You’re at the point where you are ready to start investing and you’re wondering, “How should a beginner start investing?”. Your journey with investing will be a process. The important thing to remember is that you will need to have at least some level of understanding about anything you invest in. Investment options range from very simple to very complex with everything in between. This article is meant to educate you on how to go about the process of starting your investment journey. We aren’t recommending any of these investments in particular as everyone has different goals and risk tolerances. So it’s best for you to learn as much as you can about an investment before you commit your money to it.

Start Early

One of the most crucial factors in growing your investments is the amount of time that you have to grow your investments. The compounding factor is huge when it comes to building wealth. Compounding can be looked at like this: as your money grows, you’re not only making money on the money you put in, but also on making money on the gains in your account. It is important to have a good foundation by making sure your consumer debts are all paid off first. It’s also important that you have a good handle on your budget so you know how much you have available in your budget to invest. But from there, the important thing is to just start investing.

I’ll give an example that illustrates the difference between starting early and waiting to start. If we look at an example of saving for retirement, we’ll assume that would mean age 65 as our goal. Say you were to put a minimal amount of $100 a month into an investment account and had waited until age 35 to start saving, and you averaged an annual rate of return of 10%, at age 65 you would have a total of $228,032 in your investment account. If you were to start your $100 a month saving at the age of 20, at the age of 65 you would have $1,057,085. That’s on just an investment of only $100 a month.

Start Simple

With an almost endless number of things you can invest in, it can be difficult to know where to start. The best place to start if you have money to invest is to start simple. Even though it’s best to diversify into a variety of different types of investments, it can seem a bit overwhelming to try and learn about so many different types of investments at once. Your investment journey will be developed over many years in most cases or even over your lifetime.

Like many things that we learn, you will continue to build on your knowledge as time goes along. When I talk about diversification, this is just the strategy of investing your money into several different types of investments. The advantage of this is that in many cases, when the value of one type of investment goes down, another type of investment might stay more stable or even go up. This spreads your risk out over many different investments.

Your investment strategy will develop and change as you gain more knowledge. You may start with investing in a couple of broad market ETF’s to start which will give you some diversification. It will also be in a position where you’re making some gains on your money over time as you learn about additional investment types and opportunities. (Don’t worry if you don’t know what an ETF is. We’ll be covering more details on this and other types of investments.)

Start With Investing What You Can

Some people don’t get started with investing because they think they don’t have enough to put into it. As you could see from my example of putting in $100 a month, over time the growth can be tremendous. Even if you start with just $50 a month, it would be a start and something to get you on the path of growing your wealth. As time goes along and you get to where your income increases, you can always increase the amount you’re putting in as you are able.

Some people wonder, “How much money do I need to start investing. Many brokerage companies have very low minimums. For example, Robinhood has no account minimum. They also sell fractional shares of many stocks so you could purchase stock for as little as $1. In fact, to invest in a diversified way, you could purchase as little as $1 of the SPY ETF which would be a partial ownership in 500 of the largest companies in the US. So as you can see, it doesn’t take a lot to get started. We’ll be sharing more on other ways to start investing with a small account balance.

Step 1: Determine Your Goals

Knowing what your goals are is important in the fact that you should know how soon it will be before you need the funds. Most likely at least some of the money you’ll be investing will be for retirement which could be many years or even a few decades away. You may be investing money that you plan on using for your children’s college education. Depending on how old they are, this may be quite a few years down the road. There may be other things that you plan to use the money for eventually. Being able to determine approximately how long it will be before you need the funds will affect where you invest the money.

Short Term Goals

If a portion of the money you’ll be investing is for something that you’ll need the money in less than five years, this would be a short term goal. Maybe you’re planning on buying a house in three years and you’re saving money for a down payment. This would be a short term goal. Or maybe one of your kids will be starting college in the next five years, this would also be considered a short term goal.

Money you’ll need within five years should be invested in a way that is highly liquid, which means you could access it without any trouble. It should also be invested in something that isn’t volatile. So investing in the stock market usually wouldn’t be the best choice for these funds. The reason is that if the time comes that you need the money and the value of your investments is down, you wouldn’t want to have to sell the investments at that time.

Here are some examples of investments that would be good for money that is meant for short term goals:

- High Yield Savings Accounts (Interest rates typically between 4-5%)

- Short Term Bond Funds

- Treasury Bills (Currently paying about 4.5%)

- Money Market Accounts (Some online accounts paying around 4%)

- Private Credit (Rate varies greatly, but can be anywhere from 4.5% – 15%)

There are some other options that are a little more creative and have a little higher risk, but have a higher rate of return. We’ll cover more of that later.

