While a million dollars won’t go as far as it did 10 or 20 years ago, it is still often considered as a good place to arrive at in the journey of building wealth. Making your first million may seem like an unattainable goal, but it isn’t as difficult as most people think. I’d like to lay out a path to achieve the goal of accumulating a million dollars.

Take It One Step At A Time

One way to look at it is to break it down in steps. 10 steps to be exact. It may sound surprising, but if you start with $1,000 and you double it 10 times you would end up with over a million dollars. It would actually be $1,024,000. Here is how the math works out:

- Step 1: $1,000 doubled would become $2,000

- Step 2: $2,000 doubled would become $4,000

- Step 3: $4,000 doubled would become $8,000

- Step 4: $8,000 doubled would become $16,000

- Step 5: $16,000 doubled would become $32,000 (We’re halfway there)

- Step 6: $32,000 doubled would become $64,000

- Step 7: $64,000 doubled would become $128,000

- Step 8: $128,000 doubled would become $256,000

- Step 9: $256,000 doubled would become $512,000

- Step 10: $512,000 doubled would become $1,024,000

As you can see, the first steps seem to grow much more slowly than the last couple of steps. Though in reality, doubling your money when it is a small amount is easier than with a larger amount of money in some respects.

Establish Your Foundation

As we layout in our Stages in your financial journey, it’s first important to establish your foundation. This is crucial to take care of before you start growing your investments. It is a much easier process to grow your wealth when you aren’t burdened by loads of debt. And then you want to make sure you have an emergency fund of 3 to 6 months of living expenses.

Importance of Getting Started

Like with so many things, getting started is the hardest step in many cases. The most important thing to do at the beginning is to make a decision that you’re going to start saving, even if it’s a small amount. The sooner you get started the sooner you’ll reach your goal.

If you can only save $100 a month, and even if this is all you can afford to save for the next 20 years, at the end of the 20 years with a return rate of 12% you would end up with over $91,000. If you compare that to someone that doesn’t ever start putting away money for investments at all, after 20 years they would have nothing saved.

Ultimately the goal is to save more than that every month, but as you can see, even putting away a small amount each month can add up to be a sizeable amount over time.

The Difference Between Making and Accumulating $1,000,000

The title of my article is about making your first million dollars. When people hear this they think more of accumulating a million dollars. It’s fairly easy for someone to make a million dollars. It takes more work and planning to accumulate a million dollars.

What is the difference? For someone to make a million dollars just means they have earned that from their regular salary from working. If someone makes $100,000 a year, they will have made $1,000,000 in 10 years. And that’s without any pay raises. To accumulate a million dollars, it means you have saved and grown your investments to be worth a million dollars.

Step 0 – Save up $1,000 to Start With

Well the first step is to obviously get to the point where you have $1,000 to start with. This may be easier for some people than others. In many cases, if you don’t have debt payments having to come out of your monthly budget, you may be able to commit $1,000 or more to your investments on a monthly basis. If that is the case, you may be able to get your $1,000 start in a month or less.

If you are able to put $1,000 a month into your investments, the first few steps will go rather quickly. Even if you only have $250 a month to put into your investments, this would mean within 4 months you could have your first $1,000.

Once you have $1,000 saved up for investing you may want to consider opening a brokerage account. This is an account that can be used for investing your money in many different types of investments. This would include stocks, ETF’s, bonds, crypto and also option trading among other types of investments.

Starting Your Fund with Credit Card Rewards

Now it is true that a person can’t create a large amount of wealth solely from credit card rewards. Though when you’re starting out, every little bit helps. Using credit cards can certainly be a hindrance to building wealth if not used in the right way. But if you have developed a habit of using credit cards responsibly, they can be a benefit to you, especially in the early stages of your journey to building wealth.

In today’s environment, it’s easy to pay for a large portion of your monthly expenses by credit card. The key is to make sure that you’re disciplined to not spend more because you’re using a credit card. In this case, you can use the rewards to give your initial investing account a boost.

