When trading options one of the important skills to have is to know best how to manage cash secured puts. Selling options is one way of generating higher than average returns on your investments. Options can be complicated though. So it’s best to do your research and learn the details before diving into trading options.

High Implied Volatility Options Offer Higher Premiums

When choosing a stock or ETF to trade options on, one factor that affects the premium is the implied volatility level. When the implied volatility level is high, the premiums for the contract will also be higher than average. This also means there is potentially a higher level of risk involved. As always, in presenting my experience in this article I am in no way making a recommendation as to if this would be a good investment or strategy. I only provide education to help you learn so you can make an informed decision about your own investment choices.

Certain events will naturally create a higher than normal level of implied volatility. For example, the days preceding a quarterly earnings announcement by a company will typically cause the implied volatility level of the options of their stock to increase. This is due to the possibility of their earnings report being much better or worse than anticipated. Once the earnings report comes out, the implied volatility level usually reverts back to a normal level within a short period of time.

DJT in 2024

I want to share my experience with selling and managing cash secured puts (CSP’s) on the ticker DJT. I’m not doing this because I think this is a good stock to do this on going forward. But the circumstances in 2024 caused DJT to have a much higher than normal level of implied volatility. I also want to demonstrate what actions I took to manage my positions. Managing your positions is an important skill to develop.

DJT is the ticker symbol for the company Trump Media & Technology Group Corp. The company went public on the stock market on Tuesday, March 26th, 2024. The price of this stock was bound to be volatile since it is so closely connected with Donald Trump who of course ran for president in 2024. The price of the stock was extremely volatile from the day it opened all the way through the election in November. Here is the weekly chart showing the share price during this time.

As you can see, the week that the stock went public the price per share shot up to almost $80. The following week it dropped back down to about $40 per share. Two weeks after that it dropped even further to about $22.50. Then it went up for a few weeks to a high of around $56.50 before starting to descend again. Except for a spike in the price around the middle of July it continued to decline through the last part of September when it hit a low of $11.75 per share. At that point it was becoming more evident that Trump was probably going to win the election. This caused the stock price to rise. The week before the election the share price reached $54.68 at its peak. Since the election it has been much more stable.

Higher Risk Resulted in Higher Options Premiums

The day that DJT went public, I decided to invest a small portion of my portfolio in DJT CSP’s to take advantage of the higher level of implied volatility. I started by selling two $50 strike CSP’s for a premium of $5.30 each. (10.59%) This gave me a credit of $1,058.80 after fees. I needed to commit $10,000 of margin for this trade in case I was required to buy 200 shares. $50 was still quite a bit below the current price that day as the range for the shares that day was between $57.25 and $79.38.

Then the price started to drop after a few days. Knowing that it is easiest to roll the position down when it is closest to the strike price I rolled down several times over the next few weeks. Here are the trades I made:

- 4/1 – Rolled 4/5 $50 strike put down to 4/12 $46 strike put for a $0.51 credit (1.08%)

- 4/4 – Rolled 4/12 $46 strike put down to 4/19 $43 strike put for a $0.79 credit (1.81%)

- 4/5 – Rolled 4/19 $43 strike put down to 4/26 $41 strike put for a $0.66 credit (1.58%)

- 4/8 – Rolled 4/26 $41 strike put down to 5/3 $40 strike put for a $0.67 credit (1.65%)

- 4/10 – Rolled 5/3 $40 strike put down to 5/17 $37.50 strike put for a $0.37 credit (0.95%)

- 4/15 – Rolled 5/17 $37.50 strike put down to 6/21 $35 strike put for a $0.35 credit (0.97%)

- 4/25 – Rolled 6/21 $35 strike put to 9/20 $35 strike put for a $7.29 credit (20.79%) At this point the share price was around $38

These trades were each done on the two contracts that I originally opened. They were all fairly decent premiums considering I was rolling down on most of the trades, lowering my margin level. At this point I had taken in a total of $3,170 in premiums after fees and my margin was $7,000.

