Leveraged ETF’s like SOXL have potential for generating higher than average gains, but of course there is a higher level of risk. The key is to find a strategy that takes advantage of the higher volatility to generate the higher gains while also managing the risk factor. I want to share the strategy that I implement with SOXL to generate returns using partially a swing trading strategy along with utilizing options. This strategy generates returns even in a sideways market since profit can be generated from selling options.

Taking Advantage of the High Volatility

ETF’s or stocks with high volatility typically mean that when the share price goes up or down, it goes up or down more than average. There are a couple of ways to take advantage of this high volatility. When there are wide swings in the share price, there can be good opportunities when the price has swung down further than normal to get shares at a lower price. The high volatility also sometimes means that when the price goes up it can have outsized returns.

The other way of profiting on a high volatility stock or ETF is through selling options. the higher the volatility, the higher the premiums will be on a percentage basis. SOXL is an ETF that has higher than average premiums on options which make it a good way to generate profit from selling options on SOXL.

The Basic Strategy

The strategy that I use with SOXL is that I started this journey with investing a set amount of money in SOXL shares. My plan from there is to sell shares as the price goes up and buy more shares as the price goes down. I do this through selling call and put options to generate even more income on the strategy. I have the amount that I originally invested in the shares as a target. Then if the price goes up by 10% I would sell 10% of my shares. If the price goes down 10% I would buy 10% additional shares.

An Example

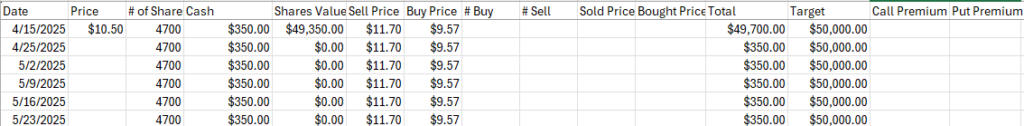

So to start with an example based on where the share price is currently which is at $10.50 per share and I want to invest $50,000 into this strategy. I keep my share count rounded to the nearest 100 shares which makes it easier with selling options. So with the $50,000 I would buy 4,700 shares at $10.50 per share for a total of $49,350. I also track the cash that I get from selling shares and from the options premium I collect to gauge my profitability. So at this point I would have $650 of my $50,000 left in my cash for this investment. I use a spreadsheet to track my progress for this strategy:

I update the spreadsheet each week with the amount I bring in from selling calls and puts as well as shares that I bought or sold for the week. In the chart above you can see the shares bought and the remaining cash.

Selling Call & Put Options

The next step is to sell call and put options at the prices we would be buying and selling shares at. So looking at the chart above, it is set to calculate the price to sell or buy at, which would be a price movement of 10% up or down. Because option strikes are only available at certain levels, I would set my call option strike to be just above my sell price and my put option strike just below the buy price on the chart. So based on this I would sell a call option with a strike of $12 and a put option with a strike of $9.50. I always set my expiration date for the Friday of the following week and roll or sell options every week.

I would sell the number of contracts that would equate to buying or selling 10% of the shares I currently hold. So based on that I would be selling 5 contracts for each option position since I currently hold 4,700 shares. (10% of 4,700 is 470. Then round that to the nearest 100 which is 500 shares) So I would sell 5 call option contracts with an expiration of Friday of next week with a strike price of $12. For selling these I would collect a premium of $45 per contract or a total of $225. I would also sell 5 put contracts with an expiration on Friday of next week with a strike price of $9.50. For selling the put contracts I would bring in a premium of $56 per contract or a total of $280.

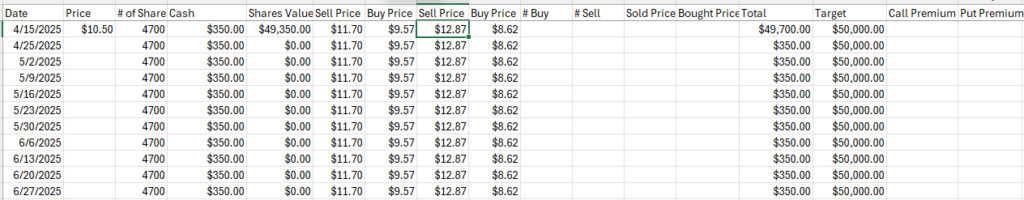

I would typically sell additional options further out to reflect if the price were to go up or down another 10%. In the next chart I have added 2 more columns for the next levels for buying and selling shares which is 10% above or below the first buy and sell prices.

The number of contracts would also change. If we ended up selling 500 shares at $12, that would leave us with 4,200 shares. So for selling additional call options I would sell 4 call contracts. (10% of 4,200 is 420 rounded down to 400 shares) For the put options I would still sell 5 contracts as if we were to purchase 500 shares at $9.50 that would put us at 5,200 shares.

So I would sell an additional 4 call option contracts with a strike price of $13 and collect $23 per contract for a total of $92. I would also sell an additional 5 put option contracts with a strike price of $8.50 and collect $31 per contract for a total of $155. SO at this point I’ve collected a total of $317 in premiums for the call options I sold and $435 for my put options. The chart below shows the premiums collected in the far right columns and the Cash column updated with the premium collected added to the total.