For example, many people could easily pay $2,000 of their normal monthly expenses with a credit card. There are credit cards that pay as much as a 3% bonus on all your credit card purchases. Some will pay an even higher rate in certain categories such as gas or dining out. If you charged $2,000 a month on a credit card that has a cash back reward of 3%, that would come out to an extra $60 a month that can be added to your investments. While this may not seem like a lot, it will more quickly get you to your goal of saving your first $1,000.

Step 1 – Grow your $1,000 to $2,000

The biggest factor in Step 1 is to be adding what you can. So for most people, getting to the end of step one should only take one to three months. If it takes you a little longer because you don’t have as much to contribute to your investments don’t worry, just put in what you can. The important thing is to just keep adding to your investments. Many people decide not to start because they think they don’t have enough money to invest.

As you may have noticed, adding money to your investments makes a much greater impact in the early steps when you don’t have a lot to work with. Once you get to where you’re in steps 8, 9 and 10, even adding $1,000 a month doesn’t make as big of a dent in the progress.

While adding money to your investment account will be the quickest way to complete Step 1, you can also start investing the money. If you don’t have much experience in investing yet, starting with a small amount of money is a good way to start. Because with investing the best teacher is experience. While you can learn about investing through reading books and other guides, actually doing the investing is probably an even greater education.

Types of Investments You Can Invest In with $1,000

When investing it is best to diversify your investments to spread the risk out over various classes of investments. When you only have $1,000 to invest, you’ll be limited in how many different investments you can spread this out to. Since you’ll probably be adding to your investments portfolio on a regular basis you can diversify more as the portfolio grows.

Stock Market

There are a number of different types of investments you can begin with. If you want to start by investing at least some of your funds into the stock market you could buy shares of an ETF based on a Market Index such as SPY. SPY is designed to simulate the returns of the S&P 500 index. So it is like buying shares of 500 of the largest US based companies. That would be a way to diversify your investments in the stock market.

Another thing to consider with the stock market is to look at leveraged ETF’s. This is a higher risk investment, but the potential returns can be quite a bit higher than the standard index ETF’s. You’ll want to find one that has a decent track record. You’ll also want to be aware of the risks and how the leveraged ETF’s work so you understand the risks. You could consider the leveraged ETF on SPY which is UPRO. Another one that is popular is TQQQ which is the triple leveraged ETF on the Nasdaq 100.

Read “What Is A Leveraged ETF”

Read “TQQQ: Detailed Performance Review

Dividend ETF’s

When you do a search for high yield dividend ETF’s, you’ll find recommendations for some of the standard ETF’s offered by the big brokerage firms. Here is a typical result you’ll run across when doing a search: Best Dividend ETF’s. You’ll see results of yield from 2.5% up to 5% and a total average annual return of 5% to 12%. These are relatively safe investments with returns that are decent for safe investments.

You could also consider putting a relatively small amount of your investment portfolio into investments that generate a higher than average return. By assessing the risk and keeping a fairly small percentage of your portfolio in this type of investment, you can limit the amount of risk. One example of this is the relatively new type of ETF referred to as Covered Call ETF’s. These ETF’s generate income from selling covered calls.

Real Estate

You may not think that you would be able to invest in real estate with only $1,000. But there are a number of investing platforms now that allow you to invest in real estate with small amounts of money. One of the ones that I like is GroundFloor. This is a platform where you can invest in loans to real estate investors. You can invest as little as $10 in each individual loan. You can choose the individual properties that you’re loaning money on. If you spread your money out over a number of different loans, it lowers the risk by diversifying. Currently GroundFloor is offering a bonus of $50 to invest by opening a new account and investing $100. Use this link to take advantage of this offer.