Adding Additional Contracts

Most of the next few weeks the share price maintained in the upper $40’s and lower $50’s level and so I was feeling a bit more confident. So on May 20th I decided to add additional contracts. You may wonder when you look at my trades why I have multiple trades for the same strike prices on the same date. The reason is that I was trading in multiple accounts. I was using both Roth and Traditional IRA’s as well as a non-qualified account. Here are more trades that I made:

- 5/20 – Sold 2 – 6/21 $40 strike puts for a $5.20 credit these were (12.97%)

- 5/20 – Sold 2 – 6/21 $40 strike puts for a $5.10 credit (12.72%)

- 5/20 – Sold 1 – 6/21 $40 strike puts for a $5.08 credit (12.67%)

- 6/6 – Sold 3 – 7/5 $40 strike puts for a $4.55 credit (11.35%)

- 6/6 – Sold 3 – 7/5 $40 strike puts for a $4.95 credit (12.35%)

At this point the share price was still around $47 so I felt in a fairly safe spot. I had increased my margin level to $51,000 and had collected a total of $8,574.80 in premiums since starting my journey with DJT.

Rolling Contracts

By 6/11 the price had dropped some down to around $40. So I decided to roll some of my positions. Here is a list of my next trades:

- 6/11 – Rolled 2 – 6/21 $40 strike puts to 6/28 $39 strike puts for a $0.64 credit (1.61%)

- 6/11 – Rolled 2 – 6/21 $40 strike puts to 6/28 $39 strike puts for a $0.64 credit (1.61%)

- 6/11 – Rolled 1 – 6/21 $40 strike puts to 6/28 $39 strike puts for a $0.50 credit (1.25%)

- 6/20 – Rolled 2 – 6/28 $39 strike puts to 7/5 $39 strike puts for a $0.50 credit (1.25%)

- 6/20 – Rolled 2 – 6/28 $39 strike puts to 7/26 $39 strike puts for a $2.46 credit (6.28%)

- 6/20 – Rolled 1 – 6/28 $39 strike puts to 7/26 $39 strike puts for a $2.00 credit (5.10%)

- 6/28 – Rolled 3 – 7/5 $40 strike puts to 7/12 $40 strike puts for a $0.97 credit (2.40%)

- 6/28 – Rolled 3 – 7/5 $40 strike puts to 7/12 $40 strike puts for a $1.00 credit (2.47%)

- 6/28 – Rolled 2 – 7/5 $39 strike puts to 7/12 $39 strike puts for a $1.02 credit (2.58%)

By June 28th the price had dropped further to the low 30’s. I hadn’t taken on any additional margin.

Adding Even More Contracts

By July 5th the price was hovering around $29 per share. I thought this may be a good time to sell additional contracts since it had dropped a fair amount. I thought that there may be a good chance that the price would start to go up some from here or at least level off. Here were my next trades:

- 7/5 – Sold 10 – 7/12 $29 strike puts for a $1.67 credit (5.72%)

- 7/8 – Sold 10 – 7/19 $29 strike puts for a $2.06 credit (7.06%)

- 7/8 – Sold 10 – 7/19 $29 strike puts for a $2.07 credit (7.10%)

I also rolled some of my current positions out another week:

- 7/8 – Rolled 2 – 7/12 $39 strike puts to 7/19 $39 strike puts for a $0.46 credit (1.15%)

- 7/8 – Rolled 3 – 7/12 $40 strike puts to 7/19 $40 strike puts for a $0.42 credit (1.02%)

- 7/8 – Rolled 3 – 7/12 $40 strike puts to 7/19 $40 strike puts for a $0.40 credit (0.97%)

The share price did make a bit of a jump on 7/15. So by July 19th when my $29 strike puts were expiring I let one set of 10 puts expire worthless. I did roll the other two sets of $29 strike puts out another week for additional credit:

- 7/19 – Rolled 10 – 7/19 $29 strike puts to 7/26 $29 strike puts for a $0.34 credit (1.13%)

