in less than a year. If you annualized the return, the total return on your investment from inception through the date of the most recent payment would have been an IRR of 205.66%. This takes into account the distributions and the increase in the value of the shares. Here is a chart showing the payments.

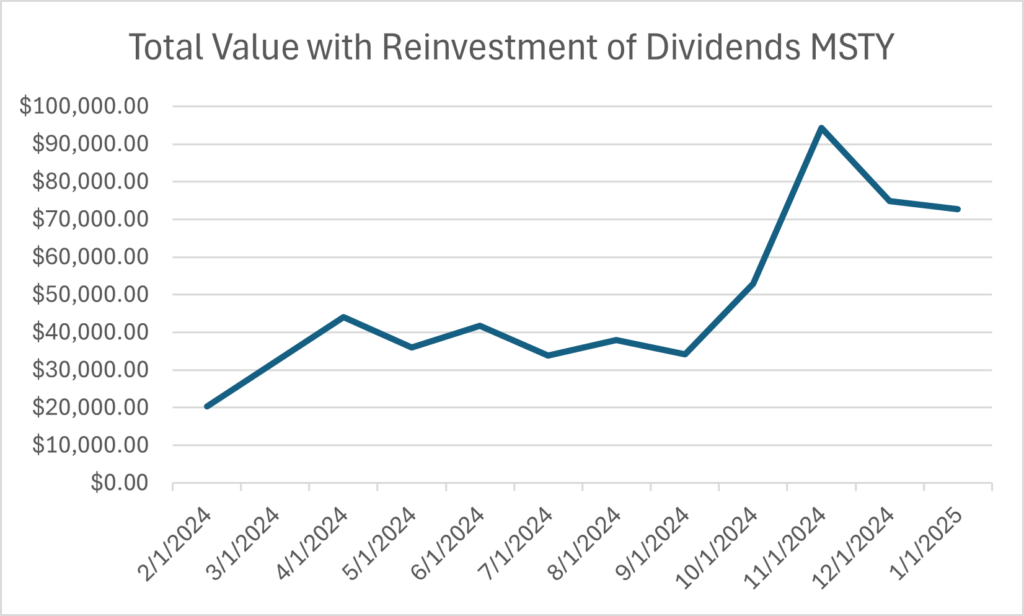

Reinvestment of Distribution Payments

One way to reduce your risk to some degree over time is to reinvest your distribution payments into buying more shares. This essentially lowers your cost basis as well as your break even point in the investment. Say for example you purchased 1000 shares of MSTY when it launched. The open price on that date was $20.38 so your initial investment would be $20,380. The first payment was made on 4/4/24. The amount paid out was $4.13 per share. So the amount you would have received from your first distribution payment would have been $4,130. The share price on that date was $39.87 so you could buy 103 more shares with the money you received from the distribution. You would do this each time a payment would be made. Based on the distribution amounts and the share price on the dates the distributions were paid, you would currently have 2,560 shares and the value of those shares would be $72,652.80. That would be an annualized return of 284.63% based on the share price of the most recent payment which was January 16th.

So as you can see from this example based on the performance of MSTY during this time period, reinvesting the payouts would result in a higher rate of return. Of course if you didn’t reinvest the distributions you would have that money to either use or to invest in something else. But if you look at it as a way of lowering your cost basis on the shares, it does reduce risk in the event of a downturn in the value of the shares. In this case, your current cost basis would be $7.96 per share rather than the $20.38 per share that you bought them for. And over time, if MSTY performed similarly to what it has, you could continue to lower your cost basis. Here is a chart showing the total vlaue of your investment with the reinvestment of distributions.

Other Strategies

There are other strategies you could implement which would possibly lower your risk even more. Even though the total return is lower by not reinvesting your distributions, it also lowers your risk as you have less money at risk in the case of the shares falling in price. If you were to not invest your payments until your initial investment had been recovered by distributions and then start the reinvestment process, you would at that point only be risking your gain on the investment. You could also reinvest only a portion of your distribution payment which would have a similar result. Of course lowering your risk in this way could lower your potential return. But that’s always the trade off with investing strategies.

The future for MSTY

As with most investments, we don’t know how MSTY will perform in the future. Because of this, it’s always important to be diversified in your investment strategy to reduce your overall risk. Each person has to decide on how they’ll allocate their investment funds. As with any investment, but especially with investments that are higher risk, you want to be prepared that you could lose some or even all the money you have invested. How likely this is to happen, only time will tell. Here is a link to the most recent update on MSTY: MSTY Review: June 2025 Update