Step 2: Grow from $2,000 to $4,000

Like in Step 1, adding what you can will be the biggest factor in getting from $2,000 to $4,000. In many cases this can be done within several months or less. Investment choices will be similar to those in step 1. The more your savings grow, the more opportunities you’ll have for things to invest in. As we go through the steps I’ll point out some of the investment opportunities you’ll have with higher balances.

Generate Side Income for Faster Growth

It will make a huge difference in your overall progress to get through the first few steps of this journey as quickly as possible. It’s also the easiest to double your money when you have a much smaller amount. You may want to consider having a side job or gig to bring in extra income to boost your progress through the first few steps. Part time jobs or gig work such as Uber or Instacart are an easy way to bring in some extra income each month to go toward your goal. Bringing in an extra $500 a month or $125 a week would give your progress on the first few steps quite a boost. $500 extra a month would be an additional $6,000 a year.

Retirement Investments

Part of your wealth accumulation may be in a retirement account. This may be in the form of a 401k at your work or in a Traditional or Roth IRA. Even though this money is primarily set aside for retirement, it should still be viewed as part of your savings. As this money grows from adding to it regularly, you’ll see it compound over time. The combination of adding money to it and the return you get every year should see it grow to a fairly significant amount over the years.

It certainly is a boost also if your employer offers a match to money that you contribute to your 401k. Let’s look at an example. Say you make $75,000 a year and your employer matches your contribution up to 5% of your pay. That would mean that you would be contributing $3,750 a year and your employer would match that with an additional $3,750 a year. We’ll also assume you get a raise every year of 3% per year. So the amount you’re adding would go up by 3% per year. If you let that grow and compound with an average return of 12% per year you would have $2,744,281 after 30 years. If you had 40 years to do this it would be up to $9,445,949. Looking at this if you started at age 20 and continued this to age 60 you could potentially have almost 10 million dollars just in your 401k. You would have reached the one million dollar mark sometime in the 22nd year in your 401k savings.

If you did this in a Roth 401k account, the almost 10 million dollars could be withdrawn after age 59-1/2 completely tax free. The amount that you contributed would have been $565,500. The rest would be the growth. While you would have paid taxes on the money that was contributed, the growth on that money is never taxed in a Roth account.

Step 3: Grow From $4,000 to $8,000

The goal is to get through at least the first two steps fairly quickly with adding as much as you can from savings from your income and through bringing in extra money through various means. As you can see, with each step further it takes more effort to double your money from just adding additional deposits. Though even with step 3 you’ll still want to focus on adding as much as you can to get to the $8,000 mark.

Start Thinking About Rate of Return Through Asset Allocation

$4,000 is still a relatively small amount of money in your journey to a million dollars. But it isn’t too early to start thinking about a way to allocate your money in a way that will maximize your returns. The reason for this is that as you get to where you have a larger balance in your investments, the higher rate of return is what will cause your assets to grow at a much faster pace.

Choosing assets that are expected to generate above average returns is the key to growing your assets at a faster than average pace. Diversifying will help to reduce the volatility of your portfolio while investing in assets that are potentially a higher than average risk level.

At this point you may not feel like you have enough money to spread it out into many different types of investments. You can start with small amounts in each type of asset. This is a good way to be learning about different types of investments and getting a feel for how they perform. Looking at past performance doesn’t give you the same experience as having your own money invested in something and being able to experience the ups and downs over time.

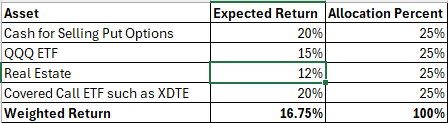

Sample Asset Allocation #1

We’ll look at some sample asset allocations to get an idea of things you can do at this point when you have somewhere between $4,000 and $8,000. This is not a suggestion as to if this is the right allocation for you, but just a sample of the type of allocation that could be used.