- 7/19 – Rolled 10 – 7/19 $29 strike puts to 7/26 $29 strike puts for a $0.33 credit (1.10%)

I also rolled some of my higher strike puts that were expiring that day that were in the money:

- 7/19 – Rolled 2 – 7/19 $39 strike puts to 7/26 $39 strike puts for a $1.09 credit (2.76%)

- 7/19 – Rolled 3 – 7/19 $40 strike puts to 7/26 $39 strike puts for a $0.98 credit (2.42%)

- 7/19 – Rolled 3 – 7/19 $40 strike puts to 7/26 $39 strike puts for a $0.88 credit (2.17%)

Continue to Roll

At this point I was using $108,500 of margin. My total accumulated premium received minus fees was $17,951. By July 23rd the share price had been going down again and was around the $33 range. I had several positions expiring on the 26th that I decided to roll on the 23rd:

- 7/23 – Rolled 2 – 7/26 $39 strike puts to 8/2 $39 strike puts for a $0.56 credit (1.41%)

- 7/23 – Rolled 1 – 7/26 $39 strike puts to 8/2 $39 strike puts for a $0.57 credit (1.43%)

- 7/23 – Rolled 2 – 7/26 $39 strike puts to 8/2 $39 strike puts for a $0.56 credit (1.41%)

- 7/23 – Rolled 3 – 7/26 $40 strike puts to 8/2 $40 strike puts for a $0.45 credit (1.10%)

- 7/26 – Rolled 3 – 7/26 $40 strike puts to 8/2 $40 strike puts for a $0.45 credit (1.10%)

Expiring Contracts

On July 26th I had 2 positions with 10 contracts each that I decided to let expire so I could reduce my margin level. I figured it was a good time to start to reduce my exposure not being sure how the election would go at that point. This lowered my margin level to $50,500. My profit from the premiums up to this point was $$18,488.80. Next I opened a couple new positions though on July 29th:

- 7/29 – Sold 2 – 8/2 $30 strike puts for a $1.30 credit (4.29%)

- 7/29 – Sold 2 – 8/2 $30 strike puts for a $1.30 credit (4.29%)

I also rolled a few positions that were expiring at the end of that week to avoid assignment:

- 7/29 – Rolled 2 – 8/2 $39 strike puts to 8/16 $39 strike puts for a $0.48 credit (1.20%)

- 7/29 – Rolled 3 – 8/2 $40 strike puts to 8/16 $40 strike puts for a $0.68 credit (1.67%)

- 7/29 – Rolled 2 – 8/2 $39 strike puts to 8/16 $39 strike puts for a $0.69 credit (1.74%)

- 7/29 – Rolled 3 – 8/2 $40 strike puts to 8/16 $40 strike puts for a $0.63 credit (1.55%)

I did decide on one of my positions to roll it down to reduce the risk:

- 7/30 – Rolled 1 – 8/2 $39 strike puts to 8/23 $38 strike puts for a $0.22 credit (0.55%)

By August 1st the price had continued to go down and was around $28. So I decided it was a good time to roll a couple more positions that were expiring the next day:

- 8/1 – Rolled 2 – 8/2 $30 strike puts to 8/23 $30 strike puts for a $0.70 credit (2.29%)

- 8/1 – Rolled 2 – 8/2 $30 strike puts to 8/23 $30 strike puts for a $0.69 credit (2.26%)

- 8/2 – Rolled 2 – 8/16 $39 strike puts to 9/13 $37 strike puts for a $0.50 credit (1.32%)

You may notice that this last one I rolled down. I decided it may be a good idea to start lowering my strike prices to reduce some risk.

