You may have heard the term “Leveraged ETF” and wondered “What is a leveraged ETF?”. If you’re familiar with ETF’s, or Exchange Traded Funds, then you know that they’re funds that you can buy shares of that are invested in a collection of other securities such as stocks or bonds. For example the ETF with the ticker symbol SPY is invested in all 500 companies in the S&P 500. It is intended to mirror the performance of the S&P 500 index.

A Leveraged ETF is a type of ETF that amplifies the returns of a similar ETF through the use of leverage. This is done in a variety of ways including using margin and options to amplify the returns. For example if you looked at a leveraged ETF that was amplifying the returns of SPY, the returns would be double or triple the returns on a daily basis of SPY. Now as good as this sounds, the thing to be aware of is that when you amplify the returns, you’re amplifying the returns when the value goes up and when it goes down.

Leveraged ETF Decay

One thing that can result from the fact that the amplification of the returns on a daily basis is that the longer term performance of the leveraged ETF won’t mirror the same leveraged results. We’ll use SPY as an example and also the leveraged ETF with the ticker symbol UPRO which is designed to amplify the returns of SPY by 3X. Say that SPY goes down in value 1% one day and the next day goes up 1%. UPRO would go down 3% the first day and up 3% the next day. If both ETFs started with a share price of $100, the first day, SPY would go down to $99 and UPRO would go down to $97. The next day when they went up 1% and 3% respectively, SPY would end up with a value of $99.99 and UPRO would end up with a value of $99.91. Now this may not seem like much of a difference, but over time, and when the ETF’s go through a cycle of many ups and downs, the difference will become much greater.

UVXY

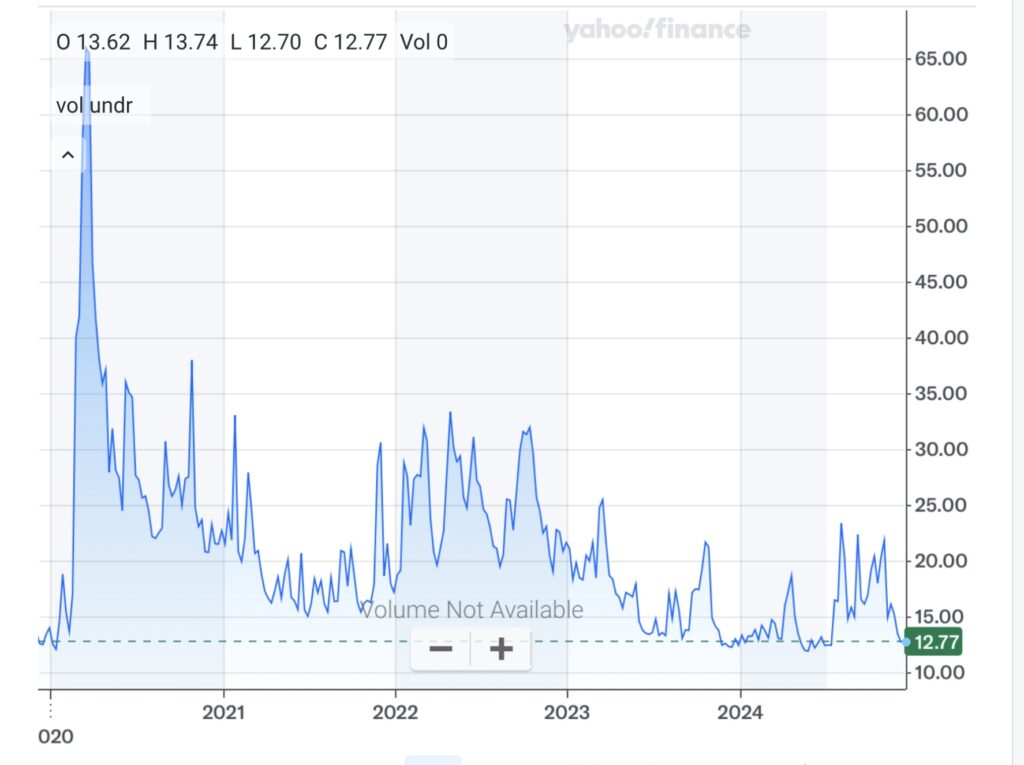

Some leveraged ETFs are affected by this decay to a much greater degree than others. If you have a leveraged ETF that is based off an ETF that goes up and down, but doesn’t have a significant increase in value over time, the value of the leveraged ETF is going to see a lot of decay as time goes along. We can look at UVXY as an example. UVXY is a leveraged ETF that seeks daily investment results, before fees and expenses, that correspond to one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index. The market volatility index has ups and downs, but it typically stays in a range except during times that it has spikes due to volatility.

If we look at a 5 year chart for VIX which is the CBOE Volatility index we can see that it has ups and downs but most of the time stays somewhere between 15 and 30. You can see the spike in 2020 which was due to the Covid pandemic as that had quite an affect on the stock market.

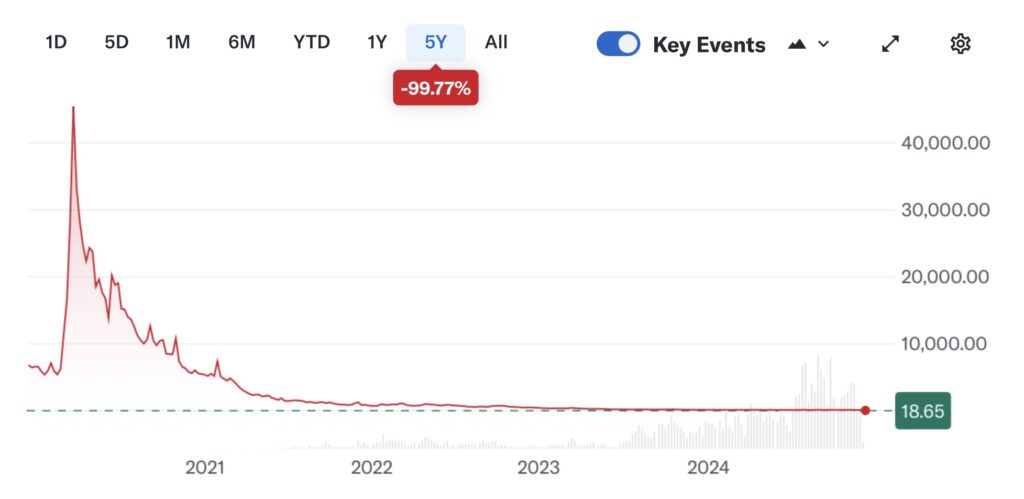

Looking at a 5 year chart for UVXY you can easily see the extreme decay that it goes through. Five years ago the share price for UVXY was around $8,108. The current share price is $18.65. This is a decrease of 99.77%

Not All Leveraged ETF’s Decay the Same

Not all leveraged ETFs have this extreme of a decay. In fact, some leveraged ETFs will increase in price much more in certain situations than the ETF they are based off of. We can compare the five year charts of SPY and UPRO. You can see from the chart for SPY, that it has increased in value 94.8% in the last five years.

In the 5 year charts of SPY for UPRO, there has been a growth in the share price of 214.76% in the last five years.

You may have noticed that even though UPRO is designed to perform at 3 times the daily performance of SPY, it isn’t triple the performance over a five year period, but it is more than double. Now this won’t be the case in every 5 year time period. The difference will fluctuate on what the ups and downs of the market have been over that specific time period.

When considering investing or trading in a leveraged ETF it is important to understand how they work. It’s also important to be aware of what can happen to the value of the investment under different circumstances.

Disclaimer

The content provided on Everyday Money Manager is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.