Long Term Goals

When investing money that is for a goal that is further down the road than five years, you can typically take more risk. The reason is that if the value goes down, you have time for the investment to recover before you need the money. In many cases higher risk investments will have a higher rate of return to compensate for the higher risk. There are many different types of risks which we outline in this article: Read “Types of Investment Risks”.

As always, you should make sure you’re diversifying your investments. This will lower the risk to some degree as it lowers the possibility that everything will go down at once. Some of the most common ways to invest for long term goals would be through investing in the stock market. This might be through stocks of individual companies or through Mutual Funds or Exchange Traded Funds (ETF’s). Both Mutual Funds and ETF’s are funds that you can invest in that include a basket of companies all in one fund. This is one way of diversifying the portion of your money that you allocate to the stock market.

For example, you could invest in the ETF under the ticker symbol SPY. This is the largest and oldest ETF. This fund invests in all 500 of the companies in the S&P 500. The S&P 500 is a stock market index representing 500 of the largest companies in the Unite States. These 500 companies represent about 80% of the total stock market in the United States.

Bonds & Bond Funds

Another common investment type for would be through investing in Bonds or Bond Funds. The main difference between stocks and bonds is that when you purchase a share of stock or a fund investing in stocks, you are essentially purchasing ownership in that company or in the companies in the fund. A bond is basically a loan to the company or government entity that issues the bond. These bonds will pay a certain interest rate based on the credit worthiness of the bond issuer. You could also invest in a bond fund which like ETF’s, they would be a basket of bonds representing bonds of many different companies or government entities.

Some other types of investments that you could invest in for long term goals are:

- Real Estate

- Private Debt

- Cryptocurrency

- Alternative Investments such as collectibles or art

- Private Equity

- Options

There are other types of investments also, but these are some of the more common ones. Some of these choices are higher risk than others. Also, some of the investments require more time commitment than others. You’ll want to determine if you’re a set it and only check on it occasionally type of investor. If so, certain types of investments probably wouldn’t be a right fit for you. If you feel like you would enjoy being more hands on, then the investments that require that you actively manage them might be right for you.

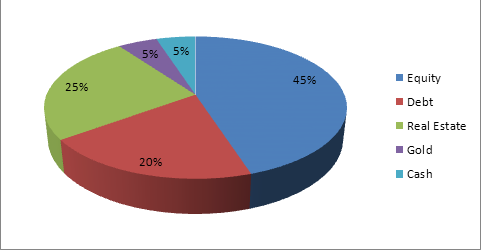

Step 2: Decide on an Asset Allocation

Asset Allocation is just a fancy term for how much of your money you put into each type of investment. Usually this is done in percentages. At the beginning you may have a very simple asset allocation and as you develop in your knowledge of different types of investments your asset allocation may grow as well.

The way your money is allocated will also be partly determined by how much money you have to work with. For example, if you’re just starting out and putting $100 a month into your investment account, you’ll be limited as to how much you can spread that out. But if you have a lump sum to start with you’ll have more options to work with.

With so many different types of investments to choose from, it can be difficult to know where to start. As I mentioned, it’s important that whatever you invest in, that you have an understanding about the investment and what you’re investing in. Someone can tell you to invest in the SPY ETF, but if you don’t know what that is or what can happen to the value of that investment over time, you may be disappointed when the stock market goes down and the value of your investment goes down as well. So the first step in deciding is to start learning about the different types of investments.

Asset Allocation for Short Term Goals

If you have money designated for short term goals, here is a possible asset allocation:

- 30% in a High Yield Savings Account

- 25% in a High Yield ETF (e.g. QYLD or KBWD)

- 25% in a Short Term Bond Fund

- 20% in a Money Market Account

This is just one example and certainly isn’t a recommendation for everyone as there are so many different combinations that you could choose. Both the High Yield Savings Account and the Money Market Accounts are easily accessible and will have a high level of safety in that the values in these accounts won’t fluctuate over time like in some other investments. They are also insured by the FDIC up to $250,000 per account type so the risk of losing the money that you put into these accounts is extremely low.

Income Type Funds

When looking at the Short Term Bond Funds and most High Yield ETFs, these will definitely have some level of price fluctuation. The prices don’t typically fluctuate as much as stock ETF’s or individual shares of stock, but the value of these investments will have some fluctuation. For example, if we were to look at the ETF KBWD, the price per share of this ETF over the last year has fluctuated between $14.34 and $16.38 and the current price per share is $15.33. So it has ups and downs, but in a smaller range than some stock ETFs.