Rolling Down Our Cash Secured Put Options

On August 5th I decided to roll down more of my positions since the price had gone down fairly consistently for the last few weeks:

- 8/5 – Rolled 2 – 8/9 $30 strike puts to 8/16 $30 strike puts for a $0.51 credit (1.66%)

- 8/5 – Rolled 2 – 8/9 $30 strike puts to 8/30 $29 strike puts for a $1.30 credit (4.44%)

- 8/5 – Rolled 2 – 8/16 $39 strike puts to 9/13 $39 strike puts for a $1.50 credit (3.82%)

- 8/5 – Rolled 3 – 8/16 $40 strike puts to 9/13 $39 strike puts for a $0.70 credit (1.76%)

- 8/5 – Rolled 3 – 8/16 $40 strike puts to 9/13 $39 strike puts for a $0.70 credit (1.76%)

- 8/12 – Rolled 2 – 8/16 $30 strike puts to 9/20 $26 strike puts for a $0.09 credit (0.30%)

Adding More Positions

By August 19th the share price had gotten down to around $23. I decided to open some additional positions to take advantage of the low share price. I also rolled some of my positions:

- 8/19 – Sold 5 – 8/30 $22 strike puts for a $1.36 credit (6.13%)

- 8/19 – Rolled 1 – 8/23 $38 strike put to 10/18 $36 strike put for a for a $0.80 credit (2.19%)

- 8/20 – Rolled 5 – 8/30 $22 strike puts to 9/13 $21 strike puts for a $0.47 credit (2.18%)

- 8/20 – Rolled 2 – 8/30 $29 strike puts to 9/20 $28 strike puts for a $0.52 credit (1.81%)

Rolling Down and Further Out

The following week the price seemed a bit more steady, but wasn’t going up at all. I decided to roll some of my positions with higher strikes further out and try to roll them down as far as possible. I decided at this point that I would just roll them out to a date occurring after the election and see where things land from there election results:

- 8/26 – Rolled 3 – 9/13 $39 strike puts to 11/15 $34 strike puts for a $0.50 credit (1.44%)

- 8/26 – Rolled 2 – 9/13 $37 strike puts to 11/15 $34 strike puts for a $2.39 credit (6.99%)

- 8/26 – Rolled 5 – 9/13 $39 strike puts to 11/15 $34 strike puts for a $0.40 credit (1.14%)

- 8/28 – Rolled 5 – 9/13 $21 strike puts to 9/27 $20 strike puts for a $1.15 credit (5.69%)

- 8/30 – Sold 1 – 9/6 $20 put for a $1.14 credit (5.64%)

- 9/3 – Rolled 1 – 9/6 $20 strike put to 9/13 $19 strike put for a $0.31 credit (1.57%)

- 9/4 – Rolled 1 – 9/13 $19 strike put to 9/20 $18 strike for a $0.40 credit (2.16%)

- 9/4 – Rolled 2 – 9/20 $28 strike puts to 9/27 $28 strike puts for a $0.45 credit (1.56%)

- 9/4 – Rolled 2 – 9/20 $26 strike puts to 10/18 $25 strike puts for a $0.76 credit (2.99%)

- 9/4 – Rolled 2 – 9/20 $35 strike puts to 11/15 $34 strike puts for a $1.66 credit (4.85%)

Adding More Positions

Up to this point I had $67,100 of margin committed to my positions. I also had taken in a total of $24,310.40 in premiums since I started with DJT puts. I had avoided getting assigned on any of my contracts. So up to this point I had just been opening, rolling and letting some contracts expire. On September 9th the price was around $18. I decided to open some new positions and also roll some positions that week:

- 9/9 – Sold 1 – 9/13 $18 strike put for a $1.56 credit (8.63%)

- 9/9 – Sold 10 – 9/20 $18 strike puts for a $2.45 credit (13.45%)

- 9/9 – Rolled 2 – 9/27 $28 strike puts to 11/15 $26 strike puts for a $1.90 credit (7.26%)

- 9/11 – Rolled 1 – 9/13 $18 strike put to 9/20 $17 strike put for a $0.20 credit (1.14%)

- 9/12 – Rolled 1 – 9/20 $17 strike put to 9/27 $16 strike put for a $0.05 credit (0.28%)