In this allocation, I’ve divided the assets into 4 investments with 25% in each. The weighted return of 16.75% shows the average return of this allocation based on the percentages. Obviously the goal is to try and get above average returns. When making an allocation, there will possibly be some of your assets where the return fluctuates from one year to the next. This is especially true with assets tied to the stock market. So QQQ would definitely be one that will have some years that will be better than others. So you just want to figure in an average return for your expected return percentage.

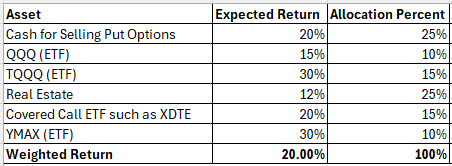

Sample Asset Allocation #2

If you chose to have a portion of your assets in higher return investments you can see how it affects the overall weighted return. In this next example we’ll look at adjusting things a little to see how the overall return changes.

In the above example you can see that we took part of the allocation from the ETF QQQ and put it into TQQQ. We also took a portion from XDTE and moved it into YMAX which is another covered call ETF. Making these two changes increased our expected weighted return average to 20%. So as you can see just from these two examples that making small changes to your asset allocation can have a significant affect on your overall returns. Obviously the higher return investments do have a higher level of risk. But as you learn about investments, you’ll be able to assess the risks to be able to make an informed decision about what is right for your portfolio.

If you’d like to try some of your own different asset allocation scenarios, we have an Asset Allocation Calculator that you can plug in your own numbers to see how the weighted return comes out. Here is a link to the page with our calculator: Asset Allocation Calculator

How Does An Increase In the Return Affect My Future Account Value?

You may wonder how increasing the interest rate will affect things in the long run. I’m sometimes surprised at how often I read a statement from someone that says it’s not practical to think that the average everyday investor can beat the average market return of 10% a year on a long term basis. There are plenty of investments that provide a potential to reasonably get above average returns on a regular basis. As we always stress, it is important to diversify when investing in higher return investments to reduce your risk overall.

When we look at some examples of how much an account can grow with an increased return rate, it can be eye opening to say the least. Let’s look at an example of starting with $1,000. If we were able to add $500 a month and got an average 10% return. In this scenario it would take us 29 years and 8 months to reach a total of a million dollars. If we increased our average return rate to 16.75% like in our first asset allocation example it would only take 20 years and 2 months to reach the one million dollar mark. Increasing the rate of return to 20% would get us to the one million dollar mark in just 17 years and 9 months.

The other thing to look at is if we were to extend our time frame out to 29 years and 8 months. This was the amount of time it would take to reach a million dollars with a 10% return rate. With that amount of time with a 20% return rate we would have a total of over 9 million dollars in our investments. That is a significant difference!

Step 4: Grow From $8,000 to $16,000

As the value of your investments grow, you will want to consider making slight adjustments to your investments. This could potentially increase your overall rate of return which will shorten your journey to a million dollars. There are a number of different investment strategies that can generate a much higher return. If you manage this correctly without putting too large of an amount at risk, it can be a profitable change to your overall strategy. I’ll mention a few things that I’ve found to work well. As always, these aren’t suggestions, but instead just some things I want to educate you about. By doing your research and becoming educated you can determine if they are right for your investment portfolio.

Selling Put Options

You may or may not know much about options trading. You may have also heard that trading options is extremely high risk. Options trading can be high risk depending on your strategy, there are option trading strategies that are a fairly moderate risk trading activity. There definitely is a lot to learn when first trading options. Selling put options can be a good way to generate a good return on your investment and in many cases is easy to manage even when the market doesn’t go your way.

I’ll share an example. APLD is a company that has relatively high options premiums. The price currently is at $9.10 a share. If you sold a put that is 11 days ‘til expiration at a strike price of $8 you could get a premium of about $0.20 a share for selling the contract. What this means is that you are committing to be obligated to buy 100 shares of APLD for $8 a share if the buyer of the put contract decides to exercise their right to sell 100 shares for $8 each. So in selling this contract you have to have $800 available to purchase the shares if required. For the contract you as the seller will receive $20 which is the premium for the contract. If you calculate the return on this trade, it comes out to 2.5% for a period of 11 days. If you annualized that return it comes out to about 83% as an annualized rate. This is a fairly easy trade to manage if required which I’ll outline in other articles. From this example though, you can see how it certainly is possible to generate a well above average return rate on this type of trade.