Next Step

At this point I would typically be done until the next week. I would keep an eye on the market during the week and if it made a big move up or down, I may sell another call or put position if the share price moved a significant amount. So in most cases I wouldn’t do anything else until the next week.

When we get to the next week, I would again check the share price on SOXL to see if any new calls or puts need to be opened. The way I determine this is if the share price has moved significantly up or down, I would sell more calls and puts using the same system for determining strike prices and number of contracts.

For example, say the price for SOXL dropped down to $9.50 a share. The next strike price that I would sell puts at would be $7.50. The way that I determine this is that if my $9.50 and $8.50 strike puts were to be assigned I would then own 5,700 shares. I then calculate my next target for selling puts by taking my $50,000 target and subtracting 10% which is $45,000. I then divide this by the number of shares which is 5,700 which comes out to $7.89. From there I always round down to the next lower strike price which is $7.50. I would sell 6 contracts at this price based on 10% of the number of shares rounded to the nearest 100. The same process would be followed if the share price rose a significant amount in selling an additional call option position.

Managing Options at the End of the Week

When the expiration dates for my open option positions arrive, I manage my open positions. In many cases this means rolling the positions to the next week to collect additional premium. For example, say it’s the expiration date for the original positions that we opened in our example and the share price has dropped to $9.50. I would roll my two call option positions to the following week as most of the remaining value would be gone on those positions. I would also roll both the put option positions even though the $9.50 strike puts are at the money. This is actually the point where you can make the highest premium from rolling in most cases.

Obviously you would get a smaller premium from rolling the calls since the share price has dropped further away from those strikes, but you would make more on rolling the puts since the share price is closer to those strikes. Even if the share price has dropped a little below my put strike or a little above my call strike, I would still roll it. If the share price had moved enough that a position was far in the money I would let it get assigned and then recalculate for where I would open new positions based on the number of shares I now owned. If this seems a little confusing, I’ll give some real life examples of how I’ve managed this in the past.

Sufficient Cash Needed for Assigned Puts

You may have already figured out for this strategy to work, you’ll need to have cash or at least margin available to purchase the shares if the price drops enough that you would need to purchase the shares if your puts get assigned. But you would have been required to have that cash or margin available to sell the puts in the first place. Obviously in an extended period of a market downturn you may need a significant amount of cash to be able to continue to buy shares as the price goes down. This is definitely something you’ll want to plan for. In the case of where you run out of enough cash to continue to sell lower strike puts, the best thing is to wait until the price recovers to start selling calls on your existing shares to continue the process if the share price has fallen far enough that it isn’t practical to sell calls without taking a loss.

Example of Managing Positions

I’ll give an example of how I managed my most recent positions with this strategy. This week I had put option positions with strikes at $14, $12 and $9. Part way through the week my $14 strike puts were assigned. On Friday my $9 puts were basically at the money so I rolled those out to the next week for a credit. I decided to let the $12 strike puts get assigned since I could make more selling calls on the shares than rolling the puts to next week, all other things being equal. So on Friday I sold calls on the shares that I was required to buy based on getting assigned at $14 and the shares I was going to be assigned on at the end of the day for my $12 puts.

Since I was selling calls on both the shares I bought for $14 and the shares I was going to be buying at $12, I sold calls for all of those shares at a strike price of $13 since it was the average of the two prices I bought the shares for. And I actually bought more shares at $12 than I did for $14 so it put me a little ahead. I collected $52 per contract for rolling the $9 puts and $11 per contract for selling the $13 calls.

A variation of this is you could decide to sell the calls at a price higher than where you bought the shares for to make additional money on the shares along with the money you make from selling the options. This could turn out better for you in an up market, but obviously you wouldn’t get as much for the call options in this case. So if the market moves sideways, it’s better to sell the lower strike calls.

Using Strategy on Other Tickers

Obviously this strategy could be used on other tickers. The reason I chose SOXL is that I feel that there is a high probability that over a longer time period, the share price will go up more than the average ETF. It also has higher volatility than many other ETF’s which makes the option premiums higher which in a sideways market is where you’ll make most of your money with this strategy.

You could use the strategy with something like TQQQ, but because the volatility is typically not as high with TQQQ you won’t make as much on your options and when the market goes up, you won’t be able to make as much from selling the shares as the price rises.

Premiums Can Fluctuate

One thing to be aware of is that the amount of premium that you can bring in will fluctuate depending on the volatility level for the week. As you may know, this can fluctuate depending on various factors of what is going on in the stock market and in the volatility of the securities used for SOXL.

How Much Can You Make With This Strategy?

The big question you may have is, “How much can I make with this strategy?” This does somewhat depend on the market and the ups and downs of the share price of SOXL. During the time that I’ve been using this strategy, just on income from the options that I’ve been selling every week, I have averaged about 0.7% per week. Annualized without compounding, this would come out to about 36% per year. Of course this doesn’t take into account the money you make on the shares as the price goes up which will vary greatly from one year to the next.

The best annual return on SOXL since inception was 2019 where it grew in share price by about 231%. 2023 was also a good year when it grew by 227%, but this was mostly due to the fact that in 2022 the share price had dropped by 85%. So there definitely is risk involved with this strategy so each individual investor needs to assess if they are comfortable with the risk level involved with the strategy. But obviously there is potential for generating much higher than market level returns.