More Rolling

Monday, September 16th the share price was around $18. Though the rest of the week the price dropped some each day. I rolled more positions during the week:

- 9/16 – Rolled 1 – 9/20 $18 strike put to 9/27 $17 strike put for a $0.45 credit (2.58%)

- 9/16 – Rolled 10 – 9/20 $18 strike puts to 9/27 $18 strike puts for a $1.00 credit (5.49%)

- 9/16 – Rolled 5 – 9/27 $20 strike puts to 10/11 $19 strike puts for a $0.17 credit (0.83%)

- 9/17 – Rolled 1 – 9/27 $17 strike put to 10/4 $16 strike put for a $0.05 credit (0.24%)

- 9/17 – Rolled 10 – 9/27 $18 strike puts to 10/11 $17 strike puts for a $0.39 credit (2.22%)

- 9/18 – Rolled 1 – 9/27 $16 strike put to 10/11 $15 strike put for a $0.25 credit (1.63%)

- 9/18 – Rolled 1 – 10/4 $16 strike put to 10/18 $15 strike put for a $0.16 credit (0.99%)

- 9/20 – Rolled 1 – 10/11 $15 strike put to 11/15 $13 strike put for a $1.20 credit (9.23%)

- 9/20 – Rolled 1 – 10/18 $15 strike put to 11/15 $13 strike put for a $0.88 credit (6.77%)

- 9/20 – Rolled 10 – 10/11 $17 strike puts to 11/15 $14 strike puts for a $0.45 credit (3.21%)

Nearing the Election

At this point the implied volatility had gone up even more on DJT options as we were getting a bit closer to the election. The premiums were higher and I was able to roll further down because of it. September 23rd the price had fallen to about $13 so I rolled the last of my positions to expiration dates that would fall after the election:

- 9/23 – Rolled 5 – 10/11 $19 strike puts to 11/15 $16 strike puts for a $0.13 credit (0.81%)

- 9/23 – Rolled 2 – 10/18 $25 strike puts to 11/15 $24 strike puts for a $0.95 credit (3.91%)

- 9/23 – Rolled 1 – 10/18 $36 strike put to 11/15 $35 strike put for a $0.21 credit (0.57%)

Opened One Last Position

Starting on September 24th things were starting to take a turn and the share price began a climb. On October 16th I did decide to close one of my positions early. I closed one $13 strike put for a debit of $1.45. The main reason I did this was I was wanting the margin in that specific account to be able to make a withdrawal. By October 29th the price had reached a level above $50 a share. I decided to open one more position as the implied volatility had skyrocketed to over 1,000%:

- 10/29 – Sold 3 – 11/15 $30 puts for a $5.00 credit (16.63%)

Volatility Around the Election

The share price went through quite a rollercoaster ride for the several days before and after the election. I was glad that the price had gone up to be near my positions with the higher strike prices. So I was hoping to get them to the point of expiring worthless. I did close a few of my lower strike positions for a small debit to reduce the risk:

- 11/6 – Closed 1 – 11/15 $13 strike put for a $0.07 debit

- 11/8 – Closed 10 – 11/15 $14 strike puts for a $0.09 debit

- 11/8 – Closed 5 – 11/15 $16 strike puts for a $0.15 debit

November 12th I rolled some of my positions down since the strikes were too high to expire worthless:

- 11/12 – Rolled 2 – 11/15 $34 strike puts to 11/22 $32 strike puts for a $0.05 credit (0.12%)

- 11/12 – Rolled 5 – 11/15 $34 strike puts to 11/22 $32 strike puts for a $0.03 credit (0.06%)

- 11/12 – Rolled 5 – 11/15 $34 strike puts to 11/22 $32 strike puts for a $0.03 credit (0.06%)

- 11/12 – Rolled 1 – 11/15 $35 strike put to 11/22 $33.50 strike put for $0.25 credit (0.71%)

- 11/14 – Rolled 3 – 11/15 $30 strike puts to 11/29 $28 strike puts for a $0.50 credit (1.74%)