It’s important to keep these types of trades as a very small portion of your overall account since the risk is a little higher than some other types of investments. But it certainly wouldn’t be considered high risk in my opinion. I share my journey with managing put options on DJT in the following article:

High Volatility Covered Call ETF’s

Earlier in the article I mentioned Covered Call ETF’s. Some examples of these that generate an extremely high distribution rate would be MSTY and CONY. There are other examples as well. MSTY currently has a dividend yield of 125.09% and CONY has a dividend yield of 150.29%. The thing to keep in mind with these is that the value of the shares can have some deterioration over time. They don’t always have deterioration, but the risk is there. For this reason you’ll want to assess the risks to determine if the high dividend payout is worth the risk to you.

I recently wrote an article which gives an analysis of MSTY. Based on the strategy of reinvesting the distributions, the annualized total return rate from February 22nd, 2024 which was the funds inception date to January 16th 2025 was 284.63%. This includes the increase in the price of the shares as well as the distributions.

CONY has had some deterioration in the share price, but has still performed well. We can look at how CONY has performed since its inception. We’ll look at the time frame from when the fund was launched which was August 15th, 2023 through the most recent distribution date which was February 6th, 2025. With reinvesting the distributions, the total annualized return rate would have been 91.69%. So even though the price of the shares had dropped about 39% during that time period, the high distribution rate caused the overall return to be well above average.

With something like covered call ETF’s you can invest small amounts in them. You can purchase as few shares as you feel is appropriate for your portfolio. For example, the share price currently of MSTY is a little under $25. So you could purchase 10 shares of MSTY for under $250. So if you had $10,000 in your portfolio up to this point, $250 would only be about 2.5% of your total portfolio. If you purchased 20 shares it would be about 5% of your portfolio.

Step 5: Grow from $16,000 to $32,000

You may be surprised at this point by how far you’ve come in a short amount of time. The important element in this whole journey is to be diligent in continuing to save and invest. At this point you may find that you can start to further diversify your funds. The more you have, the easier it is to spread it out into different types of assets.

Even at this point, it’s still crucial to keep adding to your investments as part of helping them to grow and multiply. If you’re adding $500 a month to your account, that would be an additional $6,000 in a year. If you’re starting Step 5 with $16,000 and add $6,000 from contributions in a year and you’re able to generate a 20% return on your money, you would have nearly $26,000 after a year into step 5. And in another 7 months you would have reached the end of step 5 with over $32,000 total.

Step 6: Grow from $32,000 to $64,000

If you’ve reached the point where your investments are worth $32,000, you’re half way through the 10 steps. Congratulations on reaching this milestone! Now you may not think that $32,000 is half way between one thousand dollars and one million dollars, but in our journey through the 10 steps, it is half way through the steps. For many people, it’s reasonable to think that this level can be reached in five years or less. In most cases, the reality is that the next five steps will take longer than the first five steps. The thing you’ll notice though is that your money will seem to grow faster because it’s a larger amount to compound.

When you’re in the first few steps, the amount that you’re making as a return on your money seems relatively small. When you have $2,000, and even if you’re getting a 20% return rate, that equates to about an additional $33 added from the return on your investments each month. But when you have $32,000 to work with, each month your investments are adding an average of over $500 in return on your investments. And when you get up to $64,000, you’re investments are growing by over $1,000 a month just from the return on your money.