Both of these types of investments typically also pay out a dividend on either a monthly or quarterly basis. KBWD pays out a dividend once a month and over the course of the last year has paid out dividends equal to a return of 11.41% which is a higher than average dividend than most. The dividend is where most of the money is made in this type of investment.

Asset Allocation for Long Term Goals

Starting simple is the best way to start as I’ve mentioned. Because there are so many choices with investment types, it’s best to start with what you know. If you don’t really know much about stocks or ETF’s or what options are, the first step would be to start learning about these. Probably the first thing to educate yourself on would be how the stock market works. Because in many cases, investments that are related to the stock market will be included in at least part of your investment allocation.

Real Estate is becoming more and more popular as an investment for many people. You may be thinking that purchasing a piece of real estate is way beyond where you are as an investor. Yes, for many people, it’s not feasible to imagine buying a rental property when just starting out in their investing journey. Fortunately there are several platforms that now offer small investments into real estate. This type of investment won’t be for everyone, but it does allow you to be able to invest in real estate without having to buy and manage a whole property.

Example of a Long Term Asset Allocation

Here is one possible asset allocation for money designated for long term goals:

- 50% Stock market related investments

- 30% Real Estate

- 20% High Yield Bond Funds

Again, this is just one of an endless number of directions you could start with. We’ll be covering the different types of investments in detail as time goes.

Step 3: Open Investing Accounts

Once you have a starting Asset Allocation determined based on your goals, you’ll need to open the accounts where you’ll be investing your money. There are different types of accounts depending on if it is money for retirement or money that you’ll need before retirement such as for your kid’s college.

Types of Accounts

If part of your investment will be specifically for retirement, you’ll want to consider if you should open an IRA account. This is an account for money that can be saved for retirement. There are tax benefits to putting this money into an IRA.

There are different types of IRAs, but the two most common are the traditional IRA and the Roth IRA. Here is a breakdown of the differences between the two:

Traditional IRA

- Contributions are tax deductible in the year that you make the contribution (You can deduct the contribution from your taxable income)

- Account grows tax free

- Distributions are considered taxable income in the year that you take the money out

- Required to start taking a certain amount out each year starting at a certain age (Required Minimum Distribution)

Roth IRA

- Contributions aren’t tax deductible

- Account grows tax free

- Distributions are all tax free

- No Required Minimum Distribution

There is a limit to how much you can contribute each year to either of these two accounts. For tax years 2024 and 2025 the limit is $7,000 for the year. If you are 50 or older you can contribute up to $8,000 for the year. The limit is the most you can put into both Traditional and Roth accounts combined. You can’t contribute more than the limit to both account types combined. There are also rules about contributions based on your income levels. The rules are different for traditional and Roth IRAs. If you’re unsure about which account type is best, you may want to ask your tax advisor.

Brokerage Account

For investing in stocks and ETF’s, you’ll want to open a brokerage account. A brokerage account is a type of investment account opened with a brokerage firm. Once you open your brokerage account, you will deposit the money that you want to use for investing. Once the money has been deposited, you can invest it in individual investments.

Let’s look at an example. You decide to open a brokerage account with Charles Schwab. The next step would be to complete the online application and get the account opened. You then connect your bank account so the money can be transferred electronically to your new brokerage account. Once the money has been deposited you can buy shares of individual stocks or ETF’s. You could also keep part of that money as cash which in some cases will generate interest based on the amount of money left as cash. You typically can buy and sell shares as often as you want within the account. If at any time you want to withdraw money from the account you can request a transfer from your brokerage account to your bank for any of the funds that are invested the cash portion of your account.

IRA Brokerage Account

An IRA can also be opened as a brokerage account. The process is the same. The only difference is that you would designate the account as an IRA and the type of IRA you are opening when you complete the application with the brokerage.

You will also choose ownership type of the account. There are usually options to open as an individual account owner or to open it as a joint account. A joint account would be used for example if you wanted an account owned by both you and your spouse. There is usually an option for an entity account, such as if you want the account owned by a trust or other entity type.

Other Account Types

If there are other things you’ll be investing in starting out, then you would open accounts for those investments. Initially, much of your investing would be through a regular brokerage account. If you decide you want to invest in one of the platforms that offers fractional real estate investing, you would open an account for the platform and transfer funds to start investing.

Disclaimer

The content provided on Everyday Money Manager is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.