Final Rolls

On 11/15 I did have one position of two $24 strike contracts expire worthless since they were below the share price at expiration. November 18th I made my last 5 trades:

- 11/18 – Rolled 3 – 11/29 $28 strike puts to 12/6 $27 strike puts for a $0.16 credit (0.55%)

- 11/18 – Rolled 2 – 11/22 $32 strike puts to 12/6 $31 strike puts for a $0.53 credit (1.67%)

- 11/18 – Rolled 5 – 11/22 $32 strike puts to 12/6 $31 strike puts for a $0.54 credit (1.70%)

- 11/18 – Rolled 5 – 11/22 $32 strike puts to 12/6 $31 strike puts for a $0.50 credit (1.57%)

- 11/18 – Rolled 1 – 11/22 $33.50 strike put to 12/13 $31.50 strike put for a $0.15 credit (0.44%)

Positions Expire and Results

All of these final positions expired worthless as the price had steadied out after that.

I had a total of 97 trades and I closed 4 positions before the expiration date. The whole process started on March 26th, 2024 and ended when the last position expired on December 13th, 2024. I took in a total of $31,783 in profit from the premiums. This included the small debits that I paid to close the 4 positions.

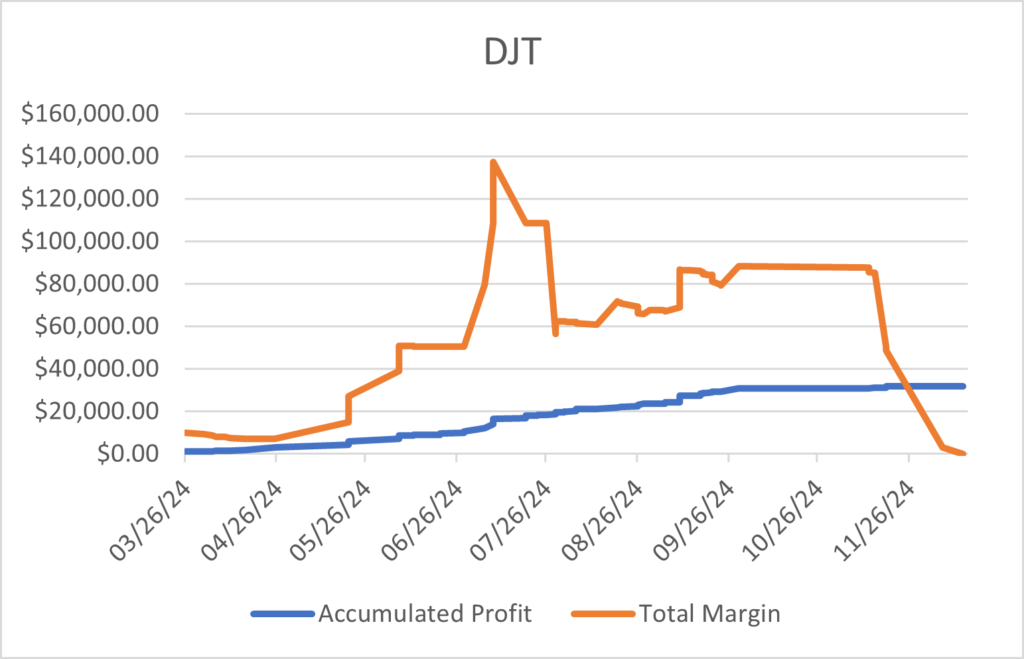

You may wonder what kind of rate of return I was able to generate from this experience. Well I calculated the annualized dollar weighted return for this experience and it came out to 91.72%. Here is a chart showing the relation between the margin used compared to the growth of the profit from the premiums over time

Hopefully being able to see the trade by trade process when learning how to manage cash secured put options will be helpful to those of you in the learning process with put options. If you find this content to be helpful make sure to subscribe to our email newsletter list below. Feel free to share your thoughts below in the comments also.