So you may be wondering how long it should take to get through step 6. Again, it will depend on how much you’re contributing and what your rate of return is. Let’s look at an example. If you’re adding $500 a month and getting a 20% rate of return, you would get through step 6 within 19 months or a little over a year and a half. Assuming you get a 15% rate of return and contribute $500 a month, it would take 21 months to reach the next step.

If you’re wondering if it is worth continuing to contribute at this point, we’ll look at an example for this also. If you stopped contributing the $500 a month when you reached $16,000 and generated a 20% return rate it would take 46 months or almost 4 years to reach the $32,000 mark. So it is important to keep adding to your investments at this point.

Step 7: Grow from $64,000 to $128,000

$64,000 may seem like still a long ways from a million dollars, but you only need to double it 4 more times to get to our goal. The speed at which you get through this step will depend quite a bit on the rate of return that you’re generating. There are some strategies that you can think about implementing that generate a higher return. Doing this with a small portion of your total investments to limit your risk can help in generating a higher overall return.

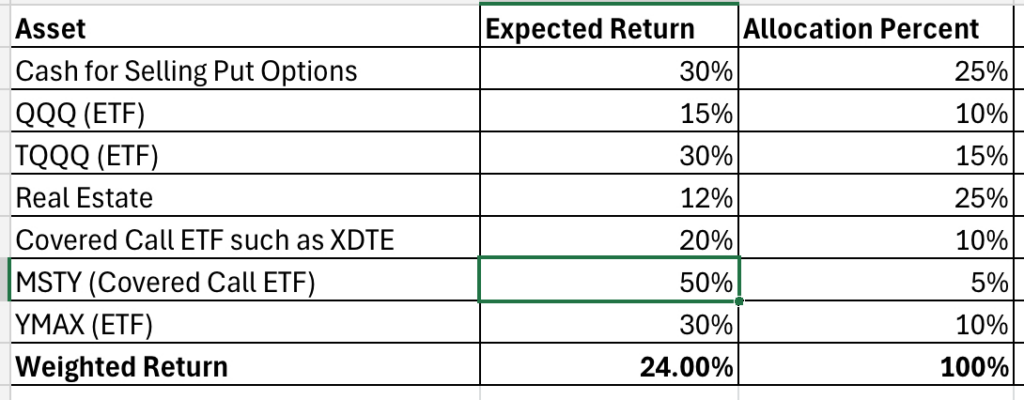

We can look at an example of how making a small change to our allocation can make a significant difference. In the example below we’ll take our previous asset allocation and change it so we change the allocation percent for XDTE from 15% to 10% and put the other 5% into something like the ETF MSTY which at least up to this point has gotten much higher returns. I also changed the expected return on the line for Cash for Selling Put Options to 30% from 20%. By modifying some of your trades in this category, you can potentially increase your return. Making these changes brings our overall weighted return to 24% instead of 20%.

I’ll be sharing other articles which will be giving details on how it is possible to potentially get these types of returns. Make sure to subscribe to our newsletter to be notified about articles where I share these strategies.

We can see how changing our overall return can make a big difference in our journey through this process. If you’re continuing to contribute $500 a month to your investments and getting a 20% rate of return, you would get from $64,000 to $128,000 in a little over 33 months. If you’re continuing did the same thing but were able to generate a 24% return you would reach that same goal in a little over 29 months. This may not seem like a big difference but in the entire journey it will make a significant difference.

If you look at the stretch in your journey of steps 4 through 10 which would be from $8,000 to a million dollars, the difference is more stark. With a return rate of 20% and a contribution of $500 a month it would take 213 months to complete this part of the journey. This is 17 years and 9 months. Using this same scenario with a 24% rate of return would take only 188 months or 15 years and 8 months. So you could shave over two years off your time for this change. And if you reached this point and continued your journey with the saving and investing, after the total of 213 months you would have a total of nearly 1.6 million instead of one million dollars. That extra $600,000 is where the biggest difference can be seen by the increase in your return rate.

Step 8: Grow from $128,000 to $256,000

So at this point there are only three steps to go. You may still feel like a million dollars is a long distance when you have $128,000, but I can tell you from experience that it will go faster than you think if you’re diligent. I recall back in my own journey how surprised I was to see how quickly my investments grew from having $150,000 to the point where they were worth a million dollars. The growth rate will depend on how well your investments do over different periods which will depend on your success with your investments and how the market does during certain time periods. I will admit that I was fortunate to have this part of my journey happening during the period over the years of 2019 through 2021. The stock market overall had higher than average returns during these three years which of course helped quite a bit. If you run into a period of a downturn in the market, it will slow your progress some, but if you stay diligent the markets have always recovered and most likely will after future market downturns.

Step 9: Grow from $256,000 to $512,000

It is important that through your journey that you don’t get overly anxious. One pitfall that many investors fall into is seeing strategies that can potentially generate higher returns and allocate too much of their assets into those strategies. It is very important to balance the risk and reward. I have seen some investors take way too high of a stake in something that has generated a high return in the past. They assume that because it has performed well in the past that it will continue. It may or it may not. That’s why it’s so important to diversify your investments and not put too much into one thing, especially investments that have a higher risk level.

The Importance of Rebalancing

Most likely you’ll have some investments that generate a higher rate of return than others. There will also be certain time periods where some investments will perform better than others because of what has happened in the stock market. There can be a benefit to rebalancing your portfolio. If you have an asset that generates a 30% rate of return and one that generates a 10% rate of return, it won’t be long before the asset with the higher rate of return will become a larger percentage of your portfolio than you originally allocated. You might want to consider reallocating by moving some of the money in assets that have grown faster to those that haven’t grown as much or are possibly in a period of being down in value.

Step 10: Grow from $512,000 to $1,024,000

So we’ve reached our final step. This step may seem like the biggest step because it’s the largest step as far as dollars go. But in reality it is the same distance by percent as the other steps. Like I mentioned earlier in the article, the first steps are easier in that it is much easier to add money to your investment account to build it up from $1,000 to $2,000 or from $2,000 to $4,000 than it is to add money to make it grow from $512,000 to $1,024,000. This step is primarily dependent on the growth from the return on your money.

Like in the previous steps though, the important thing is to continue the process of managing your investments to be able to generate the return on your money for it to grow. If you still contributed $500 a month and generated a 20% average annual return you would complete this step within 44 months or 3 years and 8 months. If you stopped contributing the $500 a month you had been contributing at the beginning of this step, it would only take an additional 2 months to complete this step. So as you can see, at this point your contributions have less of an impact on your growth rate.

How Long Does It Take to Accumulate $1,000,000?

The short answer to this question is, “it depends”. As you can see there are a number of different factors that determine how long this process will take. But if you’re diligent in contributing to your investments and are learning the best investment strategies for growing your investments, the process will go faster than you might imagine.

I think for many people this can certainly be reasonably accomplished within a 20 year time frame. In some cases it can be less than this. Some may be able to get through this journey in 10 years or less. The important thing is to just start the process. The reason for this is that the sooner you start, the closer you’ll be to achieving your goal.

What Is Step 11?

One of the interesting and maybe exciting things to think about is that the more your investments grow, the faster they will grow as far as the dollar value of your money. If we were to add an 11th step to this process and doubled our money one more time we would have over 2 million dollars. Step 12 would get you to over 4 million dollars. As you can see at this level the value of your investments appear to accelerate at a faster rate.

Educating Yourself Is Key

As you can see, one of the keys is to be able to maximize the returns on your investments. It is true that each person will have their own comfort level as to what kinds of risks they are comfortable with. But part of becoming comfortable with the risks is to learn about the different types of investments to understand the risks. Everyday Money Manager is committed to providing you with the education that you need to make informed decisions on what investments are right for you. To be notified of our new content be sure to sign up below for our email